Market Data

April 9, 2015

SMU Steel Buyers Sentiment Index: Weakening?

Written by John Packard

Steel Market Update (SMU) has two Steel Buyers Sentiment Indices, current and future. We normally concentrate our initial comments on the current index, how buyers and sellers of steel feel about business conditions and their company’s ability to be successful in the current market. However, today and going forward, we will begin focusing on how buyers and sellers feel about their company’s ability to be successful three to six months into the future.

Based on questions we have been receiving about demand from both our readers and members of the financial community we think our Futures Sentiment Index may address those issues better than our current index.

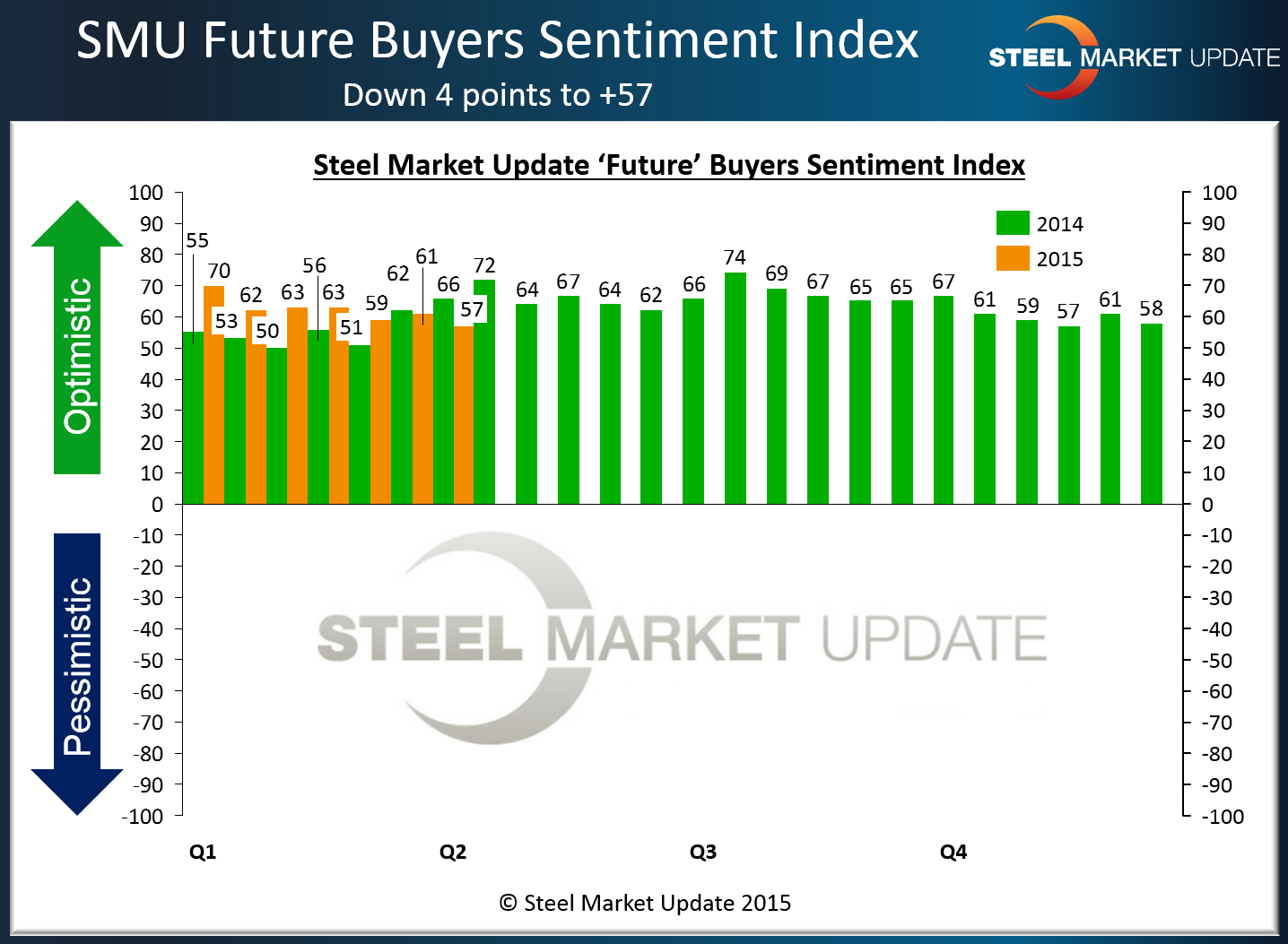

SMU Future Sentiment Index is being reported as being +57 this week. This is down 4 points from the middle of March and down 2 points when compared to the beginning of March. One year ago Future Sentiment was reported to be +66.

SMU believes in looking at the 3 month moving average (3MMA) as a way of identifying trends and changes in trends. The new revised 3MMA for Future Sentiment is now +60.83 which is lower than the +63 reported during the middle of March.

