Market Data

July 27, 2015

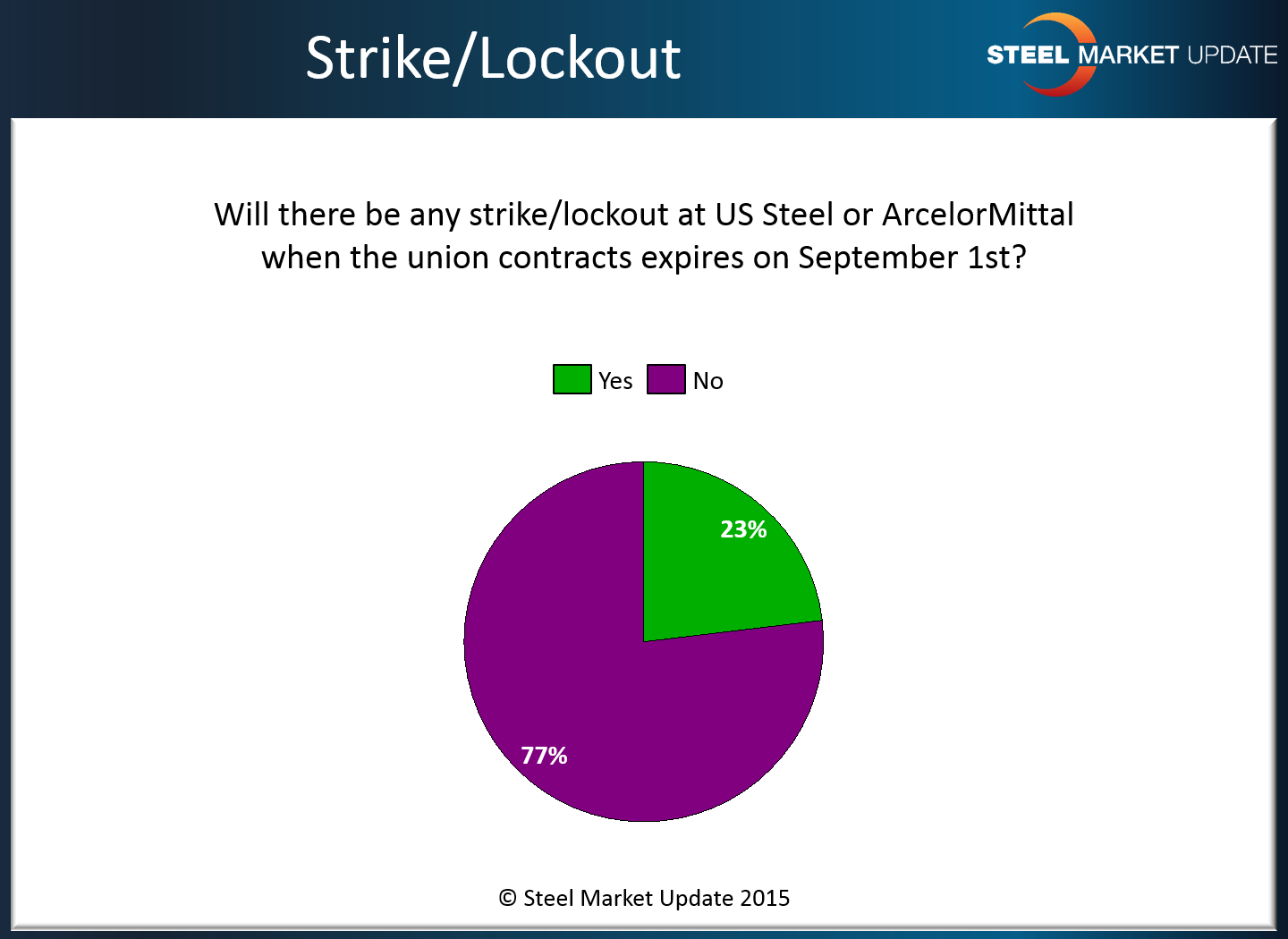

Correction/Clarification: SMU Survey Results for Strike or No Strike

Written by John Packard

On Sunday we produced an article that was perhaps confusing to some of our readers. The article entitled: “Possible Strike Does Not Worry Buyers & Sellers of Steel” had an error in the graphic produced. Our survey results has 76 percent of those responding saying they are Not concerned about the possibility of a strike or lockout at either US Steel or ArcelorMittal when their contracts expire on September 1st.

The graphic should have looked like this (the colors were reversed in the original article):