Distributors/Service Centers

April 14, 2015

Service Centers Reducing Inventories as Spot Price Declines Continue

Written by John Packard

Twice per month Steel Market Update (SMU) conducts an analysis of the flat rolled steel market utilizing our proprietary questionnaire which is presented to approximately 600 companies for review. We receive well over 100 responses every time we canvass the market with the vast majority of respondents falling into either the manufacturing or service center/wholesaler segments of the industry. In the analysis completed this past week 45 percent of the respondents were manufacturing companies and 42 percent were service centers. This is import when considering some of the subjects were investigate such as service center spot pricing into the manufacturing segment of the market.

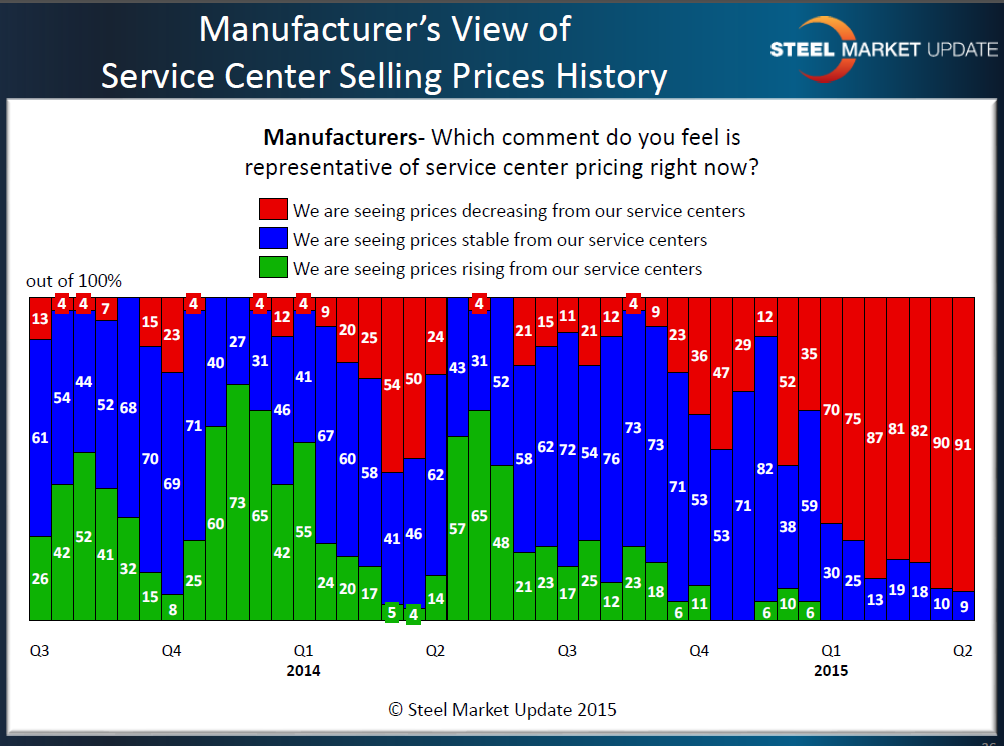

Ninety-one percent of the manufacturers responding to our latest survey this past week reported service center spot prices as continuing to decline. This is now the seventh survey, which goes back to the first week of January, where we have seen a seventy percent or higher response rate from the manufacturing segment reporting service center spot prices as dropping.

As you can see by the graphic share below, service center spot prices have been in disarray going back to 4th Quarter 2014. The main reason for this weakness in spot prices is due to service centers carrying excessive inventory levels and, by lowering spot prices, they are trying to move inventories to the end users and to other service centers.

