Market Data

May 22, 2015

The Chicago Federal Reserve National Activity Index and Steel Supply

Written by Peter Wright

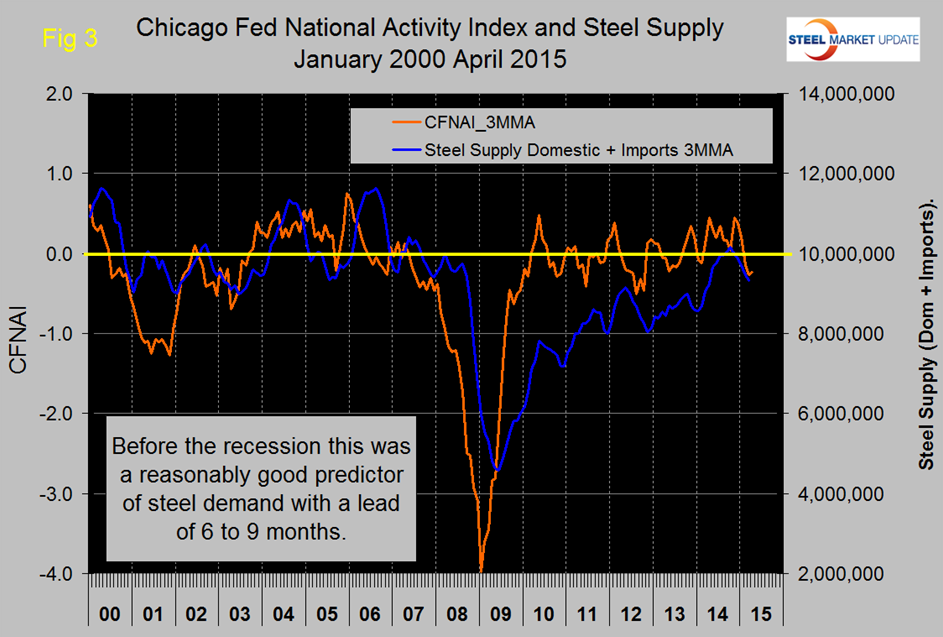

The following is the Chicago Federal Reserve statement followed by our own graphical analysis. For the first time this month we have broken out the relationship between the CFNAI and flat rolled and long product apparent supply separately. The CFNAI is an excellent reality check for much of the economic analysis that we routinely provide in The Steel Market Update and is also a reasonably good predictor of steel demand with a six to nine month lead. For example by the time the steel market went off the cliff in September 2008, the CFNAI had been signaling an increasingly severe problem for eight months. An explanation of the Index is provided at the end of this piece.

![]() Index shows economic growth increased slightly in April

Index shows economic growth increased slightly in April

The index’s three-month moving average, CFNAI-MA3, increased slightly to –0.23 in April from –0.27 in March. April’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Thirty-eight of the 85 individual indicators made positive contributions to the CFNAI in April, while 47 made negative contributions. Forty-six indicators improved from March to April, while 37 indicators deteriorated and two were unchanged. Of the indicators that improved, 19 made negative contributions.

