Market Data

August 6, 2015

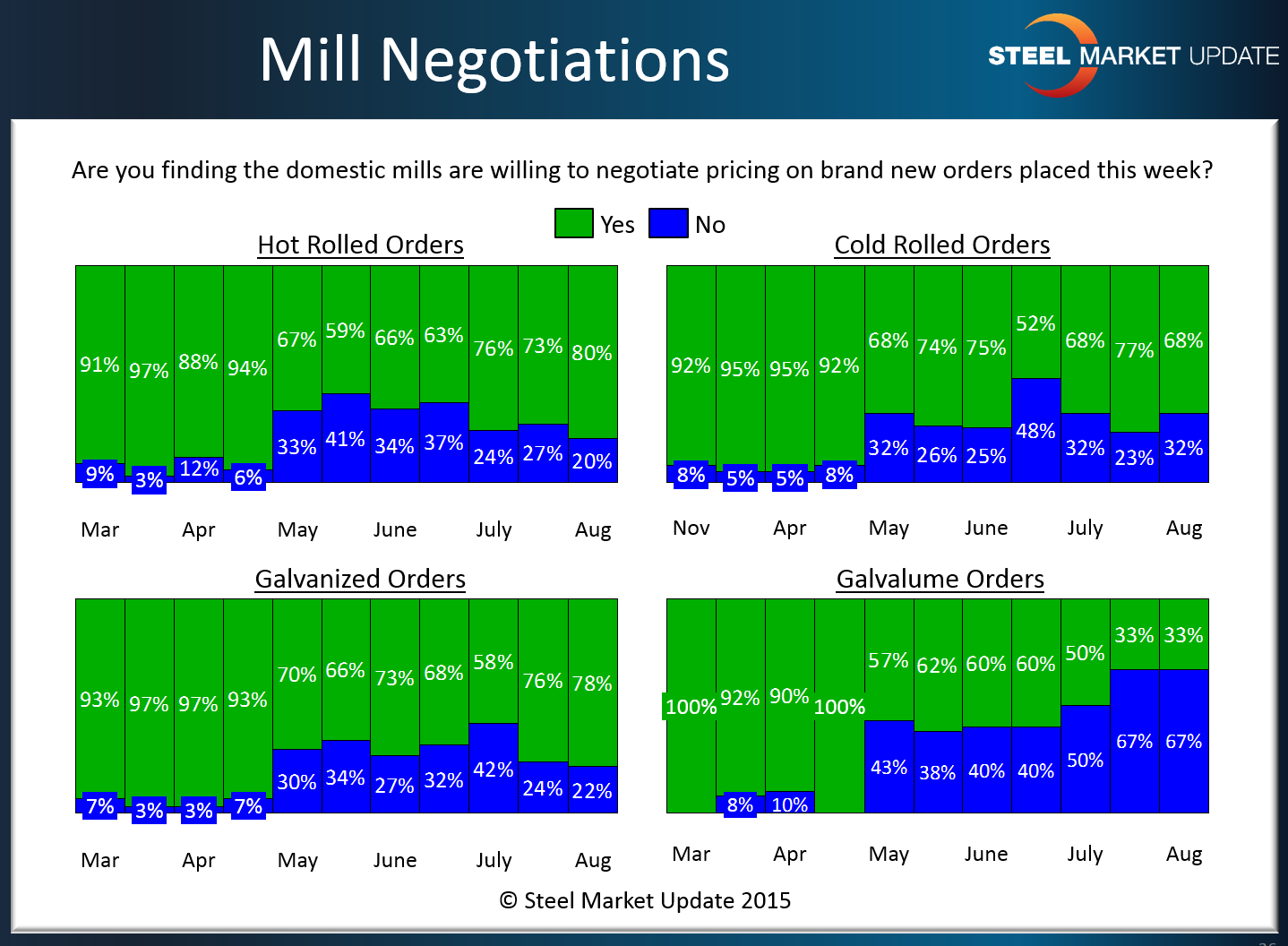

Steel Mills Negotiable on Most Flat Rolled Steel Spot Pricing

Written by John Packard

With the exception of Galvalume, all of the other flat rolled steels followed by Steel Market Update saw at least two-thirds of our survey respondents reporting the mills as willing to negotiate spot pricing.

Eighty percent of those responding to our inquiries about hot rolled pricing termed the mills as willing to negotiate. Cold rolled was 68 percent, down from the 77 percent reported in mid-July while galvanized was essentially unchanged at 78 percent.

Galvalume remained the same as mid-July when it bucked the trend with only one-third of the respondents reporting prices as negotiable.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.