Market Data

June 30, 2015

Consumer Confidence: June 2015

Written by Peter Wright

The consumer confidence index as reported by the Conference Board jumped by 6.8 points in June, as May was revised down slightly. The composite value combines the view of the present situation and expectations and this month’s result is a perfect example of why not to get too carried away by one month’s result in either direction.

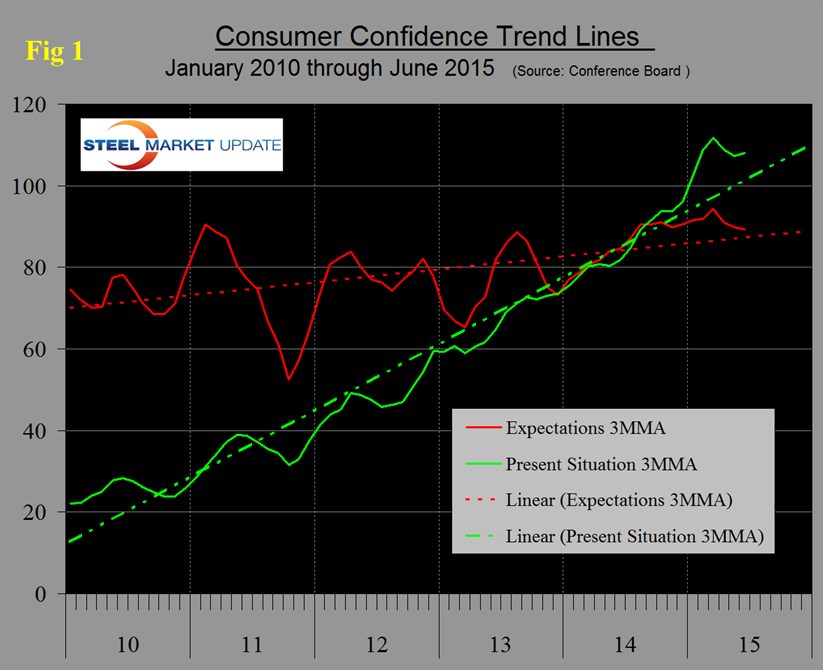

The three month moving average was unchanged. The composite value of consumer confidence has been quite erratic in the last few months. Since December the monthly results have been 93.1, 103.8, 98.8, 101.4, 94.3, 94.6, and 101.4 in June. As can be seen, in the 3MMA calculation we dropped March at 101.4 and added June at 101.4 so there was no change. In June the view of the present situation rose from 107.1 to 111.6 as expectations rose from 86.2 to 94.6. The 3MMA of the present situation increased by 0.7 to 107.9 as the 3MMA of expectations fell by 0.5 to 89.3. The 3MMA of the present situation is now above the five year trend line and that of expectations is almost exactly on trend (Figure 1).

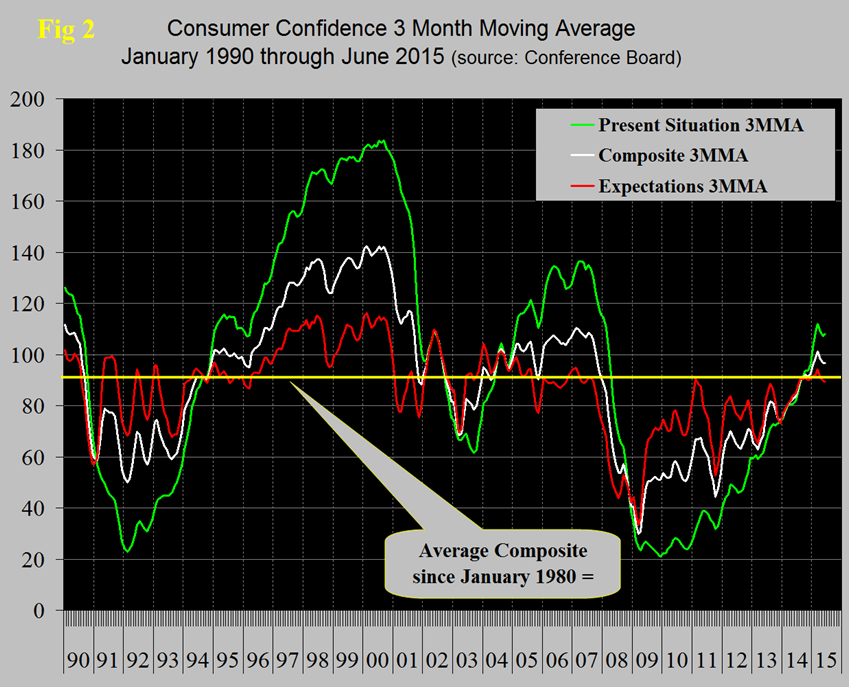

The April and May decline in the 3MMA of the composite followed 15 straight months of increase. The 3MMA of the composite at 96.8 is well above the 35 year average which stands at 90.6 since 1980. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

