Prices

July 28, 2015

SMU Price Ranges & Indices: CR Suit Having No Impact...Yet

Written by John Packard

“My offers haven’t changed much in the past 60-90 days,” is what one Texas based distributor told SMU when asked about spot pricing this week. “Still lackluster demand, no change in mill lead times and oil is still below 50. Not much reason for a change unless core demand improves….”

At the opposite spectrum we heard from a service center located in the Upper Midwest, “Lead times have not changed,” is what we were told. They told us that their company was trying to run a lean inventory and, “not out guess the market.”

From the middle of the country another large service center told us, “While the suit(s) are a longer term positive for the mills, I’m not sure we’ll see impacts in the present. We need real lead-times to move out with momentum, in order for the mills to raise prices now….”

Another service center told us that they were seeing longer lead times quoted from their domestic suppliers but orders on the books were coming in early.

All in all SMU is not seeing any major move in price momentum and it is too early for the cold rolled suits to sink in and have an impact on spot cold rolled (or other flat rolled) pricing. We only have a couple of minor adjustments to pricing this week.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over last week. Our overall average is the same compared to one week ago. SMU price momentum for hot rolled steel is for prices to remain range bound over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $560-$600 per ton ($28.00/cwt- $30.00/cwt) with an average of $580 per ton ($29.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is down $5 per ton compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to remain range bound over the next 30 to 60 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.00/cwt ($570-$600 per ton) with an average of $29.25/cwt ($585 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over last week. Our overall average is the same compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to remain within a narrow trading range over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$669 per net ton with an average of $654 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.00/cwt ($580-$620 per ton) with an average of $30.00/cwt ($600 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $5 per ton compared to last week. Our belief is momentum on Galvalume will be prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$911 per net ton with an average of $891 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

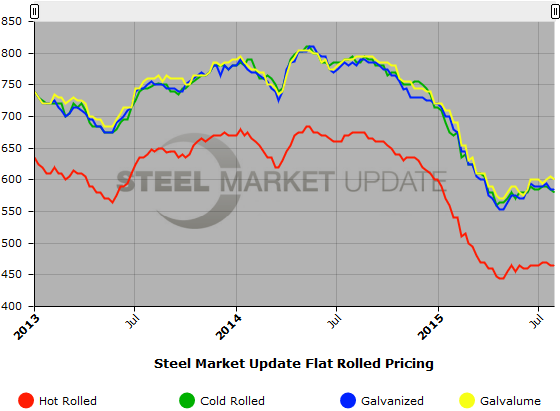

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.