Going back in time, we have seen Future Sentiment 3MMA fluctuate from a low of +60.50 in mid-December 2014 to a high of +64 at the beginning of November 2014. So far this year, the high on the 3MMA was the +63 recorded in mid-March and this week’s +60.83 is the low. We will need to watch this carefully later this month and into May to see if we are at the early stages of a weakening (less optimistic) trend or just reporting a blip in the data.

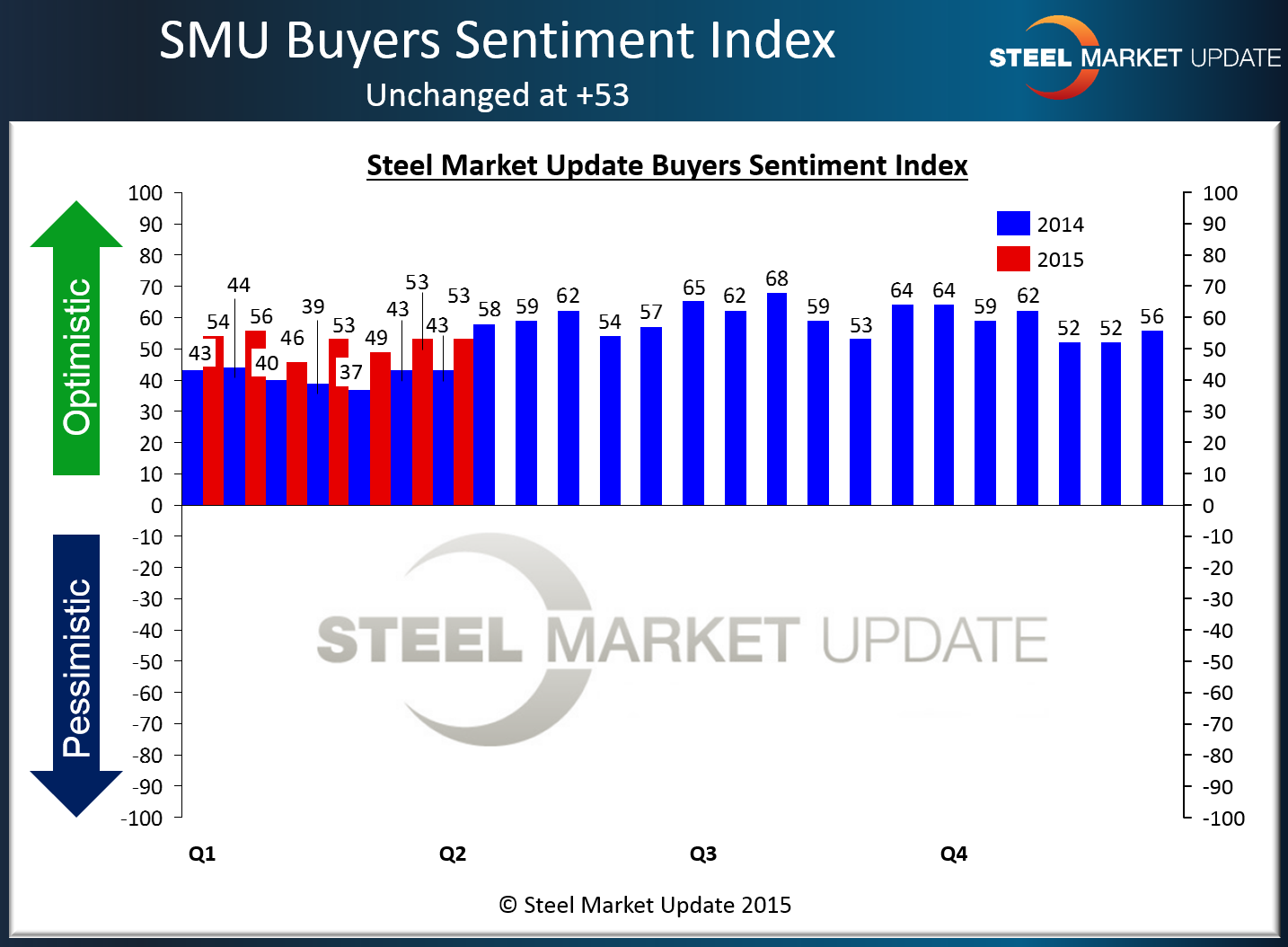

When looking at the Current Steel Buyers Sentiment Index we are reporting a +53, unchanged from two weeks ago and +4 points from one month ago. One year ago it was +43. The 3MMA for Current Sentiment is +51.67 down slightly from the +51.83 in mid-March and +52.33 one month ago. Our Current Sentiment Index has been showing a weakening or less optimistic trend for most of this year.

What Our Respondents are Saying

“Pricing is terrible. Back to the bad old days.” Trading Company

“Think slowdown is due to pricing dropping so customers only buying the absolute minimum.” Service Center

“Markets are still mixed, but overall there’s enough niche strength to call it excellent.” Manufacturing Company involved in Construction Industry.

“Business conditions need to improve in the PLATE market – Prices will bottom out at $620 Ton ($31/cwt) FOB: MILL very, very soon.” Service Center.

“Very tight margins.” Manufacturing Company associated with Construction Industry.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 45 percent were manufacturing and 42 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.