Analysis

May 19, 2015

Housing Starts, Permits and Builder Confidence

Written by Peter Wright

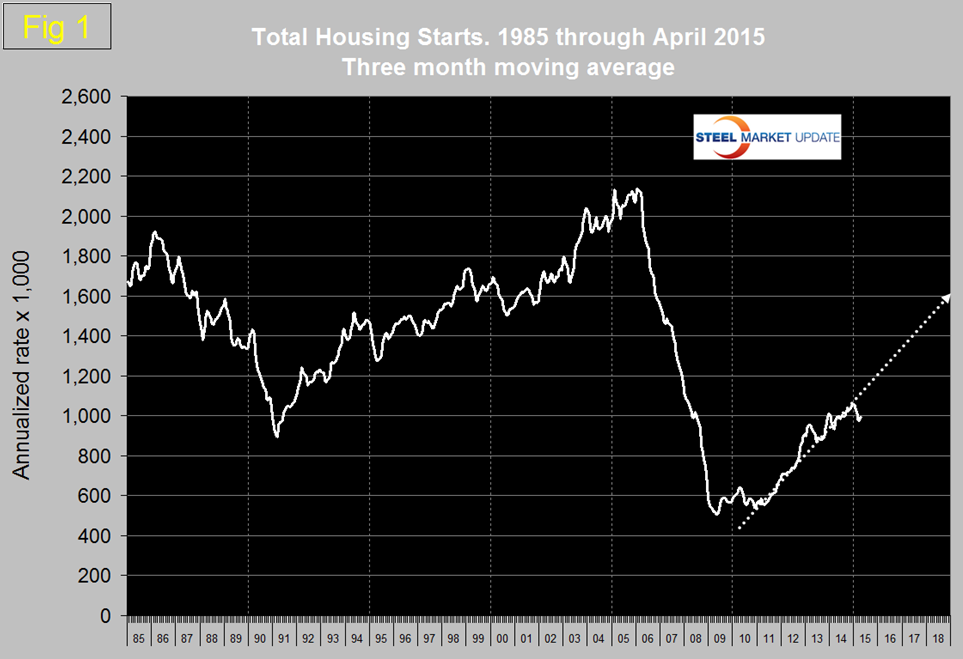

Housing starts surprised on the upside in April, possibly as a result of projects delayed by bad weather in the Northeast and Midwest picked up the pace. Total starts were 1,135,000 up from 944,000 in March. Single family were up by 16 percent and multifamily by 27 percent. At SMU we prefer to work with three month averages (3MMA) and not to get too excited or depressed by a single months result. On that basis, single family at 993,000 were up by only 2 percent and multifamily at 339,000 were up by 3 percent. The Census department results are seasonally adjusted and the monthly numbers are annualized. Figure 1 shows the 3MMA of total housing starts projected through 2018.

This projection is probably optimistic as the trajectory for the last two years does not get us to 1.6 million, more like 1.3 million. The 3MMA of March starts fell below a million after six consecutive months above that level and April did not break through that threshold. The year/year growth rate of the 3MMA of total starts in February was 7.4 percent, in March it was 4.4 percent and in April it was only 0.9 percent. On this basis we conclude that reports in today’s press are unrealistically optimistic. We hope we are wrong.

