Market Data

July 9, 2015

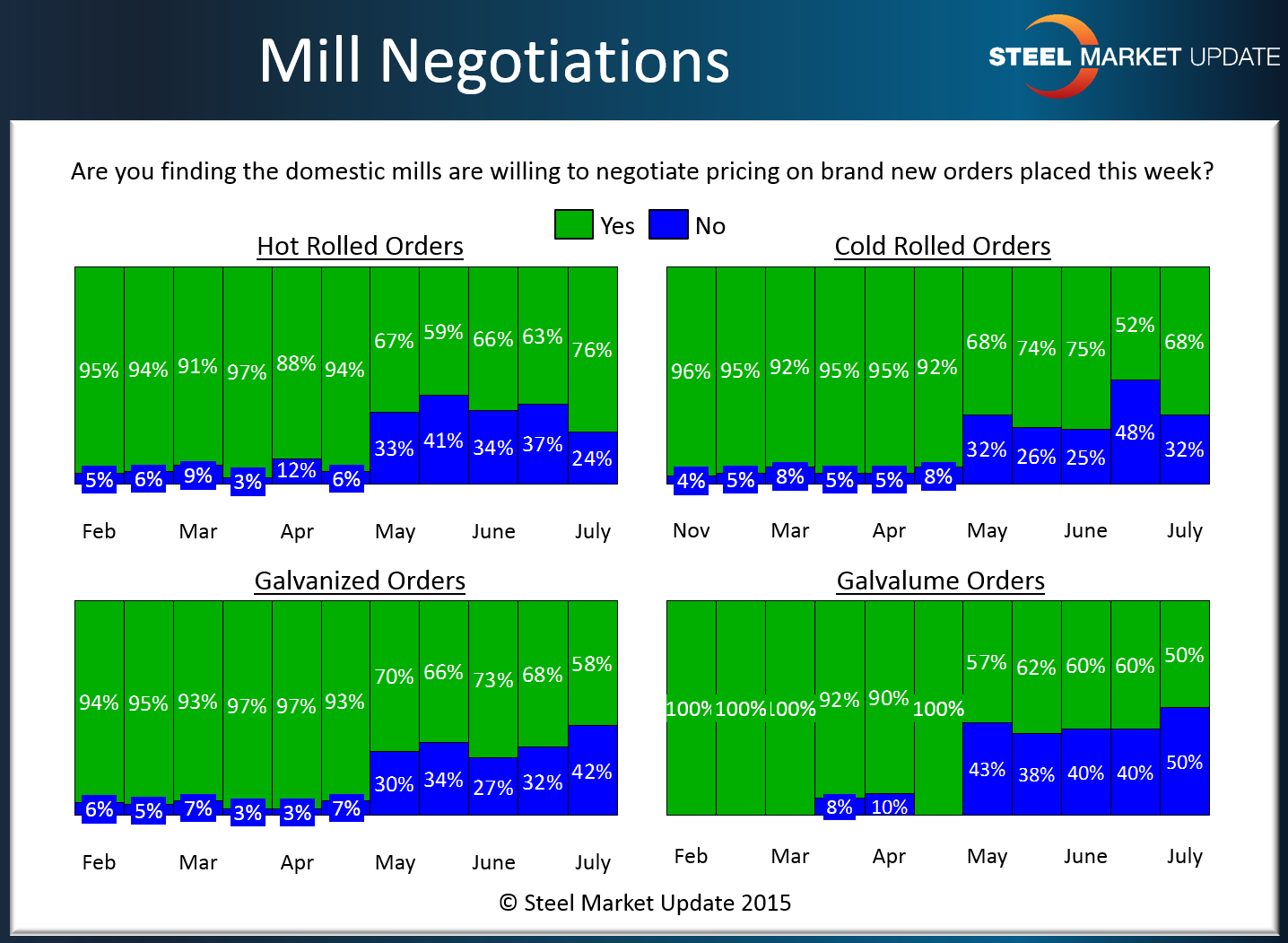

Steel Survey Reports Mixed Results Regarding Mill Negotiations

Written by John Packard

Steel Market Update (SMU) continues to collect data from manufacturing and distributors suggesting that the domestic steel mills are willing to negotiate flat rolled steel pricing for new spot orders.

The weakest product is hot rolled steel where 76 percent of our respondents reported the mills as willing to negotiate steel prices. Prior to this latest survey and going back to the month of May we were seeing the percentages as being slightly lower (see graphic below).

Cold rolled is another product that continues to be weaker than we would have anticipated, especially after three price announcements (well, two and USS third). Sixty-eight percent of our respondents reported CR prices as being negotiable.

Galvanized and Galvalume are two products that saw some strengthening of the mill’s hand when it came to negotiating prices. Of those responding to our galvanized query 58 percent reported the mills as willing to negotiate. This is down from 68 percent back in mid-June.

Galvalume dropped to the lowest percentage of all the flat rolled products hitting 50 percent. Half of those responding to our AZ inquiry reported the mills as willing to negotiate. This is down 10 percent from what we reported both at the beginning and during the middle of the month of June.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.