Prices

June 23, 2015

SMU Price Ranges & Indices: Stagnant Market?

Written by John Packard

When asked to report on how steel mill pricing was this past week, one coating mill told Steel Market Update, “Really nothing. It wasn’t up, nor down in my opinion. We are booking steadily. But people still have inventory so nobody is desperate or in a bind. Good lead time but not enough panic to warrant strong moves.”

A very large steel service center group told SMU that the hot rolled market was “stagnant, it’s dead.” The head of procurement went on to say, “There is nothing to indicate that anything is going to change at any time soon… Inventories are high and lead times are short.” This individual also said, “OK demand doesn’t fill up a mill’s schedule or service center’s order book.”

A medium sized service center told us that they were somewhat optimistic at the beginning of last week. By the end of the week they had grown less optimistic and were even less enthusiastic this week. “We could be in for a little soft patch,” is the way he put it to us this afternoon. “So many people have covered themselves for an extended period of time and the foreign mills are expediting orders in order to get them in [before potential dumping margins come into play].” He went on to say, “This is not a rock solid market.”

We heard from numerous companies that lead times have not moved much over the past week. One buyer told us that the lead time they had on heavy gauge galvanized for new orders this week was the same as what they saw two weeks ago. General coated steel lead times are being reported as 6-7 weeks by most buyers with whom we spoke this week. We did hear from one wholesaler this morning on our HARDI conference call that their steel was coming in late. A couple of other comments were made saying some items were late but most mills were delivering on time (coated products).

Hot rolled, on the other hand, was reported to be about three weeks but one upper Midwest buyer told us that the “lead times seem to be moving out on paper but many of our suppliers were shipping early. False lead times?”

We heard from one plant tied to a large national service center chain, “Just surprised at the lack of market momentum at the moment. I had thought we would see more extension of lead-times and higher prices, just due to buyers covering for the labor contracts. Until July gets filled everywhere, we may see this sluggishness. On the flip side, August might fill quickly for same reason, as awareness increases.”

From the east coast we heard from a service center, “Hot rolled remains around $460, Cold Rolled and Galvanized are sitting at $580/ton. The mills are not even asking for the additional $20/ton they announced. However, they will have to be reckoned with when the trade suits hit.”

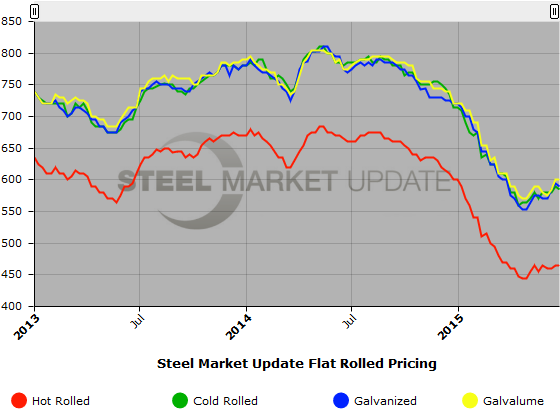

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. The lower end of our range rose $10 compared to last week while the upper end decreased by $10 per ton. Our overall average is the same compared to one week ago. SMU price momentum for hot rolled steel is for prices to move higher over the next 30 to 60 days.

Hot Rolled Lead Times: 3-6 weeks.

Cold Rolled Coil: SMU Range is $570-$600 per ton ($28.50/cwt- $30.00/cwt) with an average of $585 per ton ($29.25/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to one week ago while the upper end declined by $10 per ton. Our average is now $5 per ton lower than last week. We continue to believe that price momentum on cold rolled steel is for prices to move higher over the next 30 to 60 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.50/cwt ($570-$610 per ton) with an average of $29.50/cwt ($590 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 compared to last week while the upper end remained the same. Our average is down $5 per ton compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to move higher over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$679 per net ton with an average of $659 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.00/cwt ($580-$620 per ton) with an average of $30.00/cwt ($600 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same as last week. Our average is unchanged compared to last week. Our belief is momentum on Galvalume will be for higher prices over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$911 per net ton with an average of $891 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-6 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.