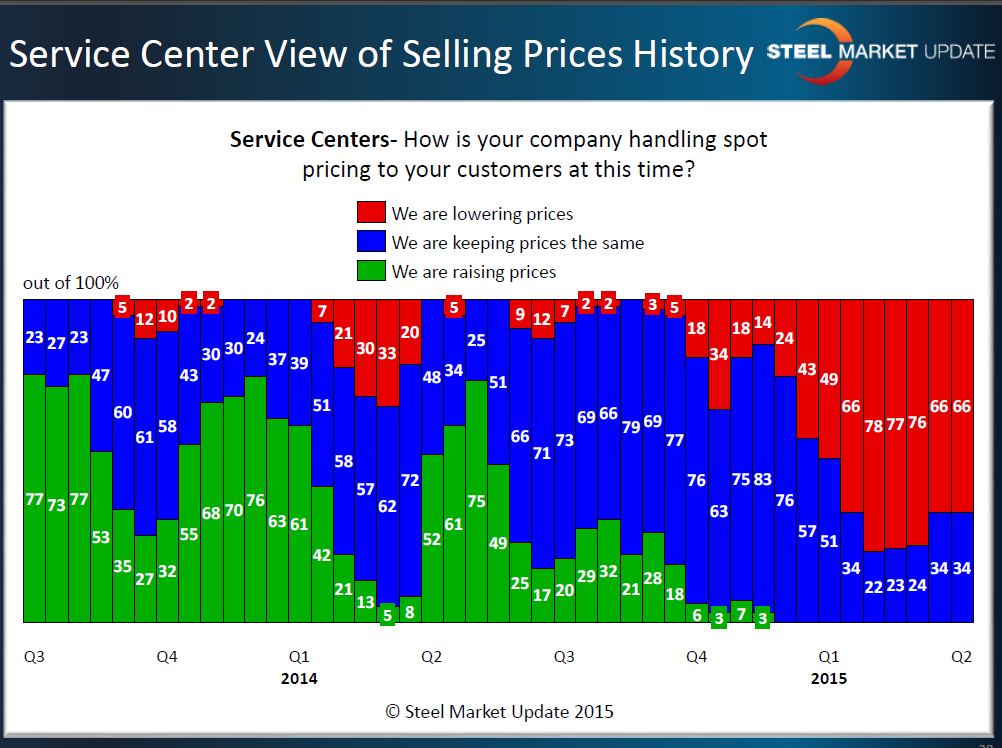

From a service center perspective, the conditions are not quite as dire as what they (and the manufacturing community) were reporting during January, February and the first week of March. Over the past two surveys the percentage of service centers reporting spot prices as declining has remained steady at 66 percent. This does not mean service center inventories are in balance but, that they are most likely heading in the right direction.

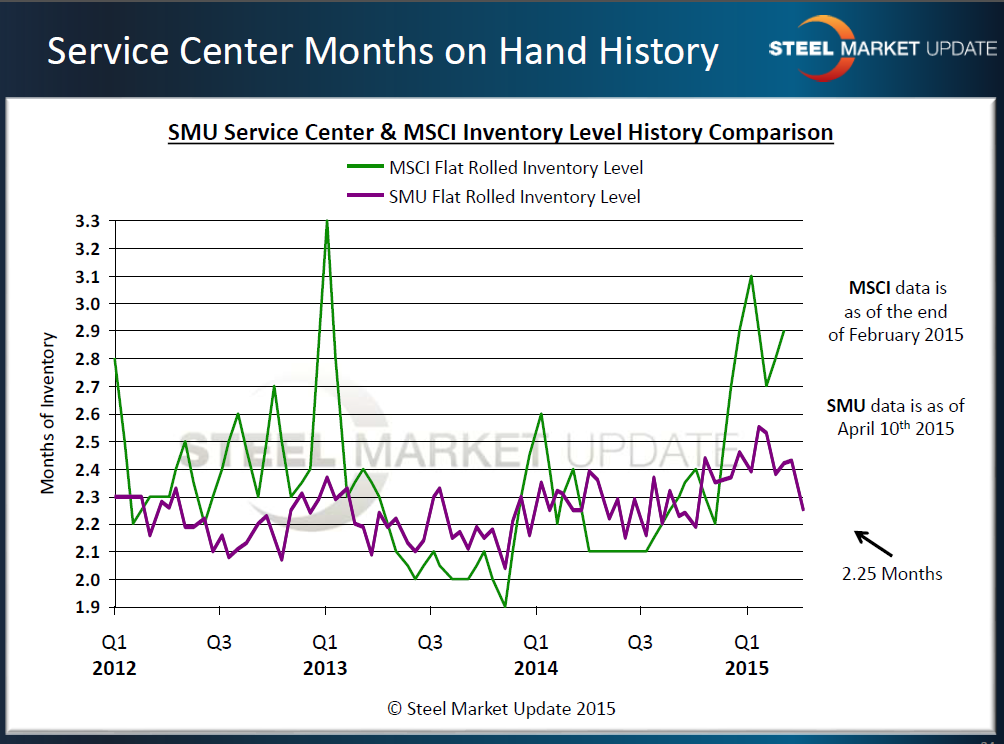

The Metal Service Center Institute (MSCI) reports shipment and inventory data tomorrow (Wednesday, April 15th) and we will learn more as to where inventories are for the flat rolled steel service centers in the United States.

In the meantime, Steel Market Update does ask our service center respondents to provide an average of the number of months of inventories that they have on their floor. In the survey completed this past week our service center respondents reported a reduction of inventories to 2.25 months supply.

We defer to the MSCI numbers as being the most accurate. However, we believe that our results are indicative of the trend which should be for the MSCI inventory levels to drop in March and to continue to drop in April.

All of the information contained in this article is available on our website to our Premium level members in a Power Point presentation and we have a number of the data sets available using our interactive graphing and table tools.