Prices

June 30, 2015

SMU Price Ranges & Indices: Eerily Quiet...

Written by John Packard

The silence you hear is, we guess, the market on vacation… There was very little movement in flat rolled steel prices and lead times this week. We have price announcements, a coated trade case, union negotiations and now new trade language and the market is just absorbing it and continuing on as though everything is the same. At least that is how it feels when we talk to buyers out there. The weakest product is hot rolled coil which can still be gotten at one or two mills in two weeks or less. Coated products have been the most active, although we did not detect any changes in pricing this week.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to last week. Our overall average is the same compared to one week ago. SMU price momentum for hot rolled steel is for prices to move higher over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $570-$600 per ton ($28.50/cwt- $30.00/cwt) with an average of $585 per ton ($29.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to one week ago. Our average is the same as it was last week. We continue to believe that price momentum on cold rolled steel is for prices to move higher over the next 30 to 60 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.50/cwt ($570-$610 per ton) with an average of $29.50/cwt ($590 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to last week. Our average is the same compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to move higher over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$679 per net ton with an average of $659 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.00/cwt ($580-$620 per ton) with an average of $30.00/cwt ($600 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same as last week. Our average is unchanged compared to last week. Our belief is momentum on Galvalume will be for higher prices over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$911 per net ton with an average of $891 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-6 weeks.

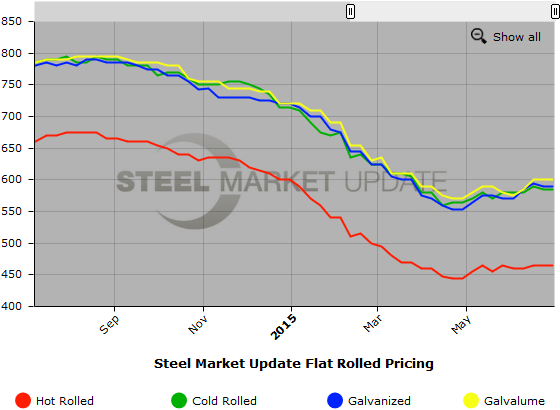

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.