Market Data

April 27, 2015

Consumer Confidence in April 2015

Written by Peter Wright

The consumer confidence index as reported by the Conference Board fell sharply in April as March was revised upwards slightly. In April the composite value which combines the view of the present situation and expectations fell from 101.4 to 95.2.

The view of the present situation fell from 109.5 to 106.8 but the big change was to expectations which decreased from 96.0 to 87.5. The decline of the three month moving average (3MMA) of the composite was less severe, falling from 101.3 to 98.5. It may be that the high values of January and March were outliers because the present values of both the present situation and expectations are currently above the five year trend line, (Figure 1).

The April decline in the 3MMA of the composite followed 15 straight months of increase, and the 3MMA of the composite at 95.2 is above the 35 year average which stands at 90.6 since 1980. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

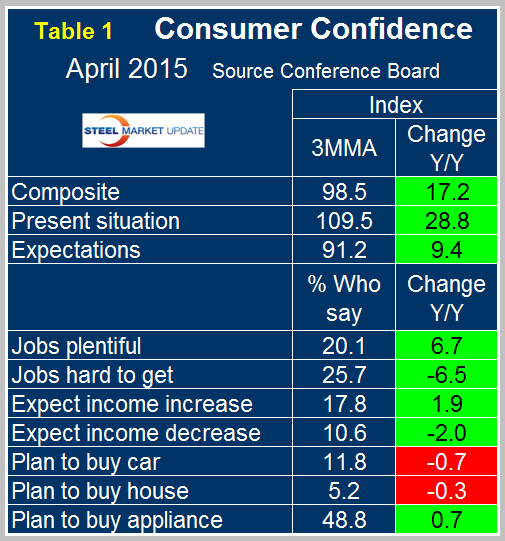

The recovery of the composite is now looking better than the turn around after the recession in 2003. The present situation component has been much more volatile over each multi-year time span than expectations since our data began 35 years ago with higher highs and lower lows. The view of the present situation moved ahead of that for expectations in October last year for the first time since the recovery began in 2009. If history repeats itself, the view of the present situation will continue to move ahead and widen the differential between it and expectations. On a year over year basis using a 3MMA the composite is up by 17.2 led by consumer’s view of the present situation which is up by 28.8, (Table 1).

The employment sub-indexes which are job availability and wage expectations backed off a little in April but continue to improve on a 3MMA basis year over year. The pattern (color code) of auto and housing purchase intentions in April were the same as February and March, being negative. Intentions to buy an appliance which had been negative in February and March became positive in April. In total the first four months of the Conference Board index for 2015 had the best performance since Q3 2007. Consumer sentiment is being positively influenced by the job market but seems to be less influenced by lower gasoline prices and consequent improvement in disposable income than was expected by economists. It may be that consumers reading all the disturbing news out of the Middle East, don’t believe the current gas price is realistic and expect it to revert to the year ago level.

The official statement from the Conference Board which considers only month over month changes reads as follows:

The Conference Board Consumer Confidence Index Retreats in April

The Conference Board Consumer Confidence Index, which had increased in March, declined in April. The Index now stands at 95.2 (1985=100), down from 101.4 in March. The Present Situation Index decreased from 109.5 last month to 106.8 in April. The Expectations Index declined from 96.0 last month to 87.5 in April.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was April 17.

“Consumer confidence, which had rebounded in March, gave back all of the gain and more in April,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “This month’s retreat was prompted by a softening in current conditions, likely sparked by the recent lackluster performance of the labor market, and apprehension about the short-term outlook. The Present Situation Index declined for the third consecutive month. Coupled with waning expectations, there is little to suggest that economic momentum will pick up in the months ahead.”

Consumers’ appraisal of current-day conditions continued to soften. Those saying business conditions are “good” edged down from 26.7 percent to 26.5 percent. However, those claiming business conditions are “bad” also decreased from 19.4 percent to 18.2 percent. Consumers were less favorable in their assessment of the job market. Those stating jobs are “plentiful” declined from 21.0 percent to 19.1 percent, while those claiming jobs are “hard to get” rose from 25.5 percent to 26.4 percent.

Consumers’ optimism about the short-term outlook, which had rebounded in March, retreated in April. The percentage of consumers expecting business conditions to improve over the next six months decreased from 16.8 percent to 16.0 percent, while those expecting business conditions to worsen increased from 8.1 percent to 9.4 percent.

Consumers’ outlook for the labor market also deteriorated. Those anticipating more jobs in the months ahead decreased from 15.3 percent to 13.8 percent, while those anticipating fewer jobs rose from 13.6 percent to 16.3 percent. The proportion of consumers expecting growth in their incomes decreased from 18.8 percent to 18.3 percent, while the proportion expecting a decline increased from 9.7 percent to 11.2 percent.

About The Conference Board

The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The Conference Board is a non-advocacy, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States.

Source: April 2015 Consumer Confidence Survey, The Conference Board