Market Data

August 4, 2015

Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices

Written by Peter Wright

The Q3 2015 February Senior Loan Officer Opinion Survey on Bank Lending Practices was released on August 3rd. This survey addresses changes in the standards and terms on, and demand for, bank loans to businesses and households on a quarterly basis and is based on the responses from 71 domestic banks and 23 U.S. branches and agencies of foreign banks. The Federal Reserve generally times the quarterly survey so that results are available for the January/February, April/May, August, and October/November meetings of the Federal Open Market Committee. The following is an abridged version of the Federal Reserve report followed by SMU comments and graphs.

![]()

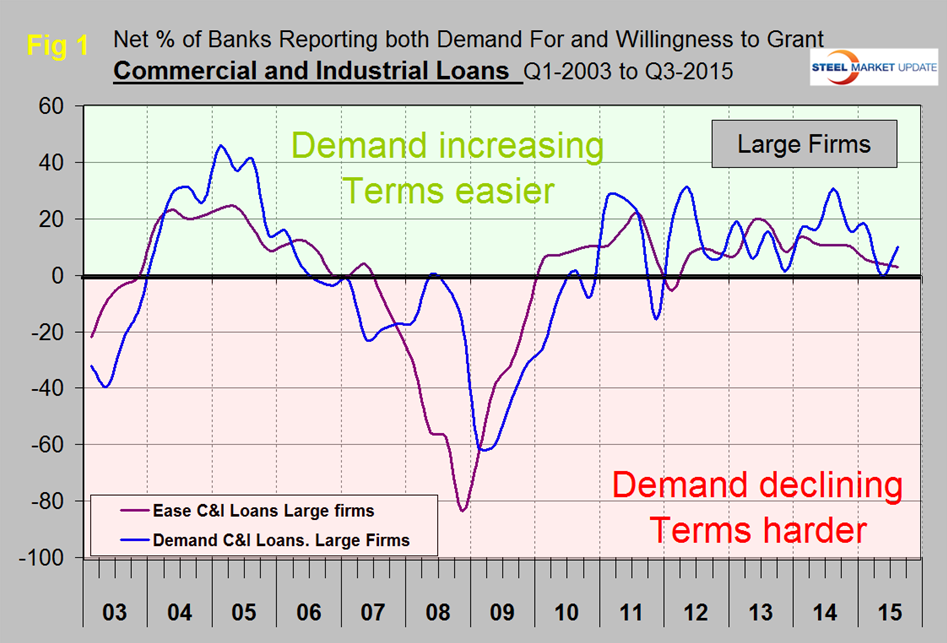

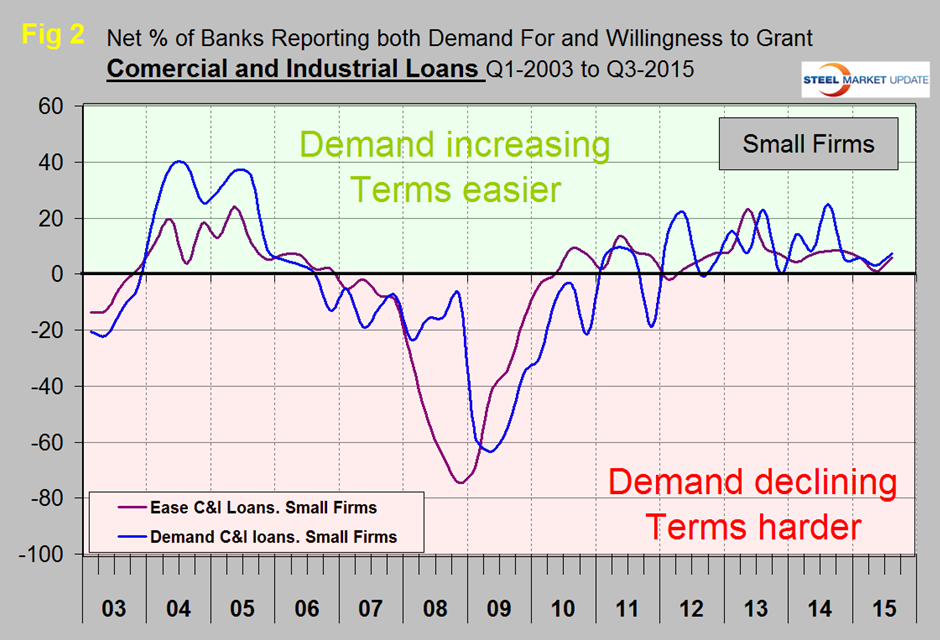

Lending to Businesses: The July survey results indicated that, on balance, banks reported little change in lending standards for Commercial and Industrial, (C&I) loans to firms of all sizes over the past three months. Among the small number of banks that indicated that they had changed their C&I lending standards, reports of easing were somewhat more common. Moreover, banks continued to report having reduced costs of credit lines and narrowed loan spreads for both large and middle-market firms and smaller businesses on net. The number of banks that indicated that they had eased loan covenants or increased the maximum size of credit lines outnumbered those that reported tightening such terms, especially for larger firms. Meanwhile, all foreign respondents indicated that their C&I lending standards had remained basically unchanged, but a few of them reportedly increased the maximum size of credit lines. Most domestic respondents that eased either standards or terms on C&I loans over the past three months cited more-aggressive competition from other banks or nonbank lenders as an important reason. Smaller numbers of banks also attributed the easing of loan terms to increased tolerance for risk or