Prices

July 7, 2015

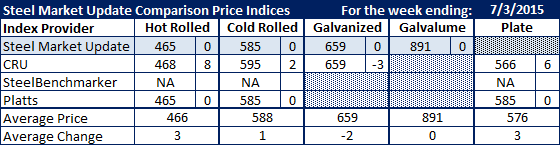

Comparison Price Indices: Prices Stagnating

Written by John Packard

Since SMU did not publish on Sunday evening we wanted to get the information regarding flat rolled steel price indices from last week. We saw prices tighten up amongst the various indexes which reported pricing last week (SMU, CRU and Platts). However, as with the week before, price momentum was flat going into the 4th of July holiday in the United States.

Benchmark hot rolled prices are within a few dollars of one another with SMU and Platts maintaining their $465 per ton number and CRU, which was at $460 the week prior moved up $8 per ton to $468.

Cold rolled results were very similar to hot rolled with SMU and Platts both at $585, same as the week before, and CRU rose $2 per ton to $595 per ton.

Galvanized saw both SMU and CRU at exactly the same number, $659 per ton for .060″ G90.

Galvalume prices did not move with SMU at $891 per ton on .0142″ AZ50, Grade 80.

Plate prices saw CRU move up $6 per ton to $566 per ton while Platts remained stable at $585 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.