Prices

June 18, 2015

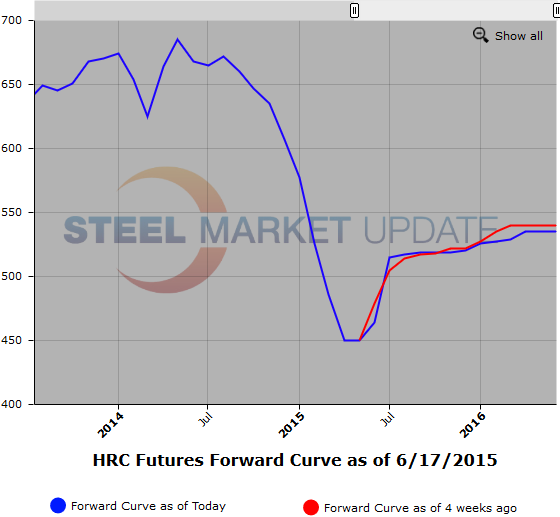

Contango Levels Remain Elevated in HRC Futures Market

Written by Spencer Johnson

Steel Market Update is pleased to introduce a new contributing writer on the HRC Futures and other futures markets. Spencer Johnson is a Risk Management Consultant with FCStone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. We welcome Spencer to the Steel Market Update team.

Spencer can be reached at spencer.johnson@intlfcstone.com

The start of the week revealed that futures market players were still focused on price increases. Nucor, of course, led the way on that front, but since then the futures market has had to grapple with the predictable outcome that every major producer is pushing an identical $20/ton increase. The sad fact is that this fully dedicated effort by mills to collectively push their $20/ton on base prices is one of the few things that seem to be supporting the already lofty contango in the futures market. The other issues that usual create a risk premium and contango are still there; we have one trade case, but more could be on the way for CRC and HRC and that risk has to be considered by sellers.

At the time of this writing, 2016 futures are trading at a roughly $70/ton premium over the current spot price, give or take a few dollars depending on your assessment of the spot market. Q4 of 2015 futures are lower, but the $60/ton contango out to that period also looks substantial. There are a few ways of looking at these spreads; historically speaking, the price is low and should be attractive to buyers who are looking to lock in buying at a price well below what they would have paid in the same period a year ago. Frankly, $520-$530/ton for HRC has looked like a bargain in any recent year and that will lead some buyers to be proactive about taking advantage of low pricing. On the other hand, some signs suggest that $60-70/ton of upside in the current HRC market seems optimistic.

Take MSCI data for example, which continues to show weakness for service centers which might make for difficulty in the mill’s push higher. Shipments in May declined and inventories remain high, which continues to underscore how much of a negative impact energy markets are having on demand. May shipments fell 5.4 percent from April, and a massive 12.6 percent lower than a year ago. End of May inventories were seen at 9.35 million tons, which equates to 2.8 month’s supply at current shipping rates. Of all the data in the MSCI releases however, perhaps the most problematic is that month over month, service center inventory levels were only seen falling a meager 100,000 tons…given that inventory overhang has been such a drag on the spot market, this was particularly discouraging.

The higher scrap price in June also means that mills are simply recovering the added costs they have been burdened with on the raw material side, as general consensus was the scrap rose about $20/ton for June. We continue to hear that buyers are more or less accepting the increase because of its size and of course because they expected to be paying up at least a bit with scrap moving up. That inevitably leads us to question whether another round of increases would be nearly as welcome as this one has been. We perhaps should mention that some spot indices have yet to reflect the full achievement of that increase…

The arrival of index linked futures contracts coupled with a more significant adoption of modern price risk management strategies has created an opportunity to re-think steel price risk. The industry is now able to demystify the steel pricing process and employ these risk management strategies to help mitigate price risk and its impact on margins. Steel Reconsiders Its Future (http://www5.intlfcstone.com/steelreconsidersitsfuture) details the development of these strategies and demonstrates how they are used to mitigate price risk. It examines the steel price cycle, provides a historical context for how the steel industry has arrived at its current state and provides several examples of firms that have used these new tools to protect their margins.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

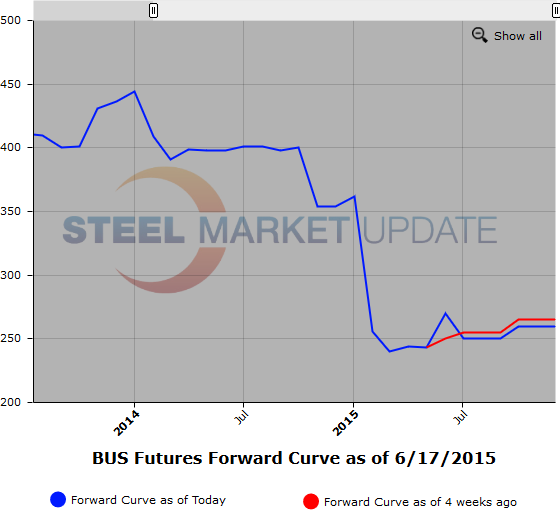

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.