Market Data

April 23, 2015

Steel Mill Lead Times: Flattening Out (Bounce to Come?)

Written by John Packard

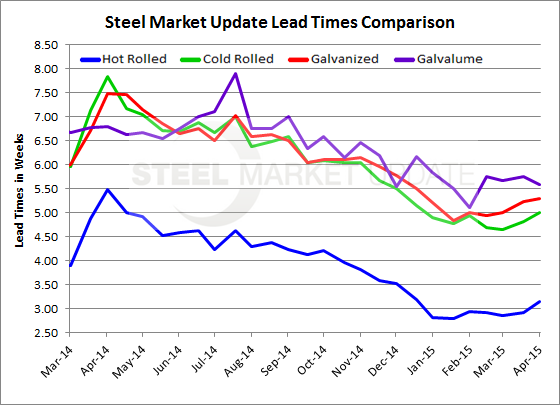

Domestic mill lead times appear to have found bottom and are stabilizing at these lower than normal rates, based on the results of the latest Steel Market Update flat rolled steel market analysis (survey).

Benchmark hot rolled lead times managed to eek above 3.0 weeks for the first time in a number of months (late 4th Quarter 2014). The actual move was negligible going from an average of 2.91 weeks to 3.14 weeks. To put hot rolled lead times into perspective, last year at this time HRC lead times were averaging 5.49 weeks (remember that one year ago there were a number of production issues causing supply problems).

Cold rolled lead times also extended a touch and are now averaging 5.0 weeks. However, the amount of the move is, like hot rolled above, negligible. Lead times at this point in time last year were 7.84 weeks on cold rolled coil.

Galvanized lead times remained essentially the same at 5.30 weeks (last survey was 5.24 weeks) and are more than two weeks below the 7.49 weeks reported one year ago.

Galvalume lead times slipped modestly to 5.58 weeks from 5.75 weeks reported at the beginning of the month. One year ago AZ lead times were averaging 6.80 weeks.

To view the interactive history of the graphic above, visit the Steel Mill Lead Times page on the Steel Market Update website here.