Prices

June 14, 2015

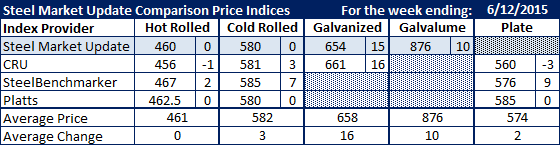

Comparison Price Indices: Coated Steel Prices Moving, Uncoated Not So Much

Written by John Packard

With the price increase announcements and the filing of a trade case against coated products we saw galvanized and Galvalume prices move higher by double digits this past week. Galvanized increased by $15 per ton according to SMU and $16 per ton according to CRU. Galvalume prices moved higher by $10 per ton.

When looking at benchmark hot rolled coil we found very little movement as SMU and Platts were unchanged, CRU was down $1 per ton and SteelBenchmarker, which only publishes their numbers twice per month, was up $2 per ton. The average of the 4 indexes was $461 per ton.

Cold rolled saw similar results with SMU and Platts unchanged from the prior week (and both at the same $580 number) while CRU was up $3 (to $581) and SteelBenchmarket was up $7 (to $585). The average of all 4 indexes is now $582 per ton.

Plate prices have also seen little movement with Platts remaining the same, CRU down $3 per ton and SteelBenchmarker up $9 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.