Distributors/Service Centers

July 14, 2015

Service Center Spot Prices Moving in Line with Mill (they're not...)

Written by John Packard

Steel Market Update found the results of one of the group of questions about service center spot sales from this past week’s flat rolled steel survey quite interesting.

There have been two price increase announcements by all of the domestic mills and a third laying there from US Steel and our results suggests – well, we are not quite sure what it suggests because we haven’t seen a trend like this in quite some time (to be honest we are still looking for another period when our graphics look similar).

We believe what we are picking up in our analysis of the flat rolled steel market and in particular the spot pricing offers being made by U.S. service centers and wholesalers, is the result of a market correction which took price levels down to where they should have been when the U.S. dollar appreciated and commodity prices collapsed.

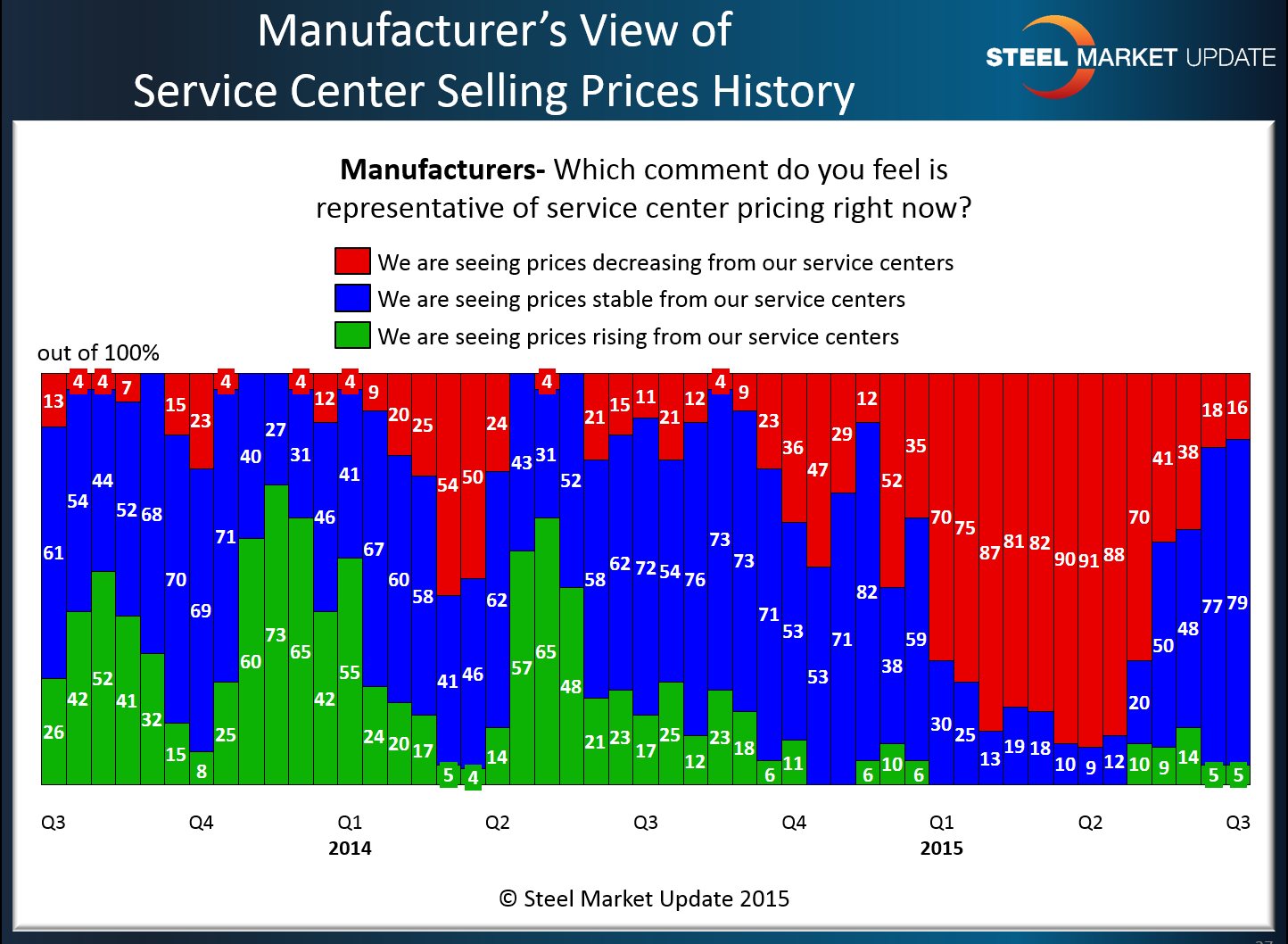

Manufacturers are reporting that service center spot prices are stable (79 percent) with the percentage of those reporting distributor prices as decreasing has dropped to 16 percent. The remainder (5 percent) reported service center spot prices as rising. As you can see from the graphic provided, manufacturers have been reporting spot prices as in decline going back to 4th quarter 2014. Over the past few months there has been a trend toward balanced or stable pricing.

What we are not seeing is a significant improvement in the percentage of service centers who were reported as raising prices. This in spite of two (or three if you are a USS supporter) price increase announcements.

The lack of movement appears to be an indication of the stagnation we have seen in mill prices over the past couple of months. The market has bottomed, bounced $20-$25 per ton and is now holding its own.

