Market Data

July 28, 2015

Texas Manufacturing Slump Beginning to Improve

Written by Sandy Williams

Texas manufacturing has been in a slump for several months but is beginning to show signs of improvement. Manufacturing activity in Texas declined slightly in July according to The Texas Manufacturing Outlook Survey conducted by the Federal Reserve Bank of Dallas. Most of the indexes in the survey were in negative numbers but slowly creeping upwards, indicating a slower pace of decline. Texas is home to a large portion of the energy industry which has been under pressure from low oil prices.

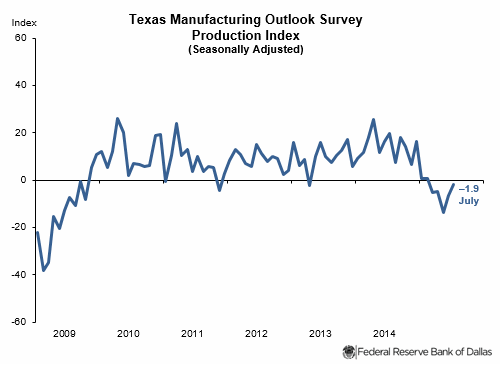

The Production Index rose to -1.9 for July, improving for the second month in a row. Likewise, the capacity utilization index increased to -4.1 and shipments index to -4.3.

The New orders index pulled out of six month decline registering 0.7 for the month. The index for growth rate of orders leapt 11 points to -5.2. Employment levels continued to be down in July.

Raw materials prices moved out of negative index numbers to 7.4 in June and then fell to zero in July. Finished goods prices continued to show a negative reading.

Texans were optimistic about future manufacturing prospects with indexes for future manufacturing activity and company outlook both posting double digit increases.

Comments from Fabricated Metal Manufacturers surveyed were as follows:

– We are currently in a push to complete multiple orders for the automotive industry that tie into the summer shutdown period and the release of a new vehicle.

– These are highly turbulent times.

– Six months from now we have a substantial amount of field repair work scheduled.

– Our revenue stream was significantly impacted by the May and June rains in the regions we serve. We have seen some recovery in July but believe it to be a result of previously postponed projects finally coming to completion. Material costs have decreased in the past month due to oversupply and reduced consumption in the steel value chain. We anticipate those price reductions to be short lived as supply is adjusted to demand. The savings allow us the opportunity to recover some margin lost in the first half of the calendar year resulting from cost reduction initiatives by our customers. Our six-month outlook for oil and gas exploration and production industry activity remains stable, though at levels more than 50 percent below the prior year.