Market Data

June 7, 2015

Lead Times: Waiting

Written by John Packard

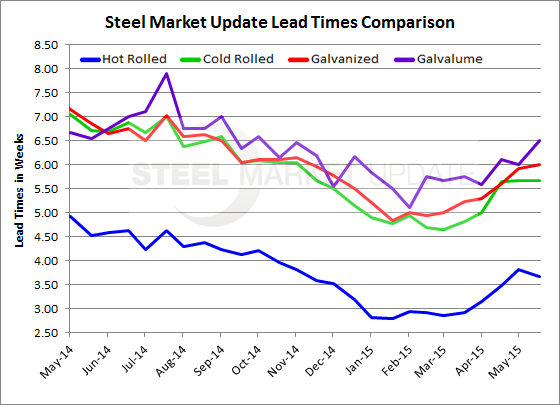

Lead times have not shot out since the price increase announcements were made in early May. Hot rolled lead times were reported as being 3.5 weeks at the beginning of May and one month later HRC lead times averaged 3.66 weeks according to the results of our most recent flat rolled steel survey. Lead times on HRC are better than the 2.86 weeks average we saw back in mid-March but are below the 4.5 weeks we saw at this point in the year this time last year.

Cold rolled lead times are stalled at just over 5.5 weeks over the last three survey periods (early May, mid-May and now early June). CRC lead times are improved over the 4.64 weeks we saw in mid-March but we are still a week shorter this year than at this point in time last year.

Galvanized lead times are now at 6.0 weeks average based on our survey respondents from last week and are now one week longer than what we saw mid-March. As with HRC and CRC, galvanized lead times are still almost one week shorter than this time last year.

The one product that did show some signs of life is Galvalume were lead times are now at 6.5 weeks which is one half week better than what we saw in our two May surveys. It is also equal to what we measured AZ lead times as being one year ago.

With the anti-dumping trade suit having been filed on coated products after our survey had begun we will be very interested in seeing if lead times move off what we are currently seeing. Our expectation is that there should be some movement as buyers adjust to the new realities of world trade in the United States.