a more favorable or less uncertain economic outlook. In addition, the banks that reported having tightened either their standards or terms on C&I loans predominantly pointed to reduced tolerance for risk, worsening of industry-specific problems, or a less favorable or more uncertain economic outlook. On balance, demand for C&I loans had increased during the second quarter, but the net fractions of banks reporting stronger demand were modest for firms of all sizes. Those banks that reported having seen stronger demand cited as reasons for the strengthening a wide range of customers’ financing needs, particularly those related to accounts receivable, mergers or acquisitions, investment in plant or equipment, or inventories. Among the banks that reported weaker loan demand, a shift of borrowing away from their bank to other bank or nonbank sources was the most commonly cited reason. A modest net fraction of foreign banks also indicated that demand for C&I loans had strengthened over the second quarter of 2015.

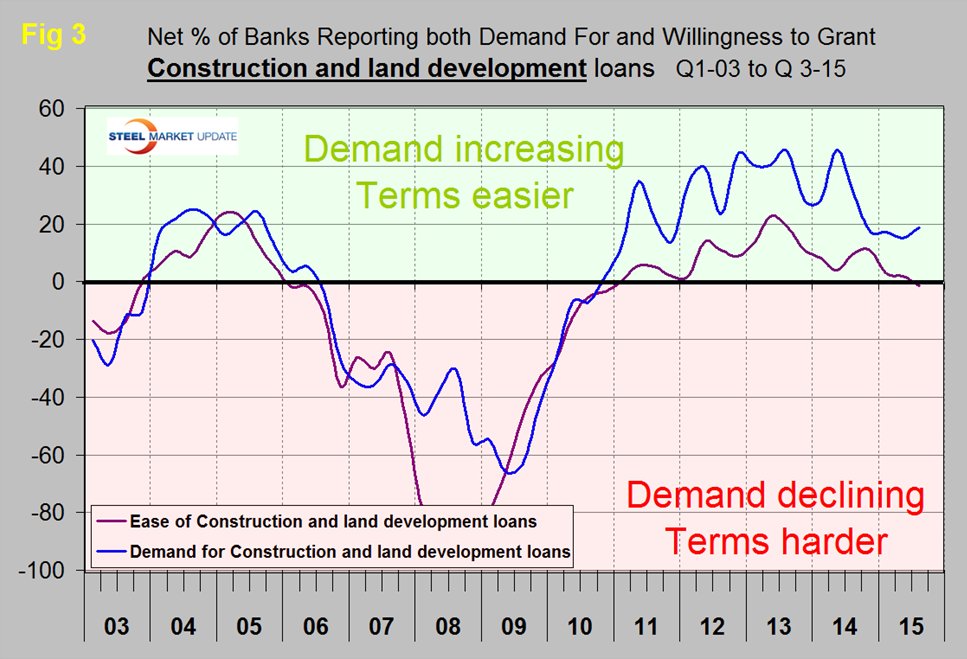

Commercial Real Estate (CRE) Lending: The majority of survey respondents indicated that their lending standards for CRE loans of all types had essentially remained unchanged relative to the first quarter. Moreover, the smaller numbers of banks that reported having eased standards on construction and land development (CLD) loans and loans secured by multifamily residential properties were about the same as those that had tightened standards on such loans. Meanwhile, a modest net fraction of banks eased lending standards on loans secured by nonfarm nonresidential (NFNR) properties, such as office buildings. Regarding changes in demand for CRE loans, the numbers of banks indicating that they had experienced stronger demand for all three types of CRE loans were somewhat larger than those reporting weaker demand. Similar to their domestic counterparts, foreign banks reported little change in their CRE lending standards while they indicated having experienced stronger demand for such loans on net.

