Market Data

May 21, 2015

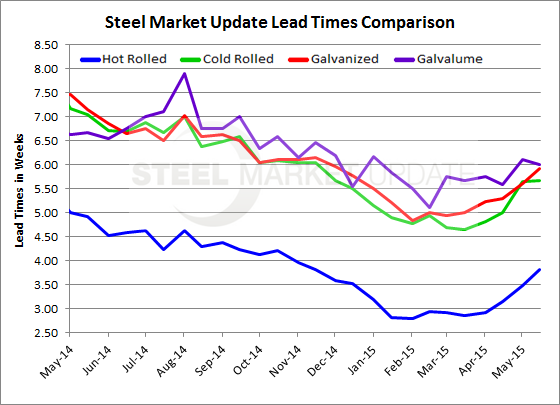

Steel Mill Lead Times Have Turned the Corner

Written by John Packard

According to the results of the Steel Market Update most recent flat rolled steel survey, domestic steel mill lead times are beginning to extend reflecting the improvement in the mills’ order books. We are, however, still far away from the lead times that we saw in the middle of May 2014.

Hot rolled lead times are now closer to 4 weeks (as an average) than the 3 weeks we reported in April of this year. One year ago HRC lead times were at 5 weeks.

Cold rolled lead times are now averaging 5.67 weeks, up slightly from the 5 weeks being reported in April but well below the 7 weeks of one year ago.

Galvanized lead times are now at 6 weeks, up from just over 5 weeks in April but below the 7 week average we reported one year ago.

Galvalume lead times are now at a 6 week average based on our respondents. This is up slightly from the 5.5 to 5.75 weeks we reported in April and below the 6.67 weeks we saw one year ago.

Again, lead times have improved but we should not consider the extension as significant enough to push buyers into the spot markets out of fear of running out of steel.

To view the interactive history of the graphic above, visit the Steel Mill Lead Times page on the Steel Market Update website here.