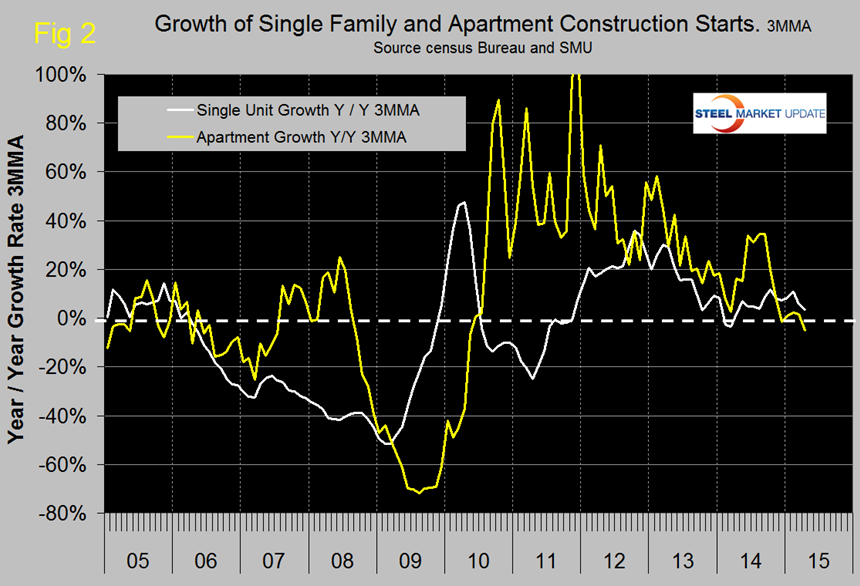

Multi-family starts are now beyond the pre-recession high of February 2006 but the growth of starts in this sector has slowed dramatically from a 3MMA year over year of 35.5 percent in August to 1.9 percent in March then to negative 4.1 percent in April (Figure 2).

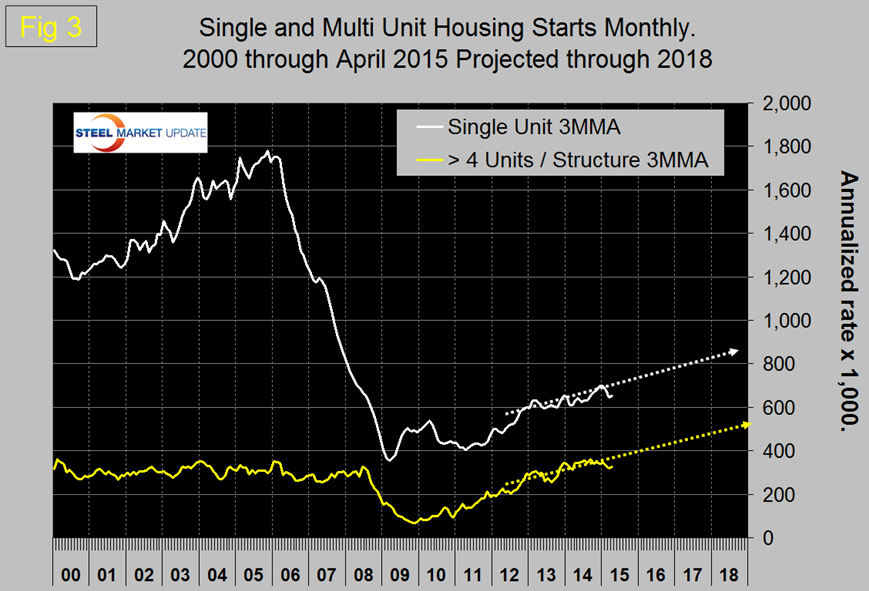

If we ignore the growth spurt of mid-2014, this sector has been slowing since early 2012 and may be approaching saturation. Single family is still 59.8 percent below the pre-recession level but growth in this sector has been higher than multi-family for the last six months. Figure 3 shows the trajectory of single family and apartments.

