Prices

May 21, 2015

May Steel Import License Data Indicating Slowdown?

Written by John Packard

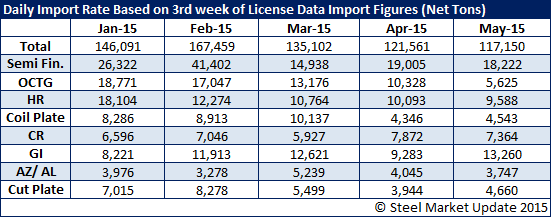

Steel Market Update (SMU) is picking up a small reduction in the daily steel import license data rate compared to prior months. As you can see from our table below, based on the third week of the month import license data as provided by the U.S. Department of Commerce, May is running at a 117,150 ton rate, down from 121,561 tons per day in April. What concerns us is the relative lack of movement lower on flat rolled products. Hot rolled, cold rolled and coated products (see below table).

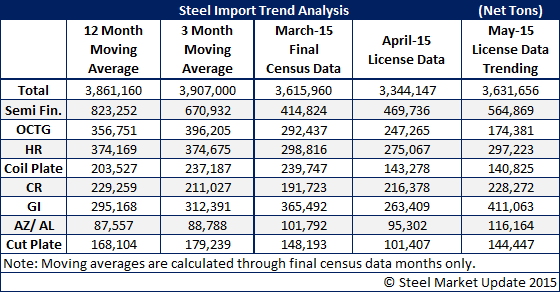

One has to remember, however, that license data can only provide a trend as to how one month may compare to another. The Final Census Data can vary by as much as a few hundred thousand tons between what the license data was suggesting.

SMU believes that the month of May will be at, or slightly lower than, the month of April which is showing 3.3 million tons (based on license data through May 19th). The month of March was 3.6 million tons and the three month moving average is 3.9 million with the 12 month moving average at 3.8 million tons. At the moment, however, the data is suggesting that May may come in higher than April. We will have to wait and see.