Market Data

May 10, 2015

Steel Mill Lead Times: Moving Out

Written by John Packard

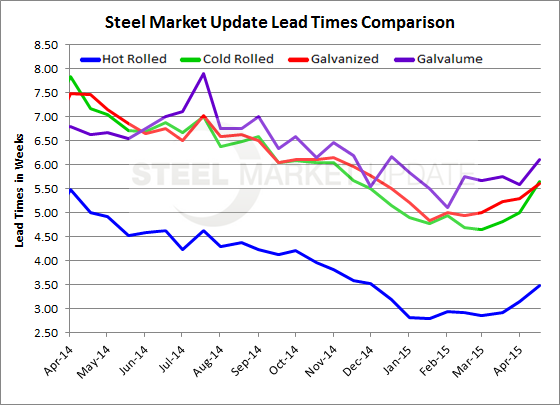

The domestic flat rolled steel mill lead times have begun to move out, according to the results from our flat rolled steel analysis questionnaire conducted this past week. We are seeing movement on all four products: hot rolled, cold rolled, galvanized and Galvalume. Lead times had bottomed in January and February and we started to see some extension of the amount of time it takes to get new orders produced in March and April just prior to the price increase announcements having been made by ArcelorMittal, Nucor, NLMK USA and others.

Since the announcements we have seen a bump in lead times as customers that need to book orders flock to the mills to protect themselves.

Hot rolled lead times, which bottomed out at an average of under three weeks, are now averaging three and a half weeks. This is much better than what we have seen so far this year but well below the 5.0 week lead time average we reported back in May 2014 (remember all of the production issues which existed at this point last year).

Cold rolled lead times, which were less than five weeks for all of 1st and early 2nd Quarter 2015, are now averaging 5.65 weeks according to our survey respondents. Cold rolled lead times one year ago average just over seven weeks (7.18).

Galvalume lead times, which at the beginning of February 2015 averaged just over five weeks are now being reported as averaging 6.11 weeks. One year ago AZ lead times averaged 6.63 weeks.

The extension of lead times is a good sign for the domestic steel mills, and for the industry in general, as longer lead times will firm up pricing.

As one domestic conversion mill told us recently during a discussion on how they have been able to hold the line on new pricing, “[We] eliminated the low end of pricing, but the big buyers have not yet come back to buy the next round. We are patient though as our book is solid… Seems like we can afford to be patient for now.”

To view the interactive history of the graphic above, visit the Steel Mill Lead Times page on the Steel Market Update website here.