Market Data

April 11, 2015

SMU Survey Results: Demand

Written by John Packard

This past week Steel Market Update publisher, John Packard, spoke to the financial community about the flat rolled steel industry. Most of the questions received during the Cowen & Company conference call were associated with demand for steel products.

Since SMU just concluded our early April flat rolled steel market analysis (survey) late last week, we will address the steel demand issue based on what we learned from those who responded to our queries.

Again, for those of you who are not familiar with our survey process, Steel Market Update invites approximately 600 people who represent about 580 individual companies to participate. This past week 45 percent of the respondents were manufacturing companies, 42 percent service centers/wholesalers, 7 percent trading companies with 3 percent each being steel mills or toll processors.

Early in the process we ask all of our respondents to report on demand as a group. Later we break out the various groups and probe them again regarding demand for their industry specific groups.

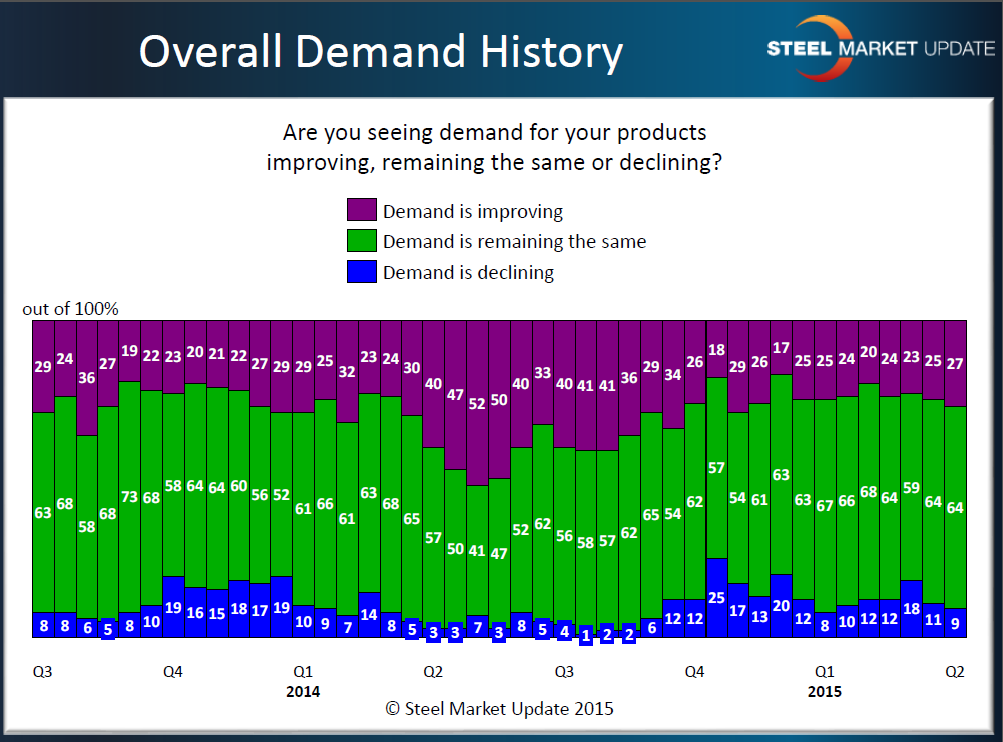

What we found is a demand trend which has been consistently within the mid 20 percentile range since early 4th Quarter 2014. As you can see by the graphic below, due to seasonal reasons it is not atypical for demand levels to be reported as muted during 4Q and into early 1Q before breaking out during the early stages of second quarter.

The 27 percent response rate from last week’s survey is 13 percent below the same period one year ago. We will need to watch demand carefully when we analyze the market again the week of April 20th to see if last week’s result is the beginning of a weakening trend.

Separate from our survey, we communicated with a coating mill who shared this with SMU: “Demand is a bit soft but more inquiries are in process now than in recent months. Everyone is digging for the best price. My take is that there is biz to be had for Q3, but that the range between the lowest and highest base is narrowing. No so much erosion on the low end of the base, but some on high end of the range as customers seem to be ready to actually place orders soon and they won’t unless they get a deal.”

