Prices

April 12, 2015

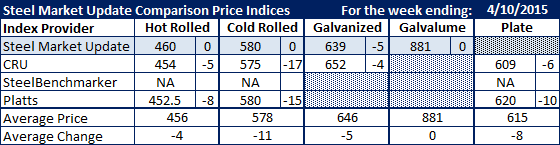

Comparison Price Indices: Price Slide Slows but Does Not End

Written by John Packard

The pace of the flat rolled steel price slide slowed this past week, based on an analysis of the various steel indexes followed by Steel Market Update. As the pace slows, the spread between indexes also tends to get tighter due to fewer variations in the data collected.

Looking at benchmark hot rolled, Steel Market Update now has the highest average at $460 per ton with CRU at $454 and Platts at $452.50 (SteelBenchmarker did not report prices this past week).

The spread on cold rolled tightened quite a bit as Platts moved to $580 (same as SMU) and CRU dropped to $575 per ton.

Galvanized .060″ G90 prices dropped at both CRU and SMU but there is a $13 per ton spread between the two indexes. We will speak with CRU sometime this week to see if they will be addressing the coating extra being used for .060″ G90 as US Steel made a change back to pre-October 2014 extras.

Plate prices also dropped this past week with Platts down $10 and CRU down $6 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.