Distributors/Service Centers

May 12, 2015

Service Center Spot Prices Starting to Break Out of Slump

Written by John Packard

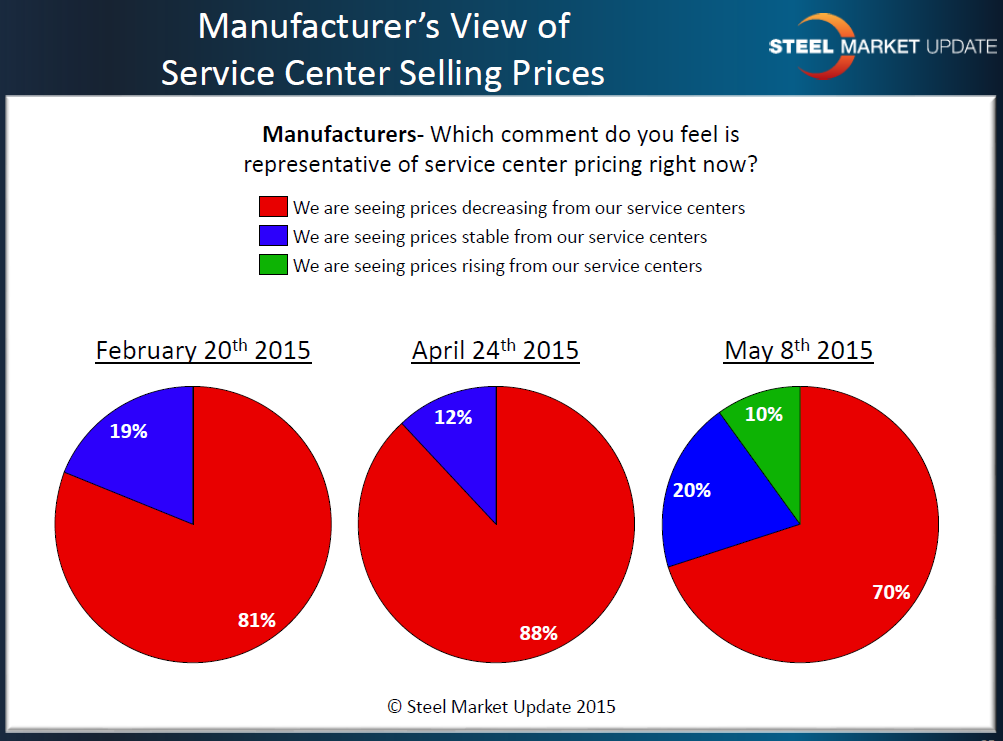

For the first time in many months we have seen a break in spot market steel pricing coming out of the service centers. Manufacturing companies have been reporting to Steel Market Update via our flat rolled steel market questionnaire for a number of months that service center spot prices were falling. In the survey just completed this past week, we saw a break in that 10 percent of the manufacturing companies picked up on higher flat rolled steel prices being offered.

This is the first time during this calendar year where any manufacturing company has reported distributor spot prices as rising.

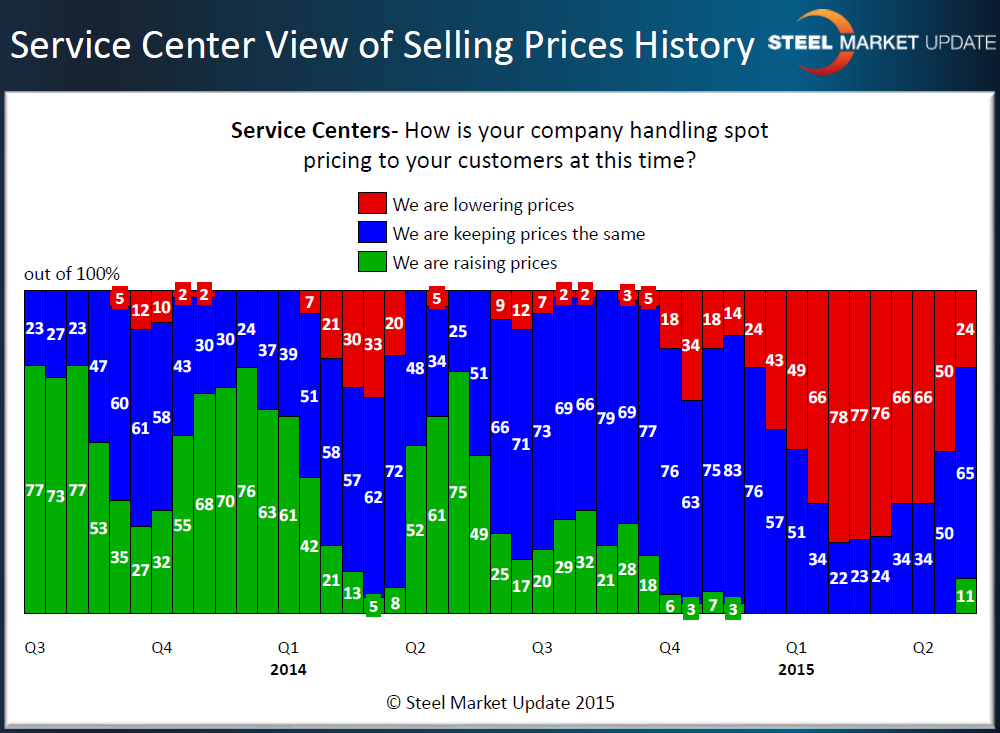

Service centers, who tend to be an optimistic bunch, also reported similar results to what we saw out of the manufacturing companies. For the first time since mid 4th Quarter 2014, service center respondents reported their company as raising spot prices. We also saw a major reduction in those reporting prices as decreasing (from 50 percent in mid April to 24 percent last week).

As SMU has stated in the past, service center support for a domestic mill price increase is imperative for the numbers to stick in the market. Many times we see distributors get to a point of capitulation – which we calculate to be when three quarters of all the service center respondents are reporting their company as dumping steel (selling at ever lower prices). The service centers reached that point in February and early March. Unfortunately, it took a number of months of bleeding off excess inventories before there was enough action on the mill books to justify increasing prices.

Here is what the longer term graphic looks like for the service centers. The manufacturing graphic looks very similar.