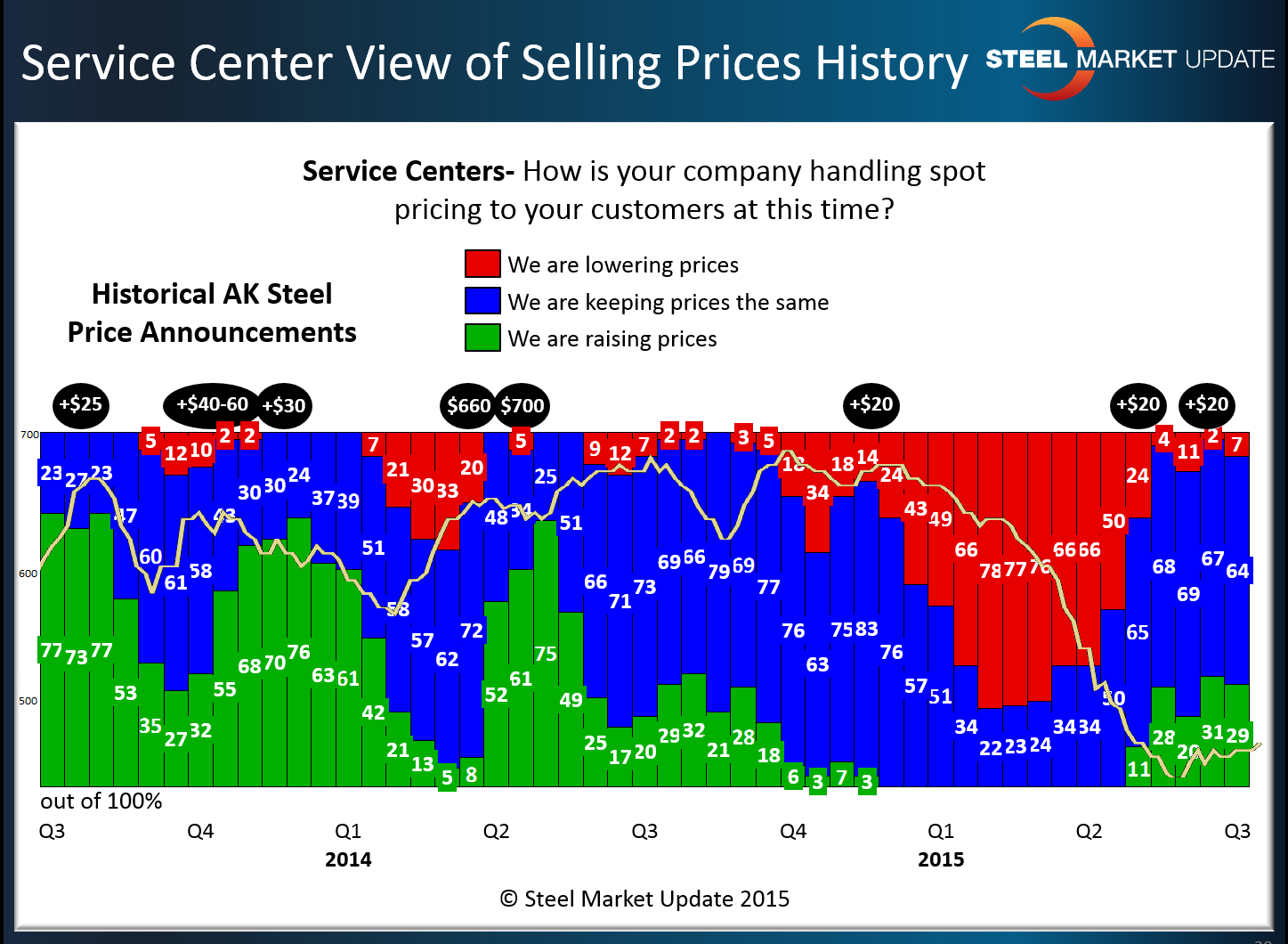

So, we have shown our readers a piece of the below graphic from time to time when the domestic mills are raising prices and we are measuring what the distributors are doing with spot prices. Our opinion is, when service centers are moving spot prices higher that supports the move by the domestic steel mills to collect the higher prices from their customers.

When the service centers are lowering their spot prices there is little (can you say none) chance that the domestic mills will be able to collect price increases. As you can see from the graphic below, we have added a line on the graph which depicts the movement of benchmark hot rolled pricing. That $20 per ton price increase announced by AK Steel in late 4th quarter 2014 had zero chance of being collected as the red bars increased in size and no green bars appear (which depict service center spot prices as moving higher).

We do see a very small percentage of distributors as saying they are raising prices (less than one third of the responding distributors) which is not a resounding measure of support for the two increases announced since the end of April 2015. However, the red bars have just about disappeared which allowed a portion of the increases to stick (but not all).

For those of you who have not seen this graphic before the black ovals represent when AK Steel announced a flat rolled price increase. We pick on AK Steel only because they publish their increase announcements in their “news” release history on their website. So anyone can check for themselves if there is a question about when and how much. AK Steel has not followed the US Steel lead on the third increase at this time.

Now we wait to see if there is any price momentum in one direction or the other that will support prices moving either higher or lower. Our SMU Price Momentum Indicator is, at this moment, indicating that prices should move higher from here over the next 30 to 60 days. We are basing our opinion on outside circumstances: trade cases and labor issues. It appears that the labor issues are being discounted and that the automotive companies may be more vulnerable than the steel mills (this would be a negative to steel prices should one of the auto companies go out on strike).

The trade case (probably cold rolled) may be a non-issue as well and we will be evaluating our Price Momentum Indicator later this week when we see the June MSCI data.