Prices

March 21, 2015

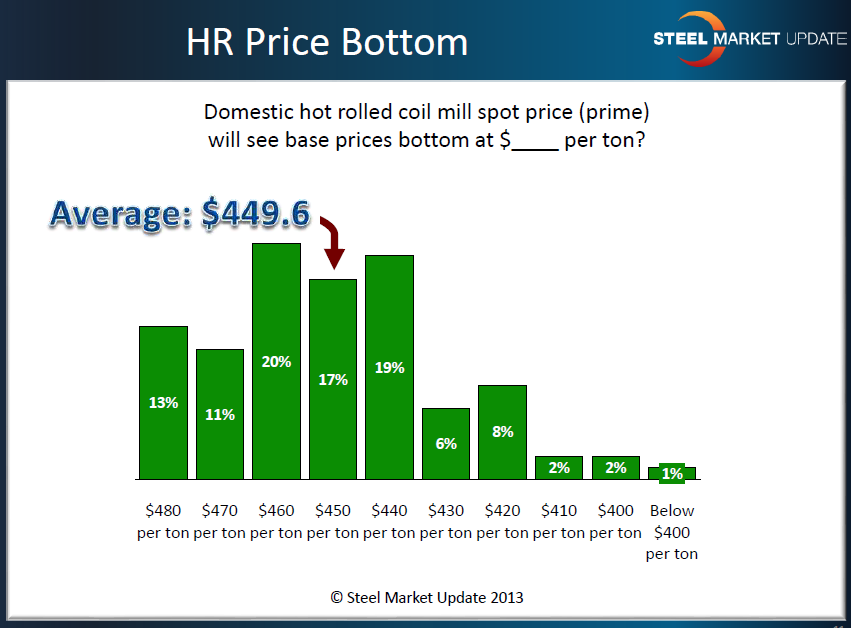

SMU Survey Respondents: Hot Rolled Has More to Fall

Written by John Packard

Last week Steel Market Update (SMU) conducted our mid-March flat rolled steel market survey. We invited approximately 600 companies to link to our questionnaire which covers a number of issues of importance for the industry. Last week’s industry participants consisted of 49 percent manufacturing companies, 37 percent service centers, 8 percent trading companies, 3 percent steel mills and the balance being toll processors.

One of the areas we probed prior to breaking out into industry groups was where those taking our survey thought hot rolled prices would bottom in the current down draft pricing cycle. As you can see by the graphic below, the average came to $449.6 per ton.