Prices

May 26, 2015

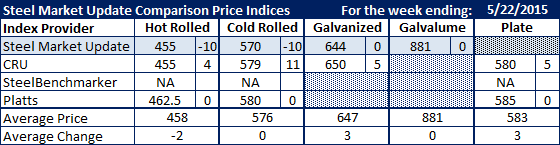

Comparison Price Indices: Looking for Stability

Written by John Packard

We saw mixed results this past week as the various indexes attempt to find firm ground for flat rolled steel pricing.

Of the three reporting indexes followed by Steel Market Update last week, one (Steel Market Update) saw two of the four products as being lower than the week before. Although, SMU advised that the change was nothing more than an adjustment based on the data collected last week. CRU saw prices as being slightly higher and Platts kept all of their items exactly the same as the week before.

Hot rolled price averages ranged from $455 at SMU and CRU to Platts $462.50.

Cold rolled price assessments ranged from SMU’s $570 to CRU $579 and Platts $580.

Galvanized assessments ranged from SMU’s $644 per ton (.060” G90) to CRU’s $650 per ton.

Galvalume was unchanged at $881 (.0142 AZ50, Grade 80).

Plate prices were seen as slightly higher by CRU which rose by $5 per ton to $580 per ton while Platts remained the same at $585 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.