Market Data

June 5, 2015

SMU Steel Buyers Sentiment Index: Optimistic & Disappointing at the Same Time

Written by John Packard

Steel Market Update (SMU) conducted our flat rolled steel analysis over the past four days. Based on the responses collected from those taking our survey we found a continuation of the optimistic trend that we have seen for a number of years now but, when compared to 2nd Quarter 2014 our index has been disappointing coming in with lower values than what we saw last year.

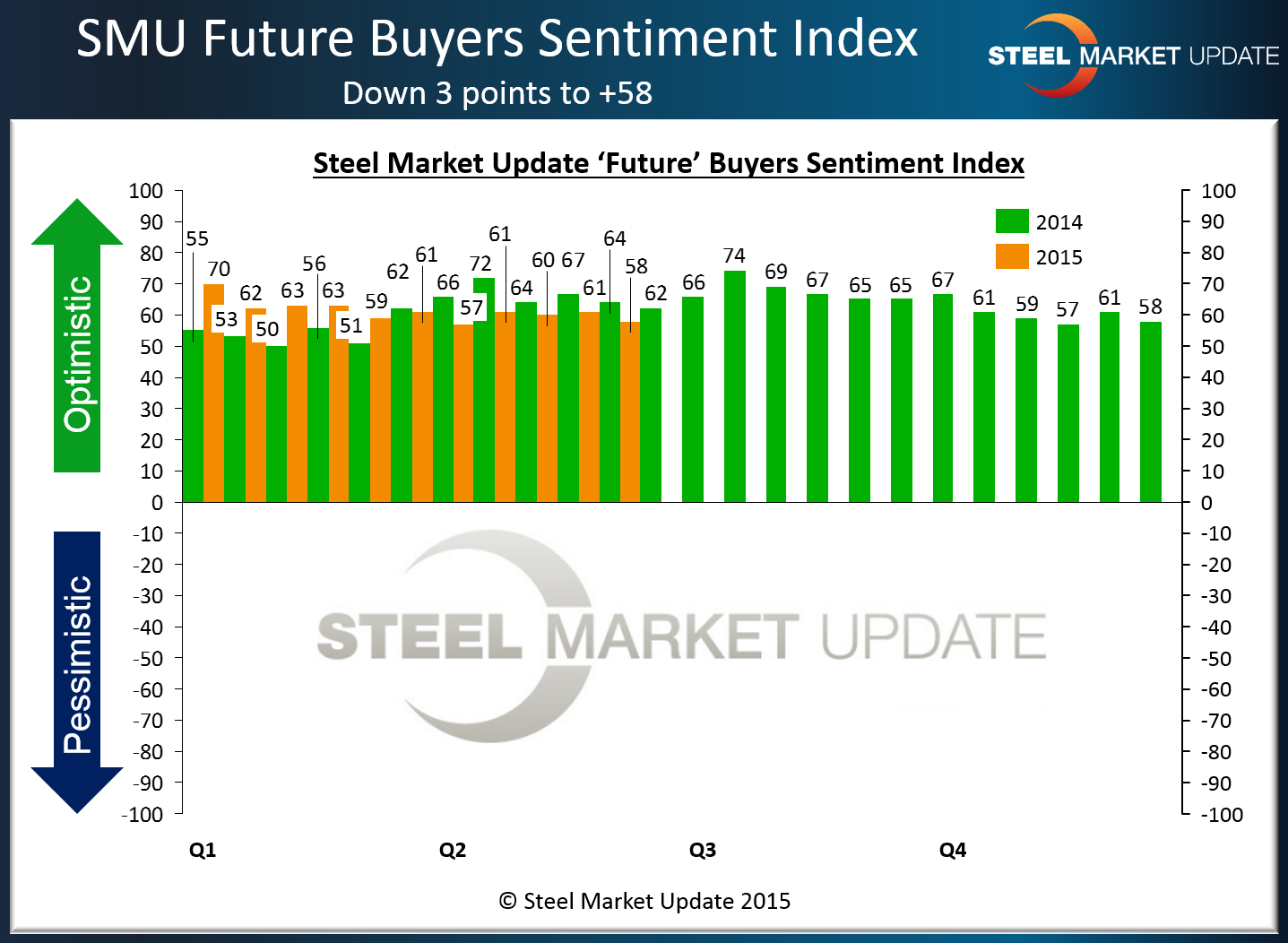

Future Sentiment, which measures buyers and sellers of flat rolled steel opinions about their company’s ability to be successful three to six months from today, is being reported at +58. This is down from the +60 reported one month ago and well below the high for the year of +70 reported during the first week of the New Year.

Looking out into 3rd Quarter, last year we saw quite an improvement in Sentiment which was due to mill production coming back online, demand improving and inventories not yet totally bloated (and devalued as prices began to slip). We wonder what impact the price increase coupled with dumping suits on coated products will have on Future Sentiment as we move forward. Higher prices are generally consider to be a positive sign by increasing inventory values. Dumping suits on the other hand can be perceived either as a positive or negative for the market as competition is restricted and manufacturing companies are forced to pay higher prices. We will watch our index closely to see what impact, if any, the dumping suits will have on how optimistic steel buyers and sellers are about their company’s ability to be successful later this year and into 2016.

