Market Data

March 31, 2015

Consumer Confidence 3MMA Composite Rises for 15th Straight Month

Written by Peter Wright

The consumer confidence index as reported by the Conference Board increased in March and February’s disappointing decline was lessened by an upward revision. In March the composite value which combines the view of the present situation and expectations rose from 98.8 to 101.3.

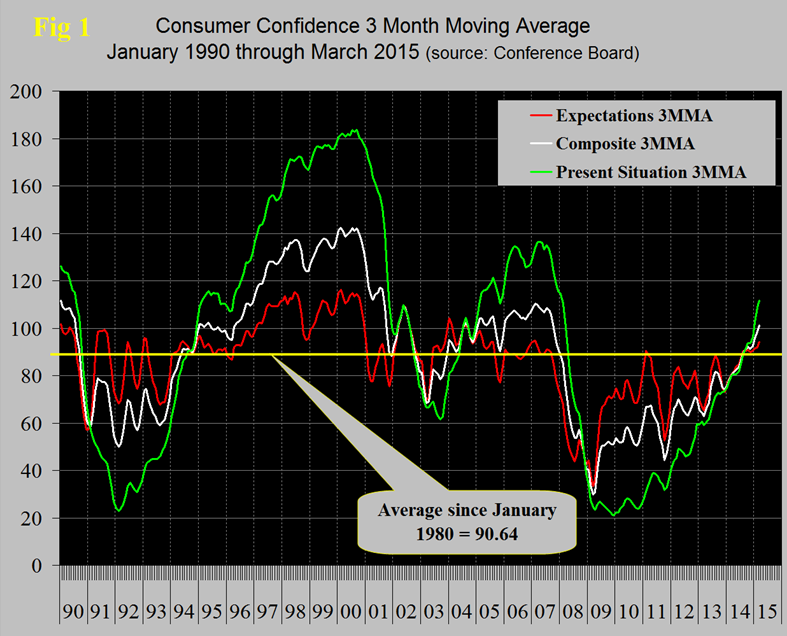

The view of the present situation fell from 112.1 to 109.1 (but the three month moving average (3MMA) continued to increase) and expectations rose from 90.0 to 96.0. The 3MMA of the composite has risen for 15 straight months and in March rose from 98.6 to 101.3. This increase was driven by the consumer’s view of the present situation the 3MMA of which increased from 108.6 to 111.7. The 3MMA of the expectations component increased from 91.8 to 94.3. The 3MMA of the composite at 101.3 is now well above the 35 year average which stands at 90.6 since 1980. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 1.

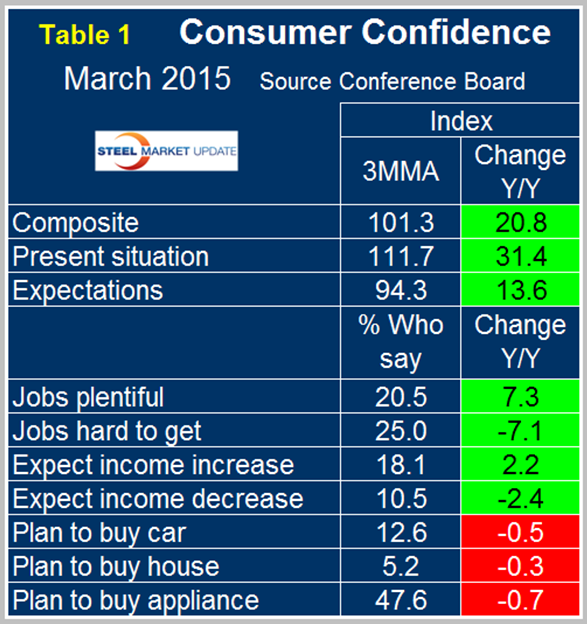

The recovery of the composite is now looking comparable to its last turn around after the recession in 2003. The present situation component has been much more volatile over each multiyear time span than expectations since our data began 35 years ago with higher highs and lower lows. The view of the present situation moved ahead of that for expectations in October last year for the first time since the recovery began in 2009. If history repeats itself, the view of the present situation will continue to move ahead and widen the differential between it and expectations. On a year over year basis using a 3MMA the composite is up by 20.8 led by consumer’s view of the present situation which is up by 31.4 (Table 1).

The employment sub-indexes which are job availability and wage expectations, continue to improve on a 3MMA basis. The pattern (color code) of auto, housing and appliance purchase were unchanged in March from February though were all less negative. In total the first three months of the Conference Board index for 2015 had the best performance since Q3 2007 which is confirmed by the University of Michigan consumer sentiment measure which had the best quarterly reading since 2004. Consumer sentiment is being positively influenced by the job market and the increase in disposable income resulting from lower gas prices.

The official statement from the Conference Board which considers only month over month changes reads as follows:

The Conference Board Consumer Confidence Index Rebounds

The Conference Board Consumer Confidence Index, which had decreased in February, improved in March. The Index now stands at 101.3 (1985=100), up from 98.8 in February. The Expectations Index increased from 90.0 last month to 96.0 in March. The Present Situation Index, however, decreased from 112.1 in February to 109.1.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was March 19.

Lynn Franco, Director of Economic Indicators at The Conference Board, said: “Consumer confidence improved in March after retreating in February. This month’s increase was driven by an improved short-term outlook for both employment and income prospects; consumers were less upbeat about business conditions. Consumers’ assessment of current conditions declined for the second consecutive month, suggesting that growth may have softened in Q1, and doesn’t appear to be gaining any significant momentum heading into the spring months.”

Consumers’ assessment of present-day conditions turned moderately less favorable for a second straight month. The percentage saying business conditions are “good” was unchanged at 26.7 percent, while those claiming business conditions are “bad” increased from 16.7 percent to 19.4 percent. Consumers were mixed in their assessment of the job market. The proportion stating jobs are “plentiful” edged up from 20.3 percent to 20.6 percent, while those claiming jobs are “hard to get” also edged up from 25.1 percent to 25.4 percent.

Consumers’ optimism about the short-term outlook, which had declined last month, rebounded in March. The percentage of consumers expecting business conditions to improve over the next six months decreased slightly, from 17.6 percent to 16.7 percent; however, those expecting business conditions to worsen also fell, from 8.9 percent to 8.0 percent.

Consumers’ outlook for the labor market saw stronger gains. Those anticipating more jobs in the months ahead increased from 13.8 percent to 15.5 percent, while those anticipating fewer jobs declined from 14.8 percent to 13.5 percent. The proportion of consumers expecting growth in their incomes improved from 16.4 percent to 18.4 percent, while the proportion expecting a drop declined from 10.8 percent to 9.9 percent.

Source: March 2015 Consumer Confidence Survey, The Conference Board