Market Data

March 26, 2015

Durable Goods Shipments, Inventories and Orders

Written by Peter Wright

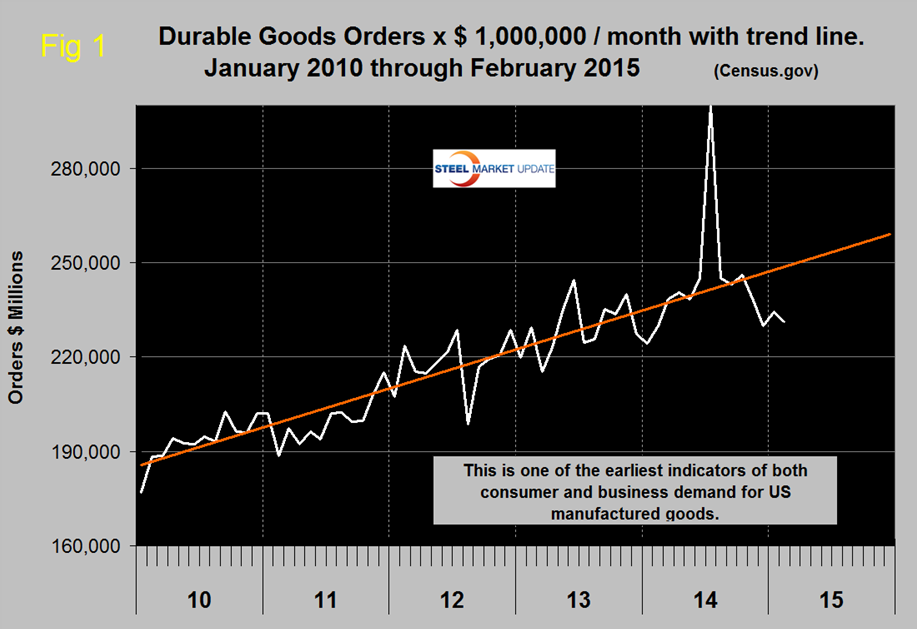

New orders for durable goods in February fell by 1.4 percent from January’s level to $231.3 billion; economists had expected a 0.3 percent gain. The three month moving average (3MMA) fell by 1.0 percent. There has been a sharp deviation from the trend line in the last three months (Figure 1).

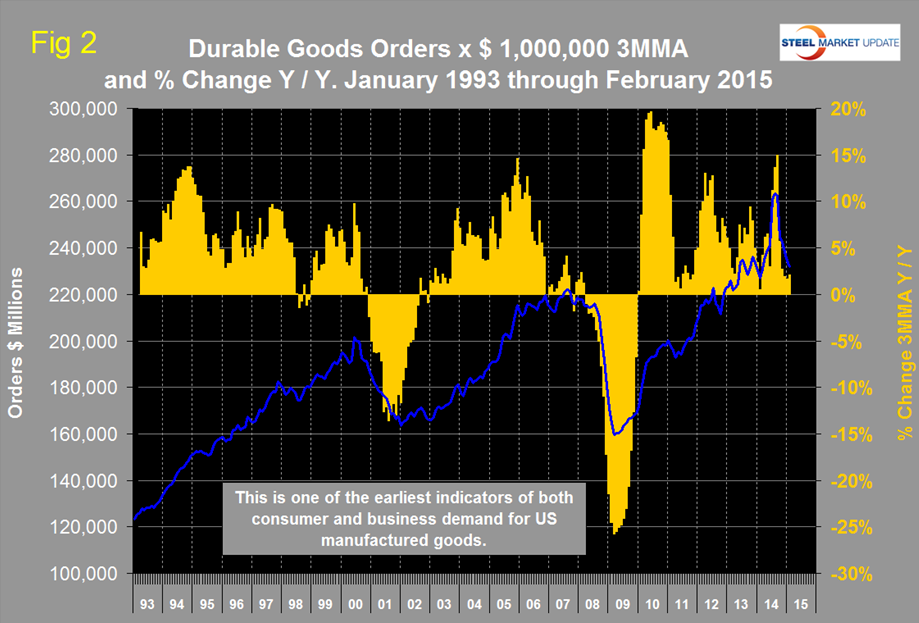

The huge spike in the 3MMA in August was a manifestation of the surge in civil aircraft orders in July. The three month moving average, is shown in Figure 2 for the period January 1993 through February 2015.

The year over year growth rate of the 3MMA came in at 2.1 percent in February, considerably better than the month over month comparison but driven significantly by defense orders which were up by 3.3 percent. The 3MMA of non-defense orders year over year was down by 2.3 percent. Core capital orders, which is a good proxy for business investment have declined since last August with a zero growth year over year.

This index is routinely whipsawed by both civil and military aircraft orders but we include it in our steel analyses because it is a reality check for other manufacturing data and is described by the Census Bureau as one of the earliest indicators for US manufactured goods.

The Census Bureau press release issued on Wednesday read as follows:

Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders. February 2015

New Orders for manufactured durable goods in February decreased $3.2 billion or 1.4 percent to $231.3 billion, the U.S. Census Bureau announced today. This decrease, down three of the last four months, followed a 2.0 percent January increase. Excluding transportation, new orders decreased 0.4 percent. Excluding defense, new orders decreased 1.0 percent. Transportation equipment, also down three of the last four months, led the decrease, $2.5 billion or 3.5 percent to $69.5 billion.

Shipments of manufactured durable goods in February, down four of the last five months, decreased $0.5 billion or 0.2 percent to $244.0 billion. This followed a 1.4 percent January decrease. Primary metals, down five consecutive months, led the decrease, $0.3 billion or 1.1 percent to $26.1 billion.

Unfilled Orders for manufactured durable goods in February, down three consecutive months, decreased $5.6 billion or 0.5 percent to $1,156.9 billion. This followed a 0.3 percent January decrease. Transportation equipment, also down three consecutive months, led the decrease, $4.6 billion or 0.6 percent to $731.6 billion.

Inventories of manufactured durable goods in February, up twenty-two of the last twenty-three months, increased $1.1 billion or 0.3 percent to $413.0 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.3 percent January increase. Transportation equipment, also up twenty-two of the last twenty-three months, drove the increase, $1.2 billion or 0.9 percent to $135.4 billion.

Non-defense new orders for capital goods in February decreased $2.1 billion or 2.6 percent to $77.3 billion. Shipments decreased slightly to $80.2 billion. Unfilled orders decreased $2.9 billion or 0.4 percent to $727.8 billion. Inventories increased $0.3 billion or 0.1 percent to $186.8 billion. Defense new orders for capital goods in February increased $0.8 billion or 10.2 percent to $8.3 billion. Shipments decreased $0.1 billion or 0.8 percent to $9.0 billion. Unfilled orders decreased $0.7 billion or 0.4 percent to $152.9 billion. Inventories increased $0.7 billion or 3.0 percent to $24.9 billion.

Revised January Data: Revised seasonally adjusted January figures for all manufacturing industries were: new orders, $467.7 billion (revised from $470.0 billion); shipments, $477.8 billion (revised from $479.1 billion); unfilled orders, $1,162.5 billion (revised from $1,163.4 billion); and total inventories, $650.1 billion (revised from $650.5 billion).