Market Data

June 7, 2015

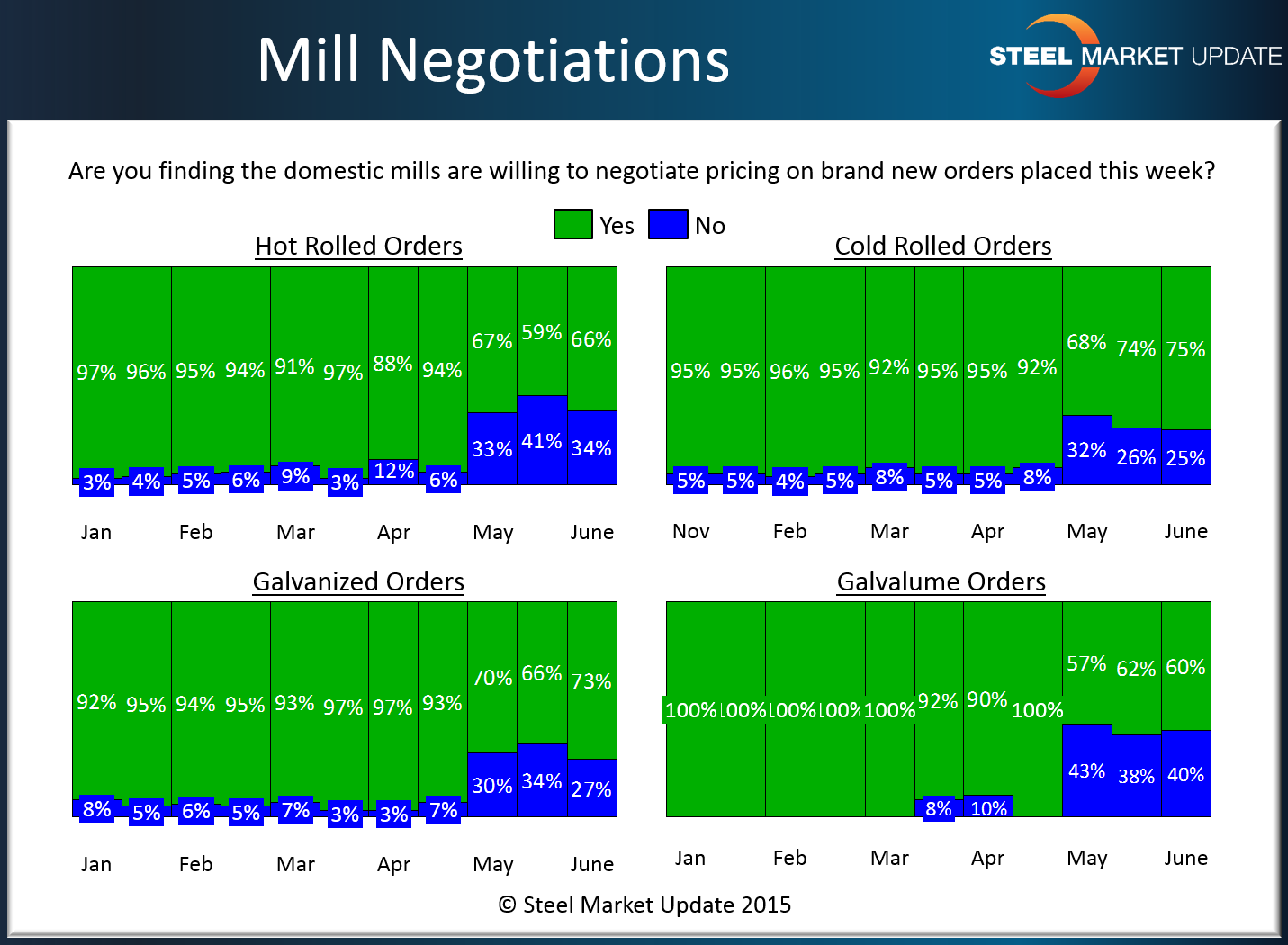

Mill Price Negotiations: Still Flexible?

Written by John Packard

Our respondents to last week’s flat rolled steel market survey continue to report prices as being negotiable, maybe not to the degree we have been seeing since the beginning of the year, but negotiable non-the-less. However, we need to remember that the vast majority of our responses were made prior to the anti-dumping trade suit being filed. So, we need to take the results with that in mind.

As you can see by the graphic below, 66 percent of the respondents reported hot rolled pricing as negotiable, 75 percent reported cold rolled pricing as negotiable, 73 percent galvanized and 60 percent Galvalume.

We will be interested to see what happens in our next survey now that the corrosion resistant anti-dumping suit has been filed.