Analysis

August 7, 2015

Final Thoughts

Written by John Packard

The first thing we need to talk about is the rumor that we have heard from multiple sources that there will be a trade case announced on hot rolled coil this week. Our sources are telling us the information is a couple of weeks old and may change but the date being suggested in August 11th. The number of countries expected to be hit might be higher than what was thought prior to the cold rolled case being filed.

So, the questions are who will be hit by this next round of filings. For those of you who are not aware, China is already not allowed to ship HR into the United States and Russia saw their Suspension Agreement terminated last year and they are not shipping HRC to the U.S.

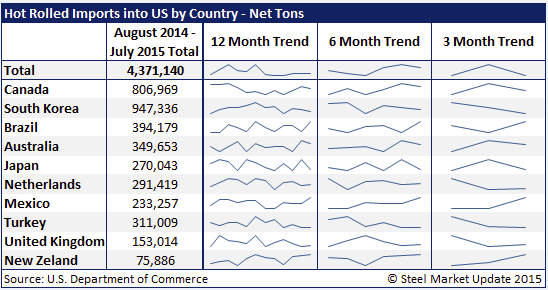

Who are the biggest exporters of hot rolled to the United States over the past twelve months? Canada, South Korea (who supplies USS/Posco HR coil on the West Coast), Australia (who supplies Steelscape on the West Coast), Turkey (although they have cut back in recent months), Brazil (which has been growing their tonnage – a year ago they were a very small supplier and that probably went to CSN in Terre Haute), Japan (last few months has been inconsistent), Mexico (had a little higher than normal spurt in July), Netherlands (pulled back a bit in June and July). I would not expect Canada to be hit and Mexico is a question mark. The mills did not hit Mexico with cold rolled but they did hit Turkey and Brazil which may be a sign that those two countries may be in the cross hairs of the domestic steel mills.

Here is a table for those who are interested in looking at data about the top 10 hot rolled suppliers. We have added a little “twist” by putting a 12 month, 6 month and 3 month trend line in the data.

Speaking of exporting… Statistics were released over the past couple of days showing Chinese steel exports as rising by 9.5 percent. The following is from an article in the Financial Review / Bloomberg regarding the surge in Chinese steel exports: “Mills in the country that produces half the world’s steel are maintaining output as domestic demand falters, exporting the surplus. Sales overseas surged 9.5 per cent to 9.73 million tonnes in July, the highest level in six months, customs data released on Saturday show. Exports expanded 27 per cent to 62.13 million tonnes in the first seven months, the highest ever for the period, according to customs data compiled by Bloomberg.”

Over the past 13 months the Chinese have exported 3,111,843 metric tons or, 3,430,215 net tons of steel products to the United States. Galvanized represents about one third of the Chinese steel exports with 976,969 metric tons or 1,076,922 net tons being HDG. The second largest product is cold rolled with 903,266 metric tons or, 995,679 net tons of CRC.

OK, I can’t leave everyone without prompting you to register for either our Steel Summit Conference (September 1 & 2, 2015) or our Steel 101 workshop. Both are exceptional programs and well worth your time and money. If you have any questions please do not hesitate to ask me: John@SteelMarketUpdate.com or 800-432-3475.

As always your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher