Distributors/Service Centers

April 16, 2015

Service Center Carbon Steel Inventories Dropped in March

Written by John Packard

According to the Metal Service Center Institute (MSCI,) U.S. steel service centers shipped 3,672,900 tons of carbon steel (all products) at an average of 167,000 tons per day during the month of March 2015. Total carbon shipments were up 10.1 percent over the previous month but 0.1 percent lower than one year ago. However, the daily shipment rate, which is what we tend to focus in on, was much lower than the 175,000 tons per day seen last year but, March 2015 did have one more shipping day (22) than the prior year.

Total steel inventories ended the month at 9,558,300 tons, down 316,900 tons from February 2015.

The number of months supply dropped from 3.0 months (unadjusted) to 2.6 months and on a seasonally adjusted basis the inventories dropped from 2.9 to 2.8 months.

Carbon Flat Rolled

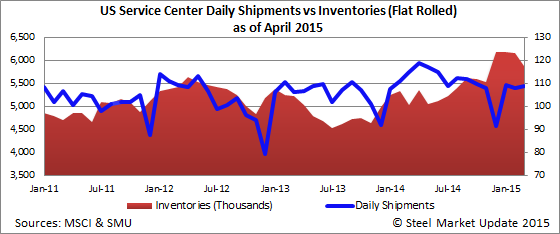

U.S. distributors shipped a total of 2,389,300 tons of carbon flat rolled which comes out to a daily shipping rate of 108,600 tons. The daily shipment rate for February was 107,800 tons and the rate for March 2014 was 114,800 tons.

Total flat rolled inventories stood at 5,874,300 tons which converts to 2.5 months supply on an unadjusted basis and 2.6 months on a seasonally adjusted basis. Both are better than the prior month which was 2.9 and 2.8 respectively.

Steel Market Update produced our Service Center Apparent Inventory Excess/Deficit report and forecast for our Premium level members yesterday. In the report we noted that we were within 17,000 tons of hitting the shipment forecast perfectly. However, inventories dropped lower than we thought they would which has reduced the apparent excess of flat rolled inventories being held at the U.S. flat rolled steel service centers. If interested, you can request a trial to our Premium level product where you will have access to this data as well as our survey presentations and a number of proprietary data and forecasts we do on a monthly basis. Contact us at: info@SteelMarketUpdate.com and we will provide you with a trial period of our Premium product and website access.

Carbon Plate

U.S. service centers shipped a total of 386,400 tons of plate products during the month of March. The daily shipping rate was 17,600 tons which is 300 tons per day better than one year ago. However, the 17,600 tons per day is less than the 18,000 tons per day shipped in February 2015.

Inventories of plate stood at 1,211,900 tons as of the end of the month of March. This is down 65,500 tons from the prior month.

The number of months on hand dropped from 3.5 to 3.1 months (unadjusted) and 3.5 to 3.4 months (seasonally adjusted).

Carbon Pipe & Tube

Pipe and tube distributors shipped 237,400 tons of pipe and tube products. This was essentially flat year over year as the pipe and tube service centers shipped 237,500 tons last year with one less day.

The daily shipping rate for March 2015 was 10,800 tons. Last year the rate was 11,300 tons.

Pipe and tube inventories stood at 679,400 tons as of the end of March 2015. This is down on a non-seasonally adjusted basis from 3.2 to 2.9 months. On a seasonally adjusted basis the months on hand remained the same at 3.0.