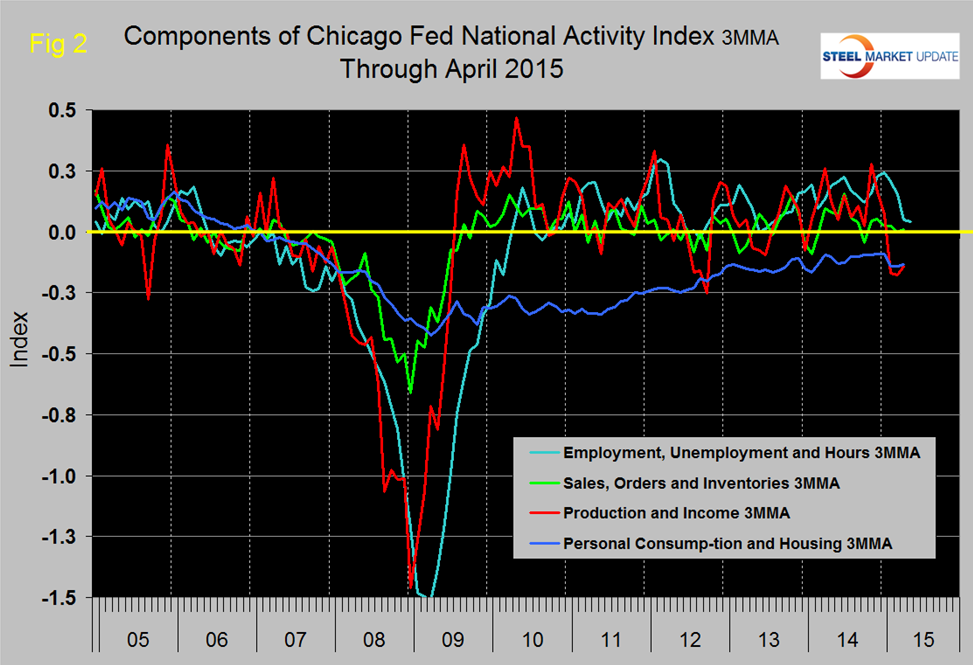

The contribution from production-related indicators to the CFNAI was unchanged at –0.16 in April. Industrial production decreased 0.3 percent in April for the second straight month. The sales, orders, and inventories category made a neutral contribution to the CFNAI in April, down slightly from +0.01 in March.

Employment-related indicators contributed +0.08 to the CFNAI in April, up from –0.08 in March. Non-farm payrolls increased by 223,000 in April, following a gain of 85,000 in the previous month; and the unemployment rate edged down to 5.4 percent in April from 5.5 percent in March.

The contribution of the personal consumption and housing category to the CFNAI increased to –0.06 in April from –0.12 in March. Housing starts moved up to 1,135,000 annualized units in April from 944,000 in March. In addition, housing permits increased to 1,143,000 annualized units in April from 1,038,000 in the previous month.

The CFNAI was constructed using data available as of May 19, 2015. At that time, April data for 50 of the 85 indicators had been published. For all missing data, estimates were used in constructing the index.

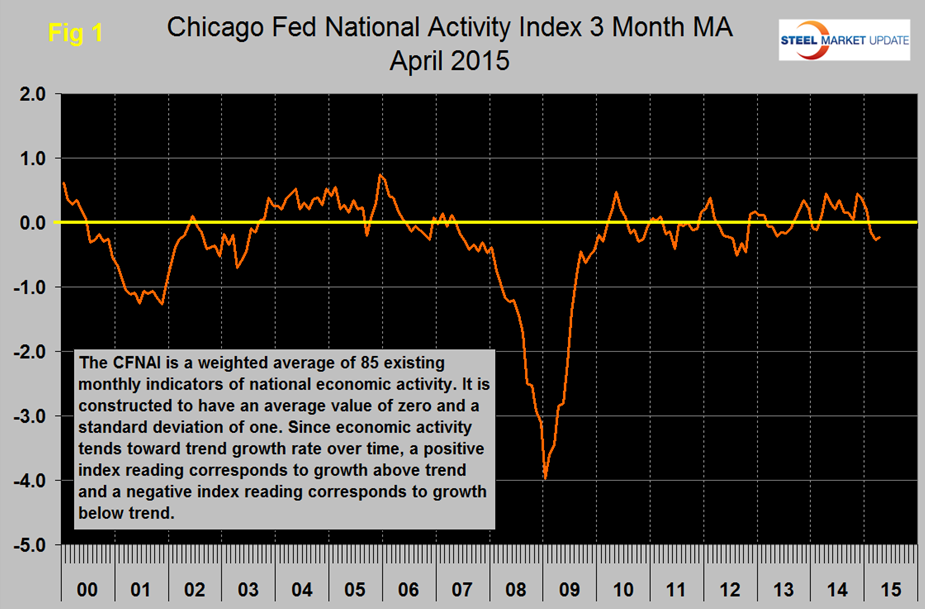

Figure 1 shows our analysis of the 3MMA of the CFNAI through April.

There was an erratic though sustained improvement from mid-2012 to November last year but in the next four months through March the index declined. April showed a slight improvement but is still below zero, meaning that the economy is expanding at less than its historical trend which is represented by the zero line (see explanation below). The April result was negative 0.15 with a 3MMA of negative 0.23. Figure 2 shows the trends of the four main sub-components. The sub-component “Employment” has declined for the last four months but is still slightly above the zero threshold. Personal consumption and housing continue to be a drag.

Figure 3 shows that the CFNAI has historically been a reasonably accurate leading indicator of steel demand (apparent supply) with a lead time of six to nine months.

