Analysis

August 4, 2015

US Auto Sales for July Up 5.3 Percent

Written by Sandy Williams

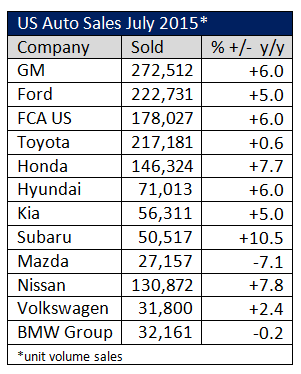

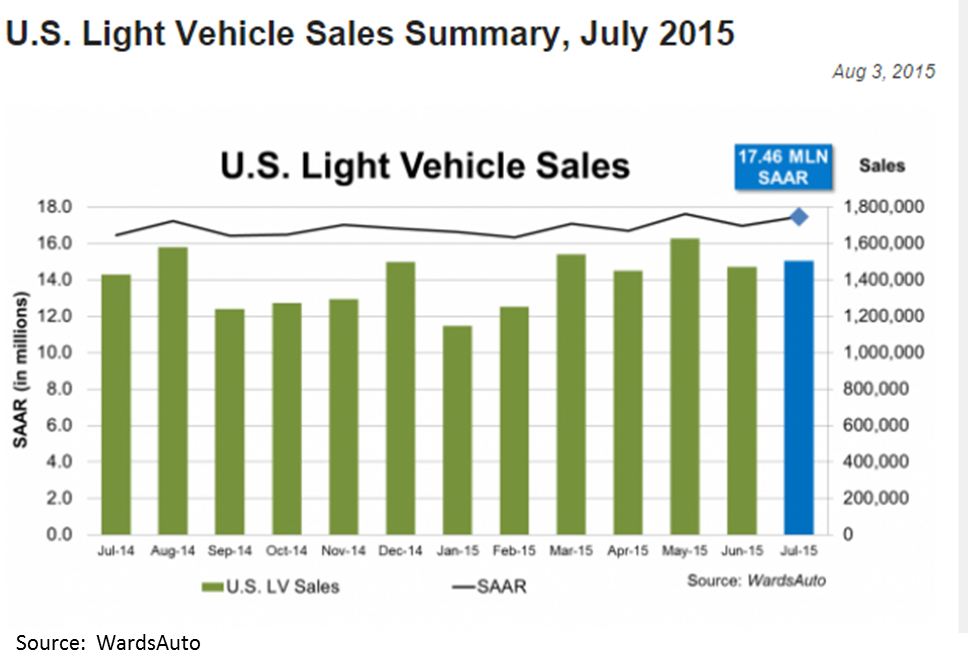

US automotive sales had another stellar month in July beating analyst expectations as consumers continued to buy trucks and SUVs. Sales for July rose 5.3 percent year over year to 1.51 million vehicles.

The seasonally adjusted annual rate (SAAR) for July light vehicle sales rose to 17.5 million beating Bloomberg’s expectation of 17.2 million WardsAuto’s forecast of 17.3 million.

The seasonally adjusted annual rate (SAAR) for July light vehicle sales rose to 17.5 million beating Bloomberg’s expectation of 17.2 million WardsAuto’s forecast of 17.3 million.

Continued low gas prices helped place SUVs and crossover vehicles into more consumer garages in July. Luxury vehicles also were in high demand, with luxury brands making up 11.5 percent of sales so far in 2015, according to True Car.

“The second half of 2015 is off to a great start, with industry sales above expectations,” said Kurt McNeil, GM’s U.S. vice president of Sales Operations. “We feel very good about our truck strategy heading into the late summer and fall, when those segments usually heat up.”

“F-Series retail sales are up 13 percent, providing the best July retail results since 2006, even with continued all-time record transaction pricing – up $3,200 versus a year ago,” commented Ford Motor Company.