Market Data

July 12, 2015

SMU Survey: Trade Related Results

Written by John Packard

Last week Steel Market Update (SMU) conducted our early July flat rolled steel market analysis (survey). We invited just under 600 companies to participate in our questionnaire which covered such items as Sentiment, pricing trends, purchasing trends, inventories, lead times, negotiations and more.

We placed two questions early during the survey process where we ask all of our invitees to comment on general industry questions.

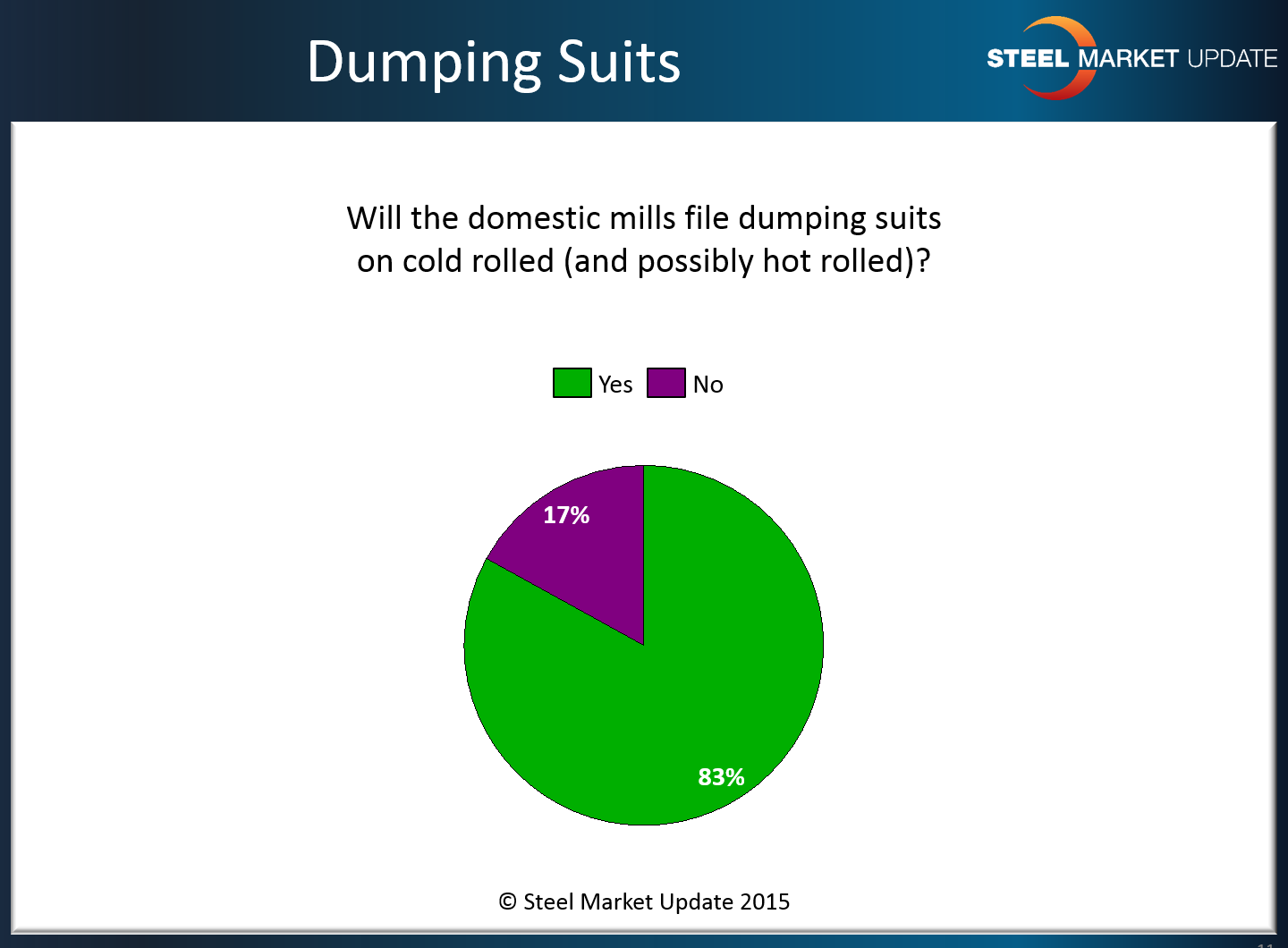

The first new question we asked was, “Will the domestic mills file dumping suits on cold rolled (and possibly hot rolled)?”

Eighty three percent of those responding believed that the cold rolled trade suit is inevitable while only 17 percent are not believers.

There were a few comments left behind:

“[They] should have before coated products.” Trading Company.

“Cold rolled, probably not HR.” Service Center.

“I think most buyers are expecting this. If they were successful with HDG, why not HR and CR also.” Manufacturing Company.

