Market Data

July 15, 2015

Philadelphia Fed Manufacturing Survey Dips in July

Written by Sandy Williams

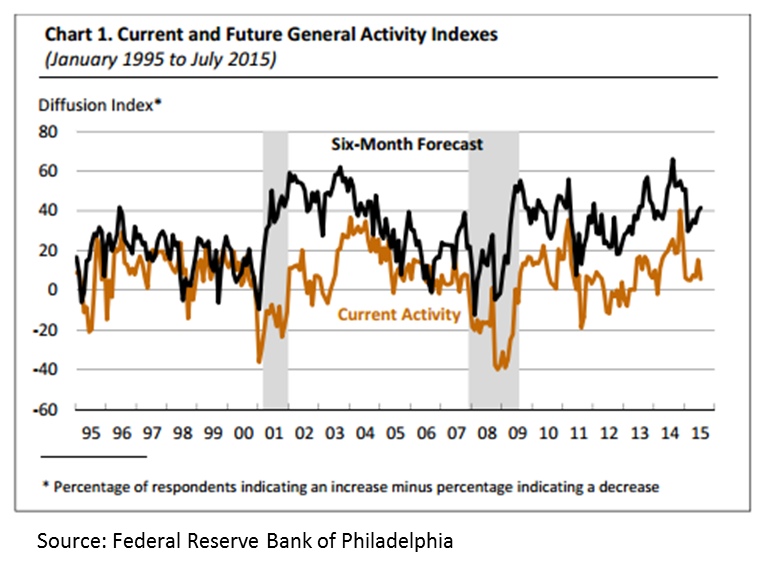

The Philadelphia Manufacturing Business Outlook Survey showed slower growth in business activity in July. The headline index dropped to 5.7 from 15.2 in June but remained positive for the month. The index has been in single digits so far this year with the exception of June.

New orders slipped eight points in July while the current shipments index fell 10 points from its six-month high in June. Both remained in positive territory. Unfilled orders and delivery times decreased in July indicating a decline in backlogs and faster delivery times.

The employment index also took a dive, dropping to -0.4. Respondents were evenly split on increases and decreases in employment.

Input prices were reported as higher in Jul, increasing for the second month and at its highest reading since October. Most respondents indicated prices received as steady (77 percent) with the percentage of those reporting higher prices slightly higher percentage than those reporting lower prices.

The future outlook improved slightly with the future general activity index rising 2 points to its highest reading since January. The index for future new orders increased 1 point while future shipments slipped 5 points after a 10 month high in June.

More 31 percent of respondents expect to increase their workforce in the next six months.

The Manufacturing Business Outlook Survey is published monthly by the Federal Reserve Bank of Philadelphia.