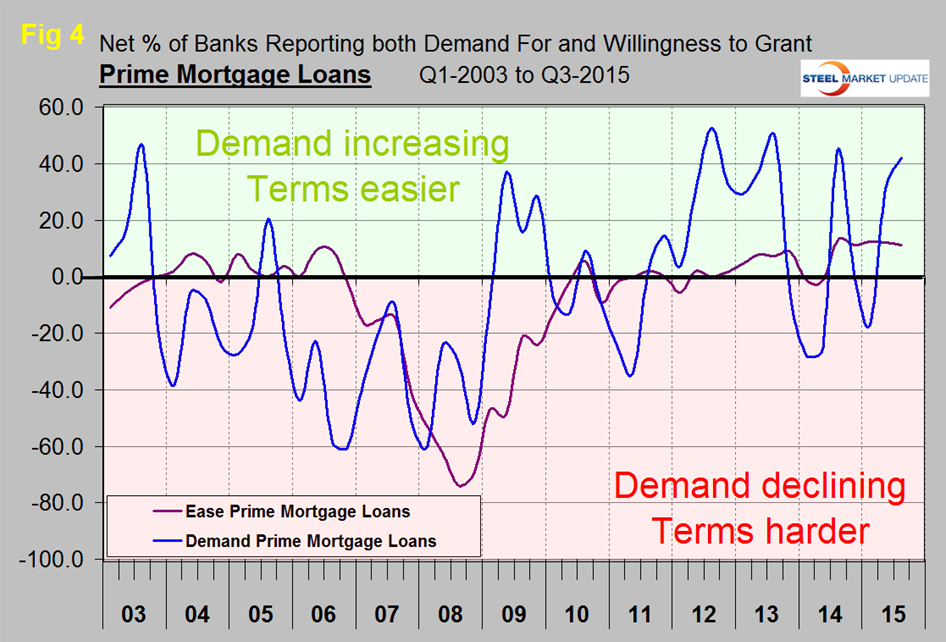

Lending to Households

Residential Real Estate Lending: Modest net fractions of banks indicated that they had eased underwriting standards on residential mortgages with the exception of government-insured and subprime categories. The easing was more pronounced for jumbo residential mortgages. Meanwhile, the vast majority of banks continued to report that they do not extend home-purchase loans to subprime borrowers. On the demand side, moderate net fractions of banks reported stronger demand across most categories of home-purchase loans. On balance, lending standards were reportedly little changed for home equity lines of credit (HELOCs), and demand for such loans strengthened.

Consumer Lending: A small net fraction of banks indicated that they were more willing to make consumer installment loans over the past three months. A few large banks reported having eased their standards for credit card loans, while standards for approving applications for auto loans and other types of consumer loans were about unchanged on net. Moreover, a few large banks also reported that, on net, they had increased credit card limits and reduced minimum credit scores to extend such accounts. On balance, terms on auto loans or other consumer loans were about unchanged. Regarding demand for consumer loans, a moderate net fraction of banks reported stronger demand for auto loans over the past three months. In addition, large banks also reported having experienced stronger demand for credit card loans on balance. Demand for other consumer loans was reportedly about unchanged at large banks and strengthened at other banks on net.

There is a huge amount of valuable data in this report which can be accessed using this internet address by those readers who wish to dig deeper.

At SMU we extract and graph the major elements in the survey. Regarding loans to businesses, the July survey indicated that demand for commercial and industrial (C&I) loans from both large (>$50MM revenue) firms and small firms (< $50MM revenue) improved slightly (Figure 1 and Figure 2).

Terms tightened slightly to large firms and eased slightly to small firms. What this means for example is that the number of banks reporting an easing of standards to small firms was 5.9 percent higher than the proportion reporting a tightening of standards. In reality most banks are not changing their standards by much. There was almost no change in the number of banks reporting a change in demand for construction and land development loans, demand is at the bottom of the range that has existed since mid-2011. The net percentage of banks reporting an easing of standards for construction loans decreased from 2.0 percent to 1.4 percent reporting a tightening of standards, (Figure 3).

In our opinion with this small sample size this means virtually no change. Demand for prime real-estate mortgages has been extremely erratic and seasonal for four years. In Q1 2015 a net 17.1 percent of banks reported a decline in demand, a net 31 percent reported an increase in Q2 2015 and a net 41.9 percent reported an increase in demand in this latest survey. This level of variability is not mentioned or explained in the official write up by the Fed, (Figure 4).

The implications of this report are reasonably good for steel people. Loan demand is positive for all categories. There has been a trend for less banks to be easing lending standards for C&I loans to large firms and for construction and land development loans in general. A net 2.9 percent of banks reported easing of standards for home equity lines of credit, with 21.7 percent reporting an increase in demand. A net 10.4 percent of banks are more willing to make consumer installment loans and a net 7.7 percent of banks have relaxed standards for credit card balances in the last three months. Demand for auto loans has improved strongly in the last three months with a net 17.8 percent of banks reporting an increase and there has been a small loosening of lending standards for auto loans.