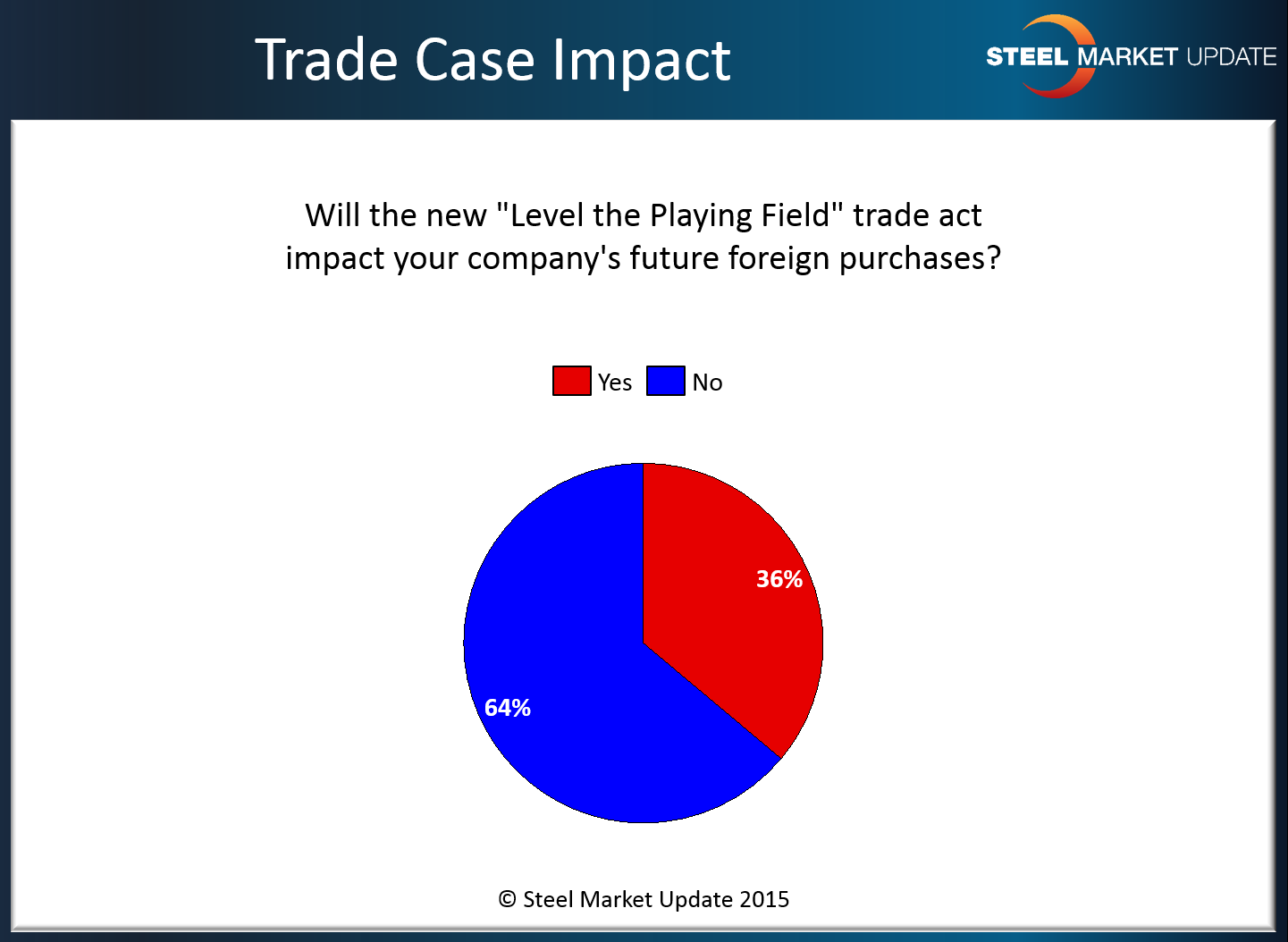

The second question asked was, “Will the new ‘Level the Playing Field’ trade act impact your company’s future foreign purchases?”

The majority of the respondents (64 percent) said “No” while the balance (36 percent) responded that the new trade rules will impact future foreign purchases.

We received a number of comments by those responding to this question:

“Domestic mills force higher prices. For them it is not an issue of supply/demand. Foreign pricing helps us be competitive AND my customers can be more competitive. After all they are losing manufacturing business to the same countries that the dumping charges are being filed against. One way or another we get skinned alive.” Service Center.

“The field will not be level, that is crap. Also US mills don’t make light gauge.” Manufacturing Company.

“It is really hard to tell at this time but I do think it will.” Service Center.

“May have to rely on alternate sourcing.” Trading Company.

“Yes, but we will pursue other opportunities.” Manufacturing Company.