Market Data

June 30, 2015

Review of the First Six Months 2015

Written by John Packard

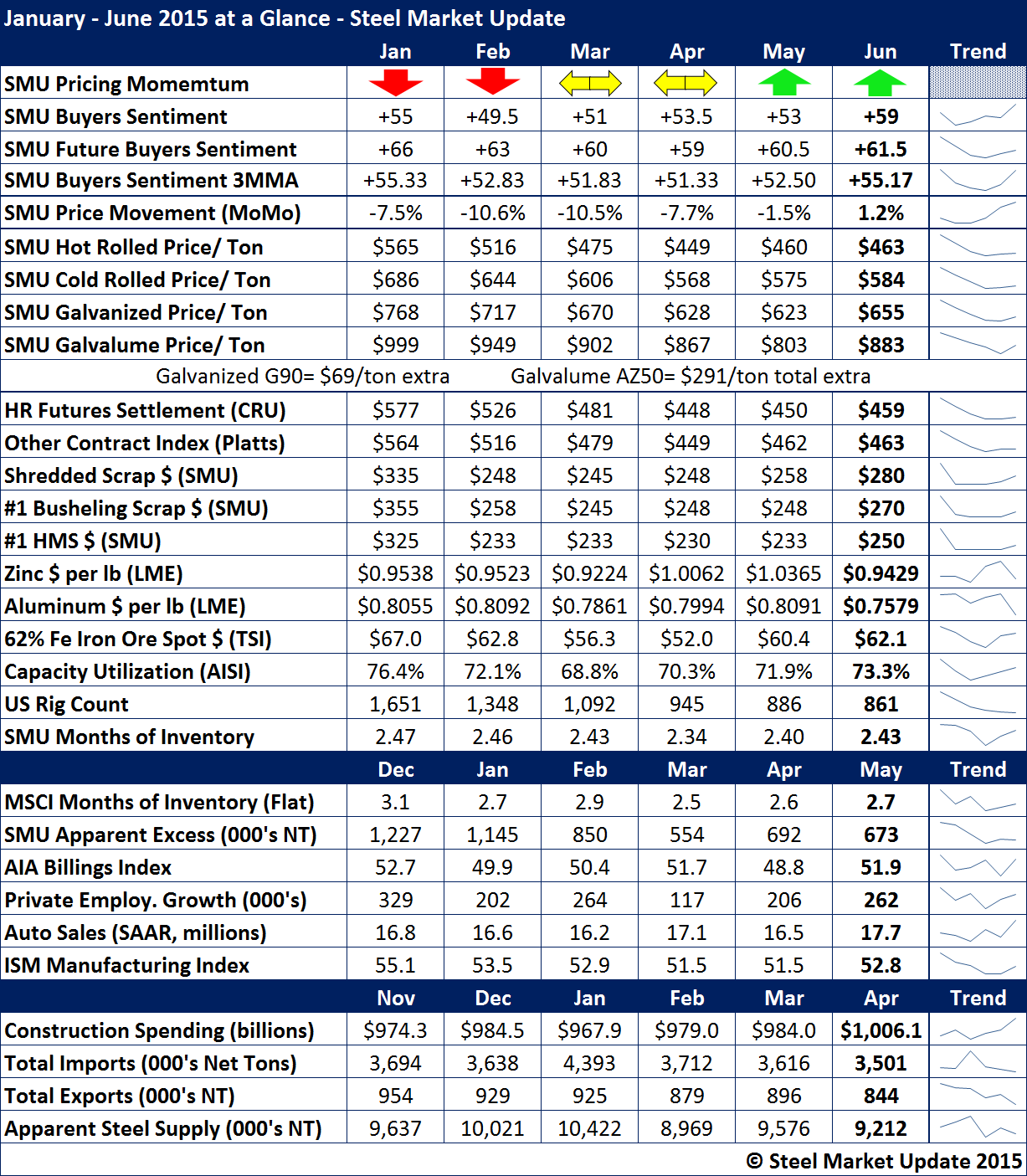

We have seen many of the indices either produced by or followed by Steel Market Update (SMU) were falling during the first few months of 2015 before stabilizing and beginning to rebound by the end of the first six months 2015. Not everything is reacting in unison so we thought we would point out a few of the highlights over the first six months of this calendar year.

The table below is much like the monthly one we used earlier in this newsletter. However, we have added a trend line to give you a better visual of what has been happening with each of our data points over the past six months. We are seeing a number of “green shoots” which give us hope that the second half of 2015 will be much better than the first six months.

Both our Current and Future Steel Buyers Indexes ended the month of June higher than the four prior months. At the same time our 3 month moving average for Sentiment was back to the high’s seen in January and better than the February through May months.

During the six month period benchmark hot rolled prices were at their zenith in January and drifted lower until the end of April when the month average bottomed at $449 per ton. Prices have since rebounded by $14 per ton (monthly average).

Zinc, which is primarily used for coated steels like galvanized and Galvalume, traded in a relatively narrow range during the six month period. The June average is close to the low’s seen in March.

Aluminum also traded within a very narrow range over the past six months. It is, however, at the lowest point we have seen during this period of time.

You can get a true feeling about the energy sector by looking at the change in rig counts just over the last six months. Rigs at the end of June are almost half of what they were in January.