Market Data

June 18, 2015

Steel Survey: Impact of AD/CVD Dumping Suit

Written by John Packard

The steel industry has been preparing for a trade suit for well over a year. Those who buy steel, manufacturers, fabricators and steel service centers have had ample time to prepare for what many had been predicting as inevitable, a light flat rolled coated steel anti-dumping (AD) and countervailing duty (CVD) suit.

As we speak with steel buyers around the country, we are probing to see what arrangements have been made to diversify their sources of supply or adjust inventory levels to limit their exposure to any potential disruption of supply.

SMU spoke recently with a buyer of ultra light gauge galvanized steel which prior to the announcement was coming from India and China. Over the past few months this manufacturer worked to create new sources of supply out of countries such as South Africa as well as expanding domestic mill sources who are able to produce the light gauge galvanized steels needed in their products.

The overall industry, including the financial community, are interested in knowing more about how the dumping suits are affecting the domestic mills. We spoke with a galvanized steel mill supplier last night at the Bank of America Merrill Lynch dinner in Chicago about their order book. They advised SMU that they were taking orders on a “controlled” basis and their mill was essentially sold out for the month of July. The mill told us that they had increased the volume of galvanized orders that they were taking but they were being very careful to take care of their existing customer base. They advised us that they are receiving a large number of inquiries for non-traditional customers.

However, we are not seeing a rush or flood of orders because service center inventories are high, there are significant number of tons of galvanized and Galvalume still arriving from foreign sources and, as mentioned above, those who are exposed to India, Taiwan, South Korea, China and Italy have made strategic choices to diversify or build inventory.

The subject of building inventory was one we wanted to probe in our flat rolled steel market analysis (survey) that began at the beginning of this week and concluded this afternoon.

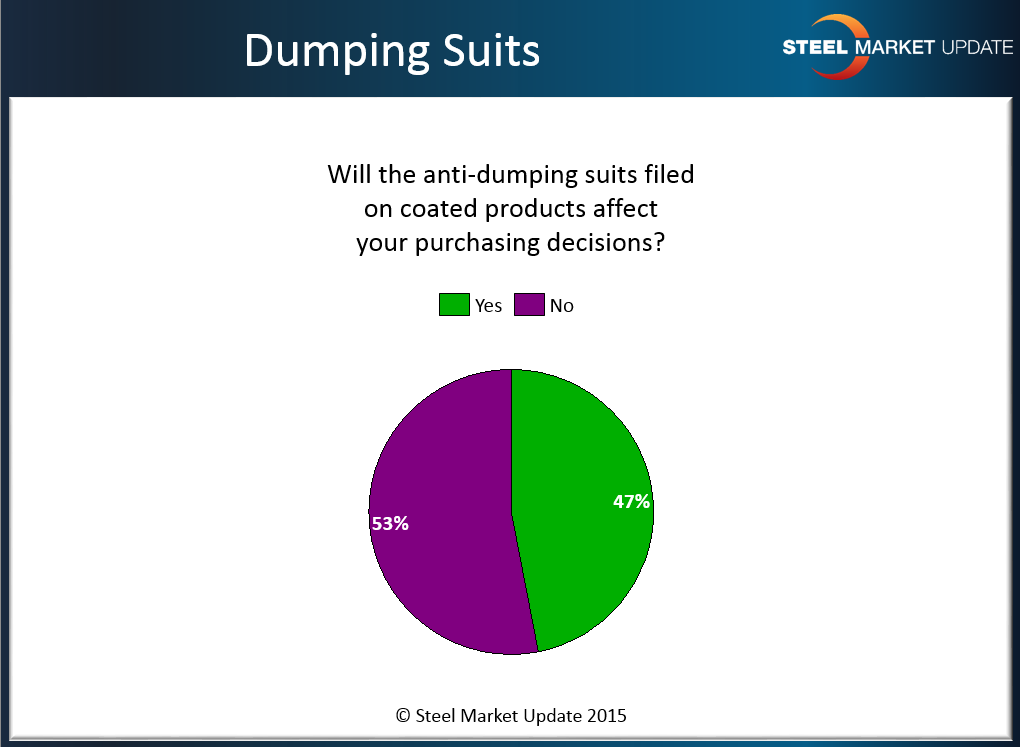

The results of our latest questionnaire, which was provided to well over 600 companies this week, indicated that 47 percent of the respondents will not affect purchasing decisions at their company.

The results of our latest questionnaire, which was provided to well over 600 companies this week, indicated that 47 percent of the respondents will not affect purchasing decisions at their company.

There were a number of comments left behind as our respondents answered the question posed about whether the suit would prompt their company to change purchasing directives.

The president of a Midwest service center told us, “We will encourage our contractual account to buy aggressively.”

A second service center executive (also located in the Midwest) said, “We will be purchasing less foreign material.”

A manufacturing company told us, “I will keep inventory levels higher than usual as current prices are likely near the bottom and the mills will attempt to get prices up as soon as they have an opportunity.”

“Higher prices will need to be passed on, or we will buy less,” is what another manufacturing company exposure to the light gauge galvanized market told SMU.