Prices

April 19, 2015

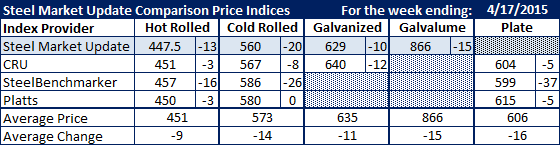

Comparison Price Indices: Neutral or Not Prices Continue Slide

Written by John Packard

It certainly doesn’t matter that Steel Market Update (SMU) Price Momentum Indicator is pointing at Neutral, flat rolled steel prices have continued to fall and last week was no exception.

Benchmark hot rolled pricing (prior to any extras being added) dropped on all four indexes followed by SMU. Our own index dropped to $447.50 per ton ($22.375/cwt). The other steel indexes are not far behind with CRU down $3 to $451 per ton, Platts down $2.5 to $450 per ton and SteelBenchmarker down $16 from the last time they reported to $457 per ton.

The average of all the HR pricing comes to $451 per ton, down $9 per ton for the week.

Cold rolled prices dropped on all but Platts and we are seeing a widening of the spread between the various indexes. SMU at $560 per ton is the lowest with CRU not too far behind at $567 per ton. Platts and SteelBenchmarker are seeing market prices a little higher at $580 and $586 per ton respectively.

Our cold rolled average of all the indexes dropped $14 per ton for the week.

Galvanized prices declined again this past week on both SMU and CRU and Galvanized prices also dropped on the SMU index.

Plate, which currently is not indexed at SMU, dropped with two of the indexes flirting with, or breaking through, the $600 per ton level. Platts saw plate prices as being a little higher at $615 per ton.

SMU Note: SteelBenchmarker releases prices twice per month as opposed to every week like the other indexes. We only report SteelBenchmarker numbers on those weeks that they report. Otherwise, they are not part of our analysis.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.