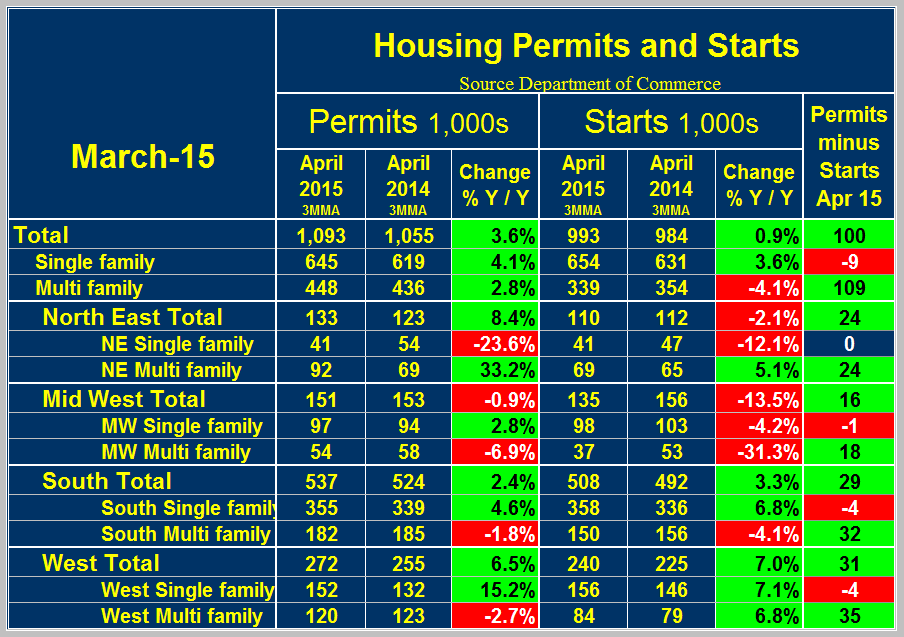

Permit data is useful is useful as a forward look at starts. If permits exceed starts then we anticipate an acceleration in construction starts and vice versa. Table 1 shows total permits and starts nationally and regionally.

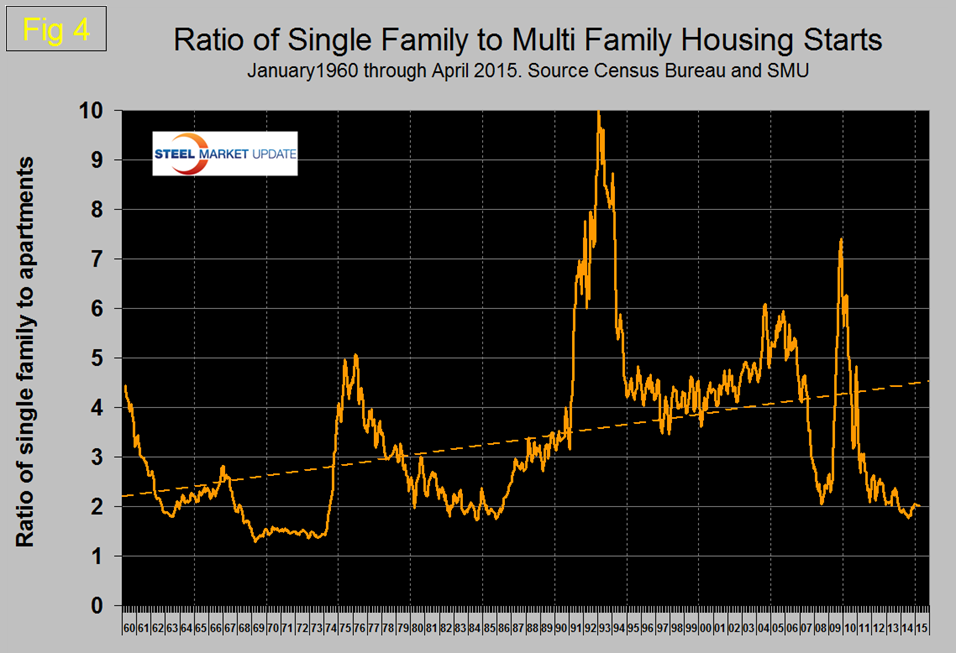

At the national level the differential between permits and starts for single and multi-family units is suggesting that the shift in consumer’s preference towards apartments is far from over. In April on a 3MMA basis permits of multi-family exceeded starts by 109,000 in contrast to the negative 9,000 for single family. In total permits were 100,000 more than starts. The differential between permits and starts for multi and single family units was the same across all regions with permits for multifamily far exceeding starts and permits for single family being less than starts. The implication is that apartment construction is poised to surge strongly and that single family construction will slow slightly. The ratio of the two sectors is shown in Figure 4 and demonstrates that single family compared to multifamily has improved slightly but single family homes continue to be less desirable than at any time in the last 30 years.

