Prices

June 7, 2015

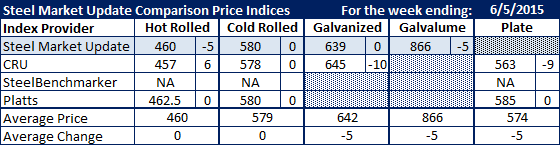

Comparison Price Indices: Stable (for now)

Written by John Packard

Flat rolled steel prices have stabilized over the past couple of weeks, according to our analysis of the various steel indexes we follow on a regular basis.

The expectation is with the increase in scrap prices and the filing of the anti-dumping suit against China, South Korea, India, Taiwan and Italy will bring a new round of price increases, whether announced or verbal.

Benchmark hot rolled coil (HRC) has been bouncing around the $460 per ton level for the past few weeks. Both CRU and SMU have seen their numbers moving a few dollars one way or another which just shows that the last couple of weeks have been stable as the market waited to see what the next price catalyst would be.

The three reporting indexes agreed on where they felt cold rolled prices are as of last week with SMU and Platts at $580 per ton and CRU close behind at $578 per ton.

Galvanized .060″ G90 saw CRU coming down $10 per ton last week and the two indexes (CRU and SMU) are now within $6 per ton of one another.

Galvalume was down $5 and CRU saw plate as being down $9 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.