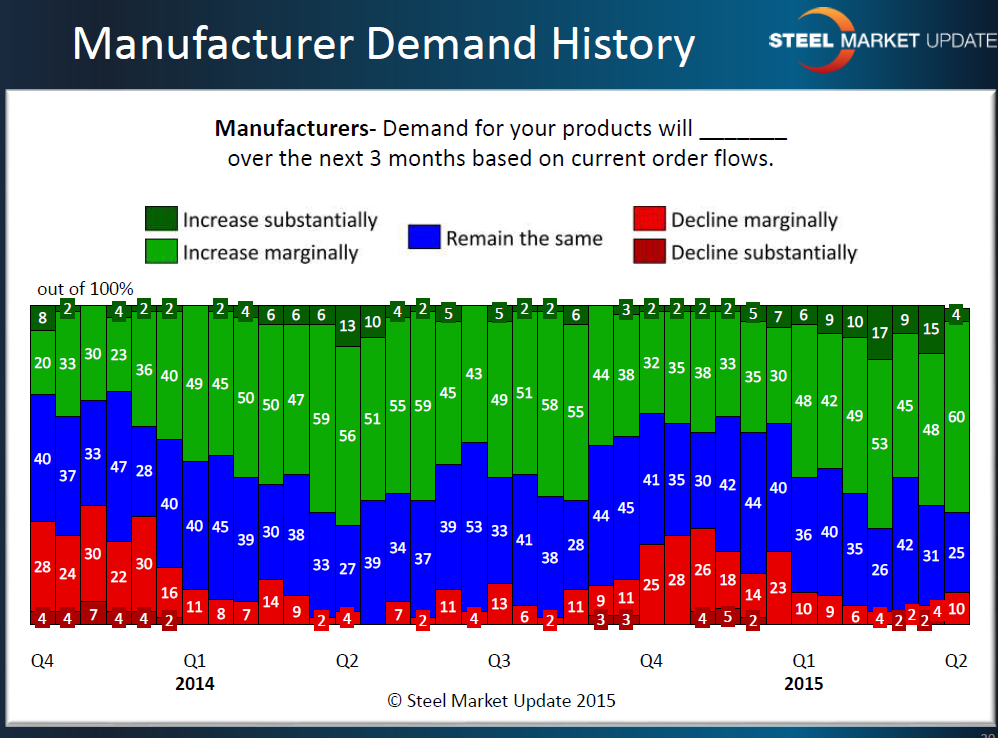

As we broke out into the various market segments during our survey process, we asked questions regarding demand again. From the manufacturers we learned that the vast majority of them, 64 percent, were either reporting business conditions as improving marginally (60 percent) or substantially (4 percent). Only 10 percent reported concerns regarding a slowing in demand. However, this 10 percent is the highest seen since the first week of January. We will need to watch and see if the 10 percent group grows or shrinks in the coming weeks.

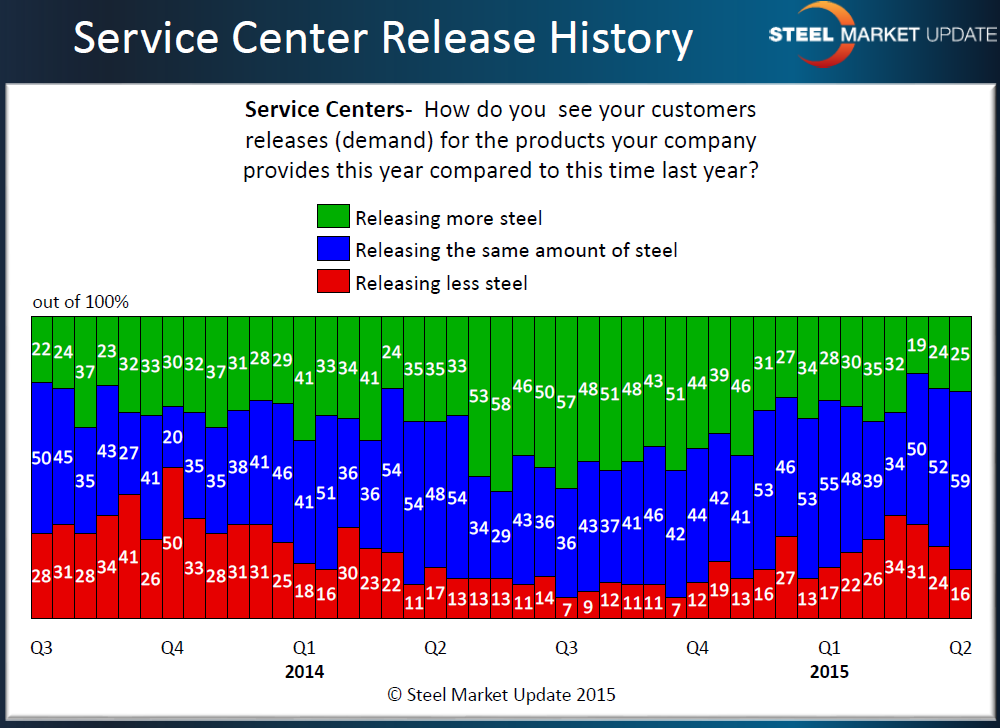

From the service center perspective, 25 percent of the distributor respondents are reporting their end users as releasing more steel now than they did one year ago. This is 10 percent lower than the same period one year ago. We also saw a trend develop during 1st Quarter 2015 indicating demand levels as dropping off in the middle of the quarter before rebounding at the end of the quarter. Second quarter is generally a very good quarter for service centers as seasonal factors kick in with more companies (such as construction related companies) releasing ever greater amounts of material.