Prices

August 2, 2015

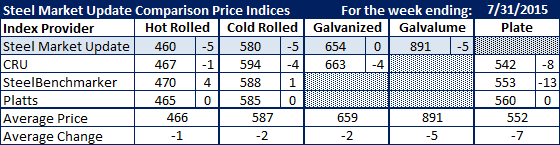

Comparison Price Indices: Slip Sliding Away?

Written by John Packard

Benchmark hot rolled slip a little this past week according to Steel Market Update and CRU, while Platts kept their hot rolled number the same (they haven’t moved in over a month). SteelBenchmarker reported prices and their hot rolled number was up $4 per ton. When all of that was said and done the average of the four indexes was down $1 per ton to $466 per ton.

The cold rolled average slipped $3 per ton as SMU saw the market down $5 and CRU saw it down $4. As with HRC Platts remained the same and SteelBenchmarker was up $1 per ton.

Our galvanized average dropped $2 per ton and the spread between SMU and CRU narrowed.

Galvalume was down $5 per ton and plate was hit the hardest dropping $11 per ton (average) even as Platts kept their plate number the same.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.