Prices

July 21, 2015

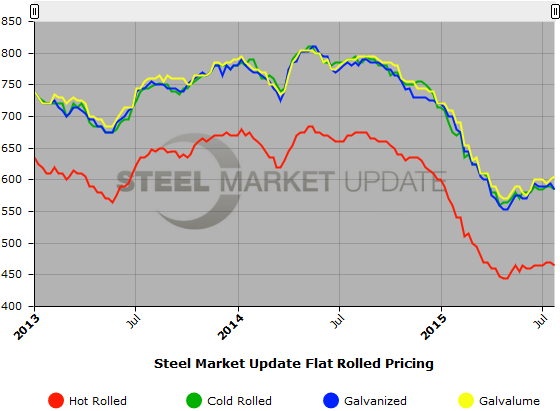

SMU Price Ranges & Indices: Don't Read a Lot into the Small Price Movements

Written by John Packard

We found a little bit of weakening in our price ranges on hot rolled, cold rolled and galvanized while Galvalume was slightly higher. We do not attribute any change in momentum with the numbers. We are of the opinion that the changes were related to the collection of data this week (with more emphasis on our questionnaire and less on one-on-one conversations with buyers). SMU is of the opinion that the numbers will bounce around (+/- $5 to $10 per ton) over the coming weeks. Our Price Momentum Indicator was adjusted to Neutral on Friday of this past week which means that the push for higher prices is more muted but, at the same time we are not seeing a wholesale drop in prices.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton over last week while the upper end remained the same. Our overall average is down $5 per ton compared to one week ago. SMU price momentum for hot rolled steel is for prices to remain range bound over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $570-$600 per ton ($28.50/cwt- $30.00/cwt) with an average of $585 per ton ($29.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end remained unchanged. Our overall average is down $5 per ton compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to remain range bound over the next 30 to 60 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.00/cwt ($570-$600 per ton) with an average of $29.25/cwt ($585 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week as did the upper end. Our overall average is down $10 per ton over one week ago. We continue to believe that price momentum on galvanized steel is for prices to remain within a narrow trading range over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$669 per net ton with an average of $654 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.50/cwt ($580-$630 per ton) with an average of $30.25/cwt ($605 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end increased $10 per ton. Our overall average is up $5 per ton compared to last week. Our belief is momentum on Galvalume will be prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$921 per net ton with an average of $896 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.