Prices

April 7, 2015

Steel Exports Out of U.S. Steel Mills Decline

Written by John Packard

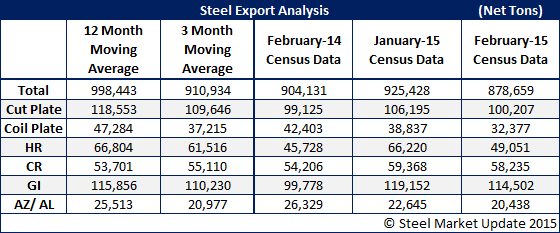

The U.S. steel mills saw exports for steel products fall during the month of February. The U.S. Department of Commerce released new information late last week regarding the exports shipped out of the domestic steel mills to destinations outside the United States. Based on their data, exports totaled 878,459 net tons (note the data is released in metric tons and we then convert to net tons to assist our readers).

During January the U.S. steel mills shipped 925,428 net tons and the twelve month moving average (12MMA) was just shy 1 million net tons (998,443 net tons).

No one product was responsible for the reduction as each flat rolled category tracked by Steel Market Update saw slightly lower numbers than the prior month.

The American Institute for International Steel (AIIS) did an excellent job in a press release on domestic steel exports. We have included their press release as part of tonight’s article:

Falls Church, VA. April 3, 2015. Steel exports fell to less than 900,000 net tons in February, after being above 1 million net tons just four months earlier.

Exports declined by 5.1 percent from January to February to 878,659 net tons. This was 2.8 percent less than the February 2014 total.

A 15.5 percent month-to-month decrease in purchases by Canada – the year-over-year dip was nearly exactly the same – pushed exports to that country down to 406,537 net tons. The other major buyer of steel from the United States, Mexico, increased its purchases by 4 percent to 351,141 – nearly 16 percent more than a year earlier – but this offset less than one-fifth of the decreased sales to Canada. Exports to the European Union (EU) grew by more than half to 48,552 net tons, which was 81.2 percent more than last February.

For the first two months of the year, exports were down 3.4 percent to 1.8 million net tons. Exports to Canada shrank 12 percent to 887,393 net tons, while exports to Mexico were up more than 8 percent to 688,740 net tons. Exports to the EU have grown sharply, increasing nearly 59 percent to 80,146 net tons.

Export numbers can be difficult to interpret. Certainly, the strong dollar could be a contributing factor to the decrease. Four years ago, the Canadian dollar was worth more than the United States dollar; two years ago, the two were roughly even; one year ago, the United States dollar was worth around 1.10 Canadian; and now, it takes about 1.25 Canadian to buy a United States dollar. When, before even taking other factors into account, the exchange rate with the United States’ biggest trading partner increases prices by 25 percent in two years, it should be no surprise when that country buys fewer American goods. Yet the peso, similarly, has lost about 20 percent of its value against the dollar in the past two years, and exports to Mexico are increasing. And the value of the United States dollar has increased sharply against the euro during the past year, but EU purchases are also up (though, of course, they were starting from a much smaller base). Would-be sellers to Canada, though, must also deal with additional challenges, including a weak economy that shrank by 0.1 percent in January and a steep decline in steel demand in the energy sector as plummeting oil prices have led businesses to cut back on oil and natural gas projects, not to mention a cold winter month north of the border. As long as Canada – along with other countries – fails to arrest its economic decline and falling currency, and as long as oil remains around $50 a barrel or less, steel exports seem unlikely to grow.