Market Data

April 23, 2015

SMU Steel Buyers Sentiment Index: 3MMA Trending Lower

Written by John Packard

As we discussed at the beginning of the month April, Steel Market Update (SMU) will present our Future Steel Buyers Sentiment Index at the beginning of our Sentiment articles. Future Sentiment provides a better look at what steel buyers and sellers of flat rolled steel are thinking regarding their company’s ability to be successful three to six months out (Future). Later in our Sentiment article we will look at how they feel about their company’s ability to be successful at this point in time (Current Sentiment). We are making the change in the order because we are finding more people are interested in what is going to happen versus what is happening right now.

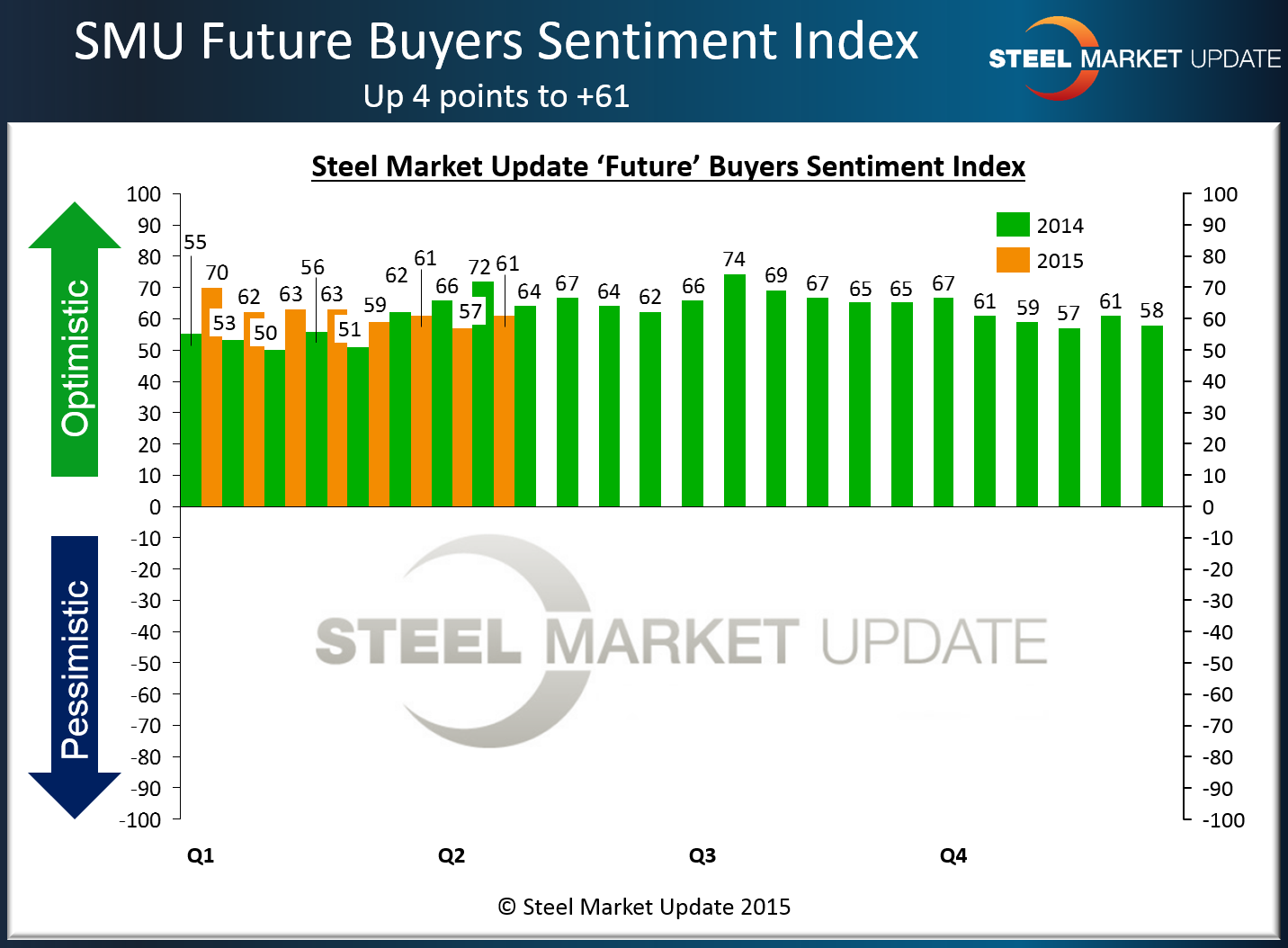

The SMU Future Buyers Sentiment Index rose 4 points to +61 over our last survey which was conducted at the beginning of April. The index is unchanged compared to mid-March and is down from +72 one year ago.

SMU has noticed that after almost two years of uninterrupted growth in the comparison’s for Sentiment year-over-year (YOY) we are seeing a break in that trend over the past two months. Sentiment continues to be well ensconced in the optimistic range of our Index (anything above +10 is considered optimistic).

Our second concern is with the three month moving average which has been trending lower as well. The 3MMA smooths out the data to give us a better look at the trend lines. The three month moving average (3MMA) of the Future Buyers Sentiment Index is trending lower at +60.67, a slight decrease from +60.83 two weeks ago and down from +63.00 in mid-March. One year ago this index was +59.50.