The 3 month moving average (3MMA) is being reported this week as being +59.67 down from the +60.17 of one month ago and below the +65.83 of one year ago.

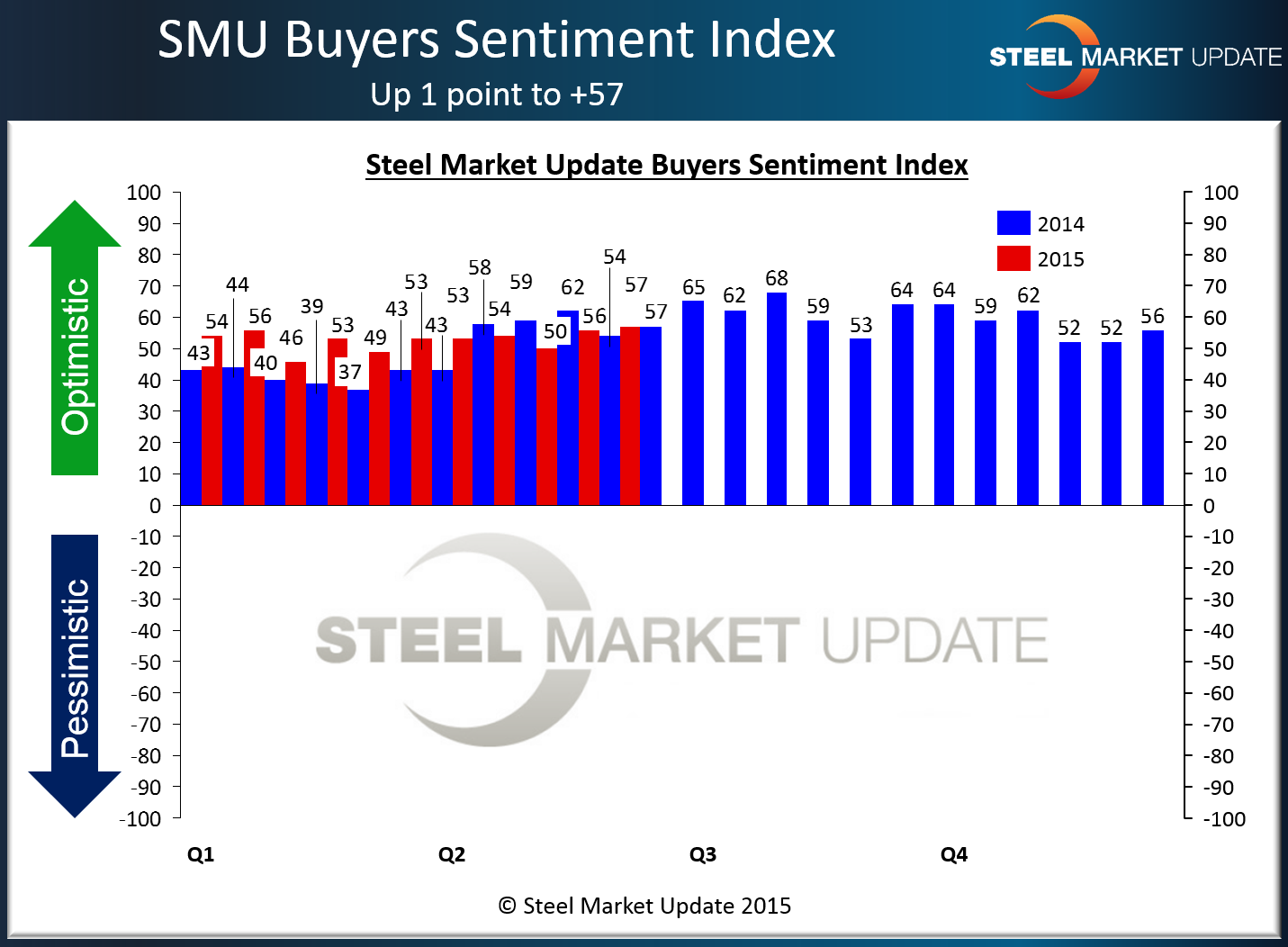

We are seeing Current Sentiment diverge from Future Sentiment as Current Sentiment improved +7 points over one month ago and is being reported this week at +57. Current Sentiment is +3 points more optimistic than what we measured at this point in time last year. However, as you can see by the graphic below, during 2nd Quarter 2015 optimism is running at slightly below 2014 rates. Looking into 3rd Quarter we saw quite an uptick in optimism last year hitting +68 during the 1st week of August. With the recent price increases and dumping suits we question whether optimism will improve from today’s level or slide lower from here.

Current Sentiment 3MMA is +53.8 slightly higher than the +52 reported at the beginning of May. One year ago the 3MMA was +53.17.

What our respondents are saying:

“We are anticipating an uptick in demand over the next 90 days.” Service Center

“Still waiting on construction sites to clear up or it would be excellent today.” Metal Building Mfg

“Housing still slower than plan.” Manufacturing Company

“Demand for plate products is improving steadily. Energy sector spending is down, however repair & maintenance spending in the segment continues to be decent. Mining opportunities are limited but not yet eliminated. Given lending rates, new home starts and infrastructure spending continue to be strong. Inventories are still high at the service centre level, however companies are looking for new stock regardless of this.” Steel Mill

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 47 percent were manufacturing and 34 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.