Based on permit data the ratio will not change any time soon. We have stated in previous reports that we may be experiencing a generational shift in home preference driven by student loan debt and the realization that increasingly a job is not forever and the opportunity to be mobile is desirable. In addition the purchase of a house as an investment is not as attractive as it was before the recession. These issues promote the idea of rent in preference to purchase.

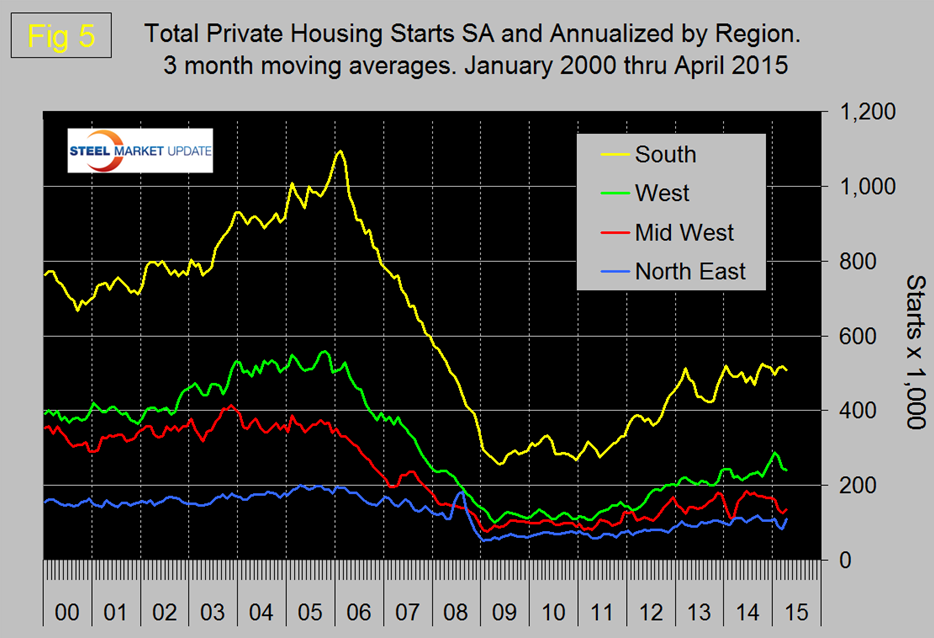

Figure 5 shows the regional situation for the 3MMA of total residential starts since February 2000. So far in 2015 only the South and North East have held their own.

The National Association of Home Builders (NAHB) confidence report was released on Monday. Any value above 50 indicates an overall positive business confidence. The index fell by two points in May to 54 but this still a post-recession historically good result. The West which was very strong in January and February has suffered a correction and the North East continues to have a net negative sentiment.

The official release from the NAHB, abridged by SMU reads as follows:

Builder Confidence Falls Two Points in May

Builder confidence in the market for newly built, single-family homes in May dropped two points to a level of 54 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. It is a nine-point increase from the May 2014 reading of 45.

“Despite this month’s slight dip, builder confidence in the new home market remains above the 50-point benchmark,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo. “Overall, the second quarter of 2015 is shaping up to be very solid.”

The index’s components were mixed in May. The component charting sales expectations in the next six months rose one point to 64, the index measuring buyer traffic dropped a single point to 39, and the component gauging current sales conditions decreased two points to 59.

Looking at the three-month moving averages for regional HMI scores, the South and Midwest each rose one point to 57 and 55, respectively. The Northeast fell by one point to 41 and the West dropped three points to 55.