We believe that one of the main reasons for Sentiment beginning to change is due to the prolonged slide in flat rolled steel prices and the devaluing of inventories is a cause for concern.

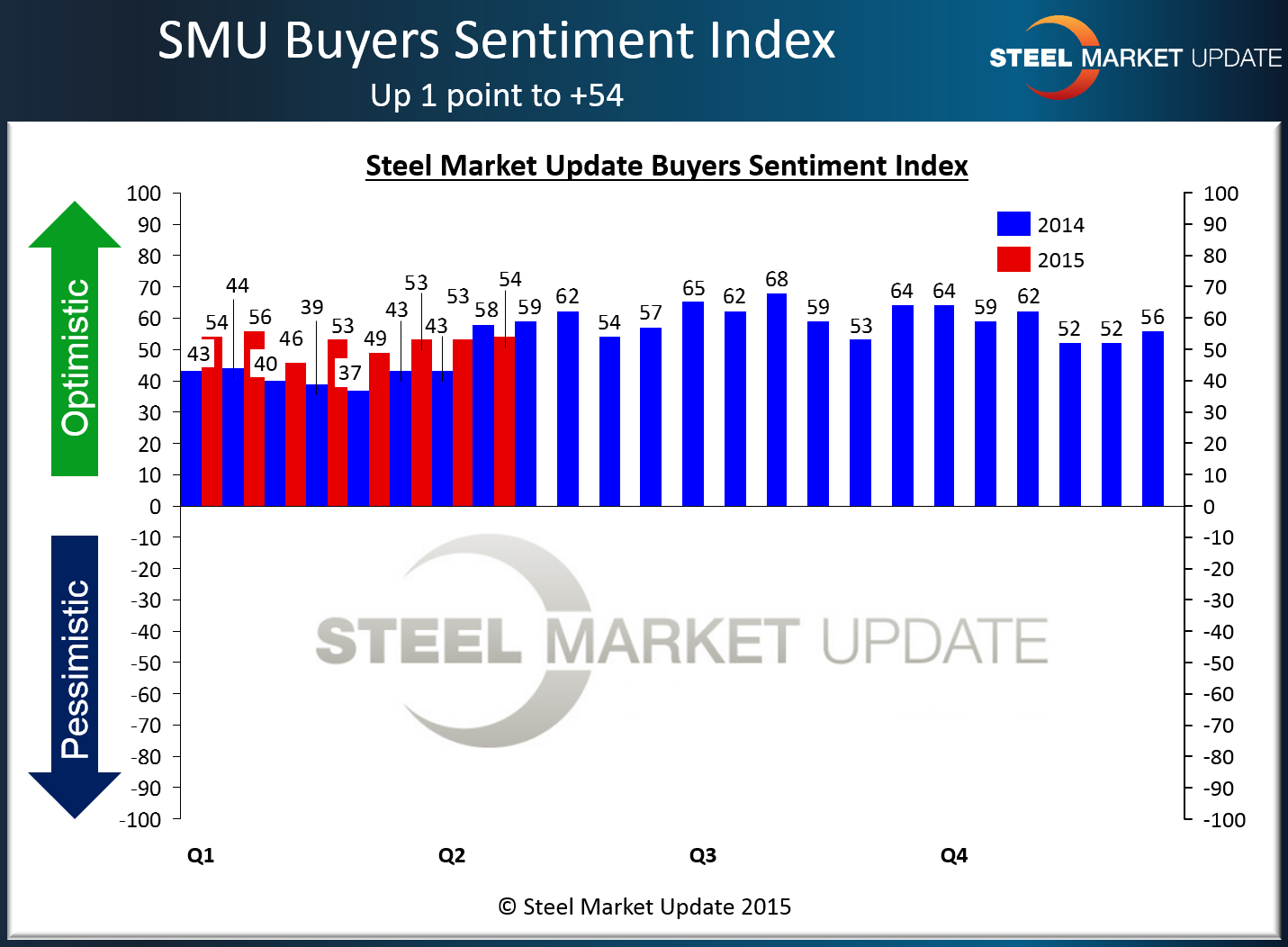

Current Sentiment was measured at +54 this week, up one point from both our last survey and our mid-March survey. One year ago the index was at +58.

The three month moving average (3MMA) of the SMU Buyers Sentiment Index was +51.33, down from +51.67 two weeks ago and down from +51.83 in mid-March. The 3MMA index has consecutively declined with each survey over the last 2 months. One year ago, the 3MMA was +43.33.

What Our Respondents are Saying

“If the pricing ever finds a floor we’ll be feeling much better.” Manufacturing company.

“With the price of corn this low, it will affect the farm market. I always feel good about the economy in the spring then things falter.” Manufacturing company.

“Price keeps falling and we have 6 months worth of inventory.” Service center.

“We are positioned well to service our clients very well. Inventory is good (for us).” Plate service center.

“We thought that we would have hit the bottom of the market before now.” Service center.

“Would be excellent if site conditions would improve. Tough 1st Quarter for construction in our region.” Manufacturing company.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 45 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.