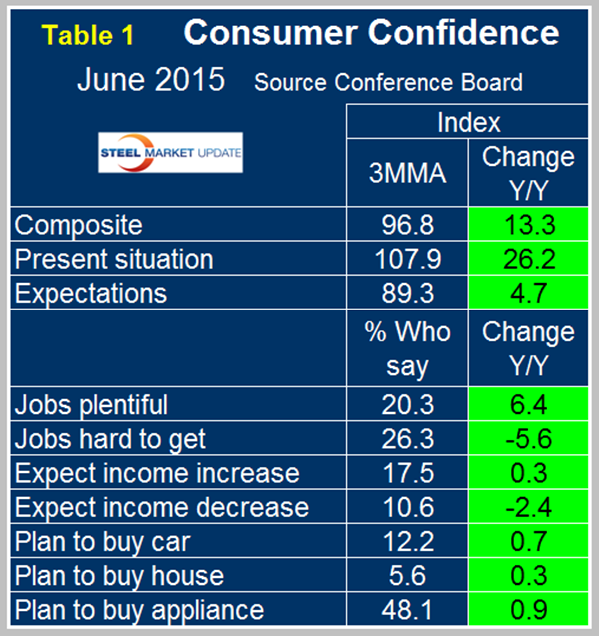

The recovery of the composite is now looking better than the turn around after the recession in 2003. The present situation component has been much more volatile over each multi-year time span than expectations since our data began 35 years ago with higher highs and lower lows. The view of the present situation moved ahead of that for expectations in October last year for the first time since the recovery began in 2009. If history repeats itself, the view of the present situation will continue to move ahead and widen the differential between it and expectations. On a year over year basis using a 3MMA the composite is up by 13.3 led by consumer’s view of the present situation which is up by 26.2 (Table 1).

The good news is that this is the first time for Table 1 to be all green for as long as we can remember, certainly since before the recession. The four employment sub-indexes which describe job availability and wage expectations have all strengthened in the last year as indicated by the color code green. The year over year trends for auto, home and appliance purchase were all negative in March. Intentions to buy an appliance became positive in April, intentions to buy a car became positive in May and in June all three were positive year over year. Overall in the first six months of 2015, the Conference Board index has had the best performance since Q3 2007.

The official news release from the Conference Board follows:

The Conference Board Consumer Confidence Index Increases Again

The Conference Board Consumer Confidence Index, which had improved moderately in May, increased further in June. The Index now stands at 101.4 (1985=100), up from 94.6 in May. The Present Situation Index increased from 107.1 last month to 111.6 in June, while the Expectations Index advanced to 94.6 from 86.2 in May.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was June 18.

“Consumer confidence improved further in June, following a modest gain in May,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Over the past two months, consumers have grown more confident about the current state of business and employment conditions. In addition, they are now more optimistic about the near-term future, although sentiment regarding income prospects is little changed. Overall, consumers are in considerably better spirits and their renewed optimism could lead to a greater willingness to spend in the near-term.”

Consumers’ assessment of current conditions improved again in June. Those saying business conditions are “good” increased from 24.7 percent to 26.4 percent, while those claiming business conditions are “bad” was virtually unchanged at 17.8 percent. Consumers were also more positive about the job market. Those stating jobs are “plentiful” increased from 20.6 percent to 21.4 percent, while those claiming jobs are “hard to get” declined from 27.2 percent to 25.7 percent.

Consumers’ optimism about the short-term outlook also increased in June. The percentage of consumers expecting business conditions to improve over the next six months rose from 16.0 percent to 18.5 percent, while those expecting business conditions to worsen decreased from 11.3 percent to 9.8 percent.

Consumers’ outlook for the labor market was also more upbeat. Those anticipating more jobs in the months ahead increased from 14.7 percent to 17.8 percent, while those anticipating fewer jobs declined from 16.6 percent to 15.1 percent. The proportion of consumers expecting growth in their incomes was virtually unchanged at 17.5 percent, while the proportion expecting a decline edged down slightly from 10.7 percent to 10.2 percent.

About The Conference Board

The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The Conference Board is a non-advocacy, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States.