Market Data

June 18, 2015

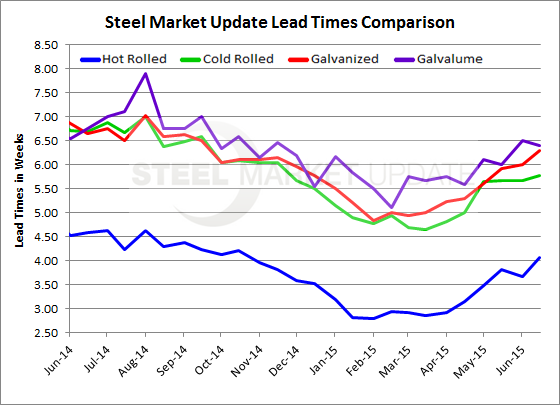

Lead Times Continue to Slowly Extend

Written by John Packard

Lead times moved out slightly on three of the four flat rolled products: hot rolled, cold rolled and galvanized. The only product which essentially remained the same was Galvalume.

Hot rolled lead times averaged 4 weeks, according to the results of this week’s flat rolled steel market analysis (survey). This is up from 3.66 weeks and we have seen lead times move out approximately one week since the middle of April.

Cold rolled lead times moved up ever so slightly to 5.78 weeks and CR lead times have extended approximately ¾ of a week since mid-April.

Galvanized lead times also extended by approximately ¼ of a week as our average moved from 6.0 weeks to 6.29 weeks. This is 1 week longer than mid-April.

Galvalume remained at approximately 6.5 weeks which is also about one week longer than what we saw in the middle of April.