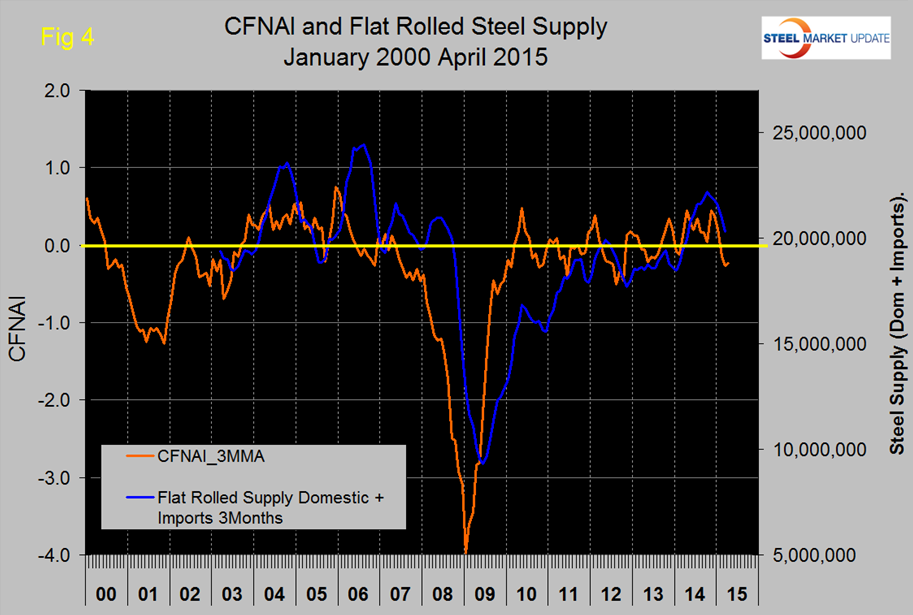

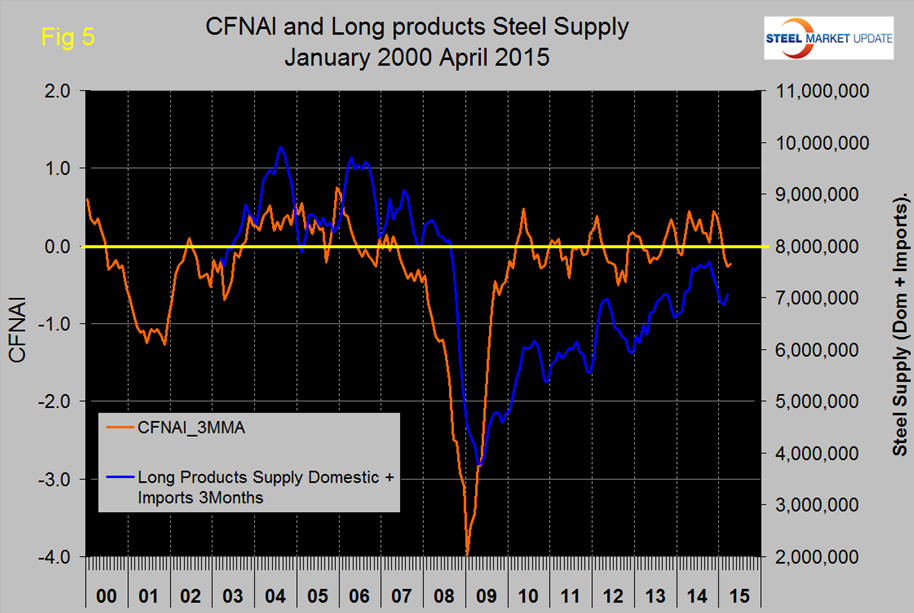

SMU monitors several benchmark indicators to evaluate whether steel consumption is where it should be based on historical patterns. Total steel supply has now closed the gap that developed after the recession. Figure 4 and Figure 5 show this same relationship for flat rolled and long products separately and the difference is quite dramatic and in agreement with our analysis of steel service center shipments.

The gap closure has been entirely driven by flat rolled with long products still trailing badly. Based on the historical lead of the CFNAI it looks as though total steel demand will decline for the next few months.

Explanation: The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories. A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth. When the CFNAI-MA3 (three month moving average) value moves below -0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above -0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended. When the CFNAI-MA3 value moves above /+0.70 more than two years into an economic expansion, there is an increasing likelihood that a period of sustained increasing inflation has begun.