Prices

June 9, 2015

Manufacturers Report Distributor Spot Prices as Mixed Bag

Written by John Packard

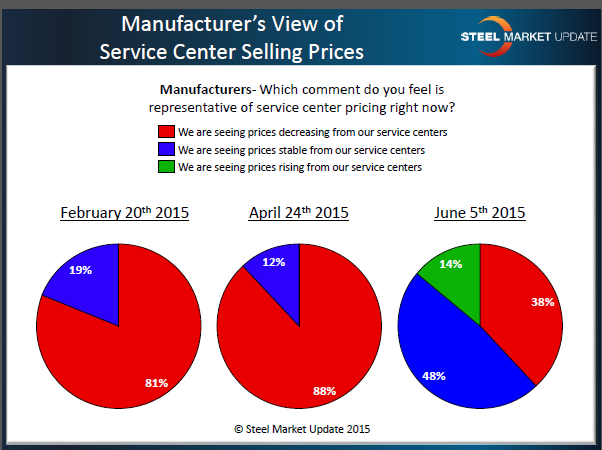

Twice per month Steel Market Update asks both manufacturing companies and service centers/wholesalers to weigh in on the subject of service center spot price offers. In the survey concluded on Thursday of this past week, with most responses having been locked in prior to the dumping suit announcement, we found manufacturers reporting mixed results. Thirty-eight percent of the manufacturing community reported service center spot prices as declining. Only 14 percent of the manufacturers reported prices as rising.

This is an improvement from what the manufacturing companies were reporting all through the first 4.5 months of this calendar year. During that time frame, the manufacturers were reporting lower spot prices with percentages running from 70 percent to 91 percent.

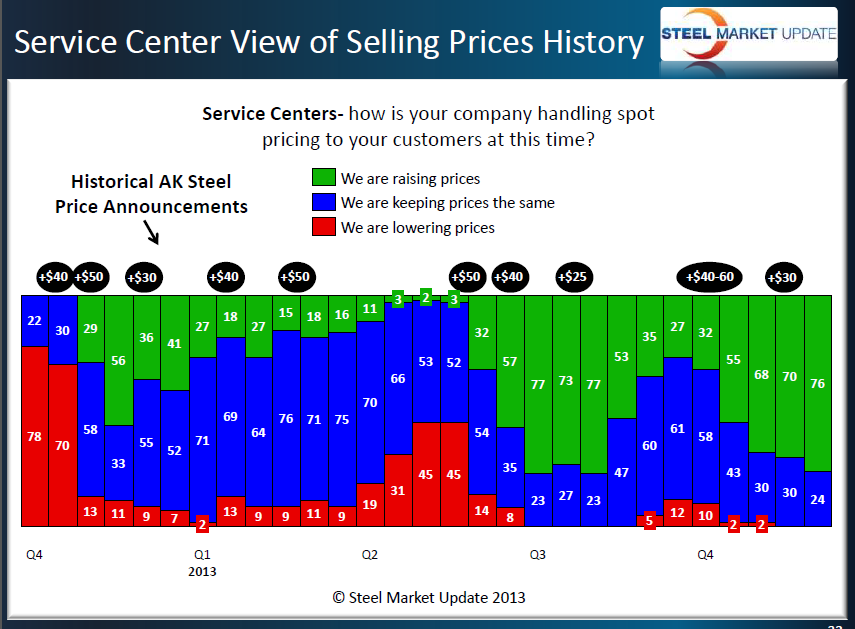

Service Centers were a little more optimistic in their evaluation of spot pricing as 20 percent reported spot prices as rising and only 11 percent had prices falling. The vast majority of distributors reported spot prices as remaining the same.

The distributors reporting spot prices as rising did not exist going all the way back to mid fourth quarter 2014.

It is important to have the service centers supporting the overall market by raising spot prices after the domestic steel mills announce price increases. The 20 percent level is still a bit “tepid” and may reflect continued short lead times on hot rolled, cold rolled and coated products, as well as heavier than needed inventories at the distributors.

In the graphic below we have placed the price increase announcements in order to better reference the importance of service center spot price support to steel mill announcements. The $20 per ton announcement made in 4th Quarter 2014 went nowhere and prices continued to slide from that point until the most recent announcement made at the beginning of May. If the red bars fail to dissipate when announcements are made, then the price increases will not succeed.