Prices

June 28, 2015

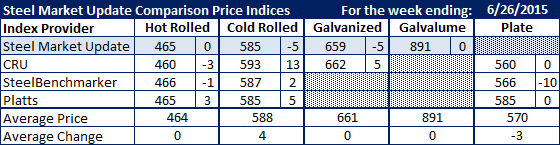

Comparison Price Indices: Another Week of Wait and See

Written by John Packard

Benchmark hot rolled prices remain stuck at $465(ish) according to the four flat rolled steel indexes followed by Steel Market Update. Platts rose $3 last week and reported $465 per ton HRC as did Steel Market Update, which was unchanged from the prior week. CRU was down $3 per ton to $460 per ton and SteelBenchmarker reported $466 per ton. Our average came in at $464 per ton, unchanged from the previous week.

Cold rolled saw three of the four indexes moving higher with one, CRU, up $13 per ton from the previous week. The other three indexes reported $585 per ton (SMU/Platts) and $587 per ton. The average for CRC rose $4 per ton to $588 per ton.

Both CRU and SMU saw galvanized .060” G90 as being close to $660 per ton. SMU was $659 down $5 per ton while CRU reported GI at $662 per ton, up $5 per ton.

Galvalume .0142” AZ50, Grade 80 remained unchanged at $891 per ton.

Plate prices ranged from $560 per ton (CRU) to a high of $585 per ton (Platts) with the average dropping $3 per ton to $570 per ton.

We advise our readers not to be too concerned when prices bounce up and down $5 per ton or less on a weekly basis. We believe this is due to just the way the numbers are being collected on a weekly basis and have less to do with prices eroding at this point in time (however, they aren’t busting out to the high side either).

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.