Market Segment

March 17, 2015

U.S. Service Center Flat Rolled Inventories at 2.9 Months

Written by John Packard

According to data just released by the Metal Service Center Institute (MSCI), U.S. service centers shipped 3,332,300 tons of all steel products during the month of February 2015. The daily shipment rate was 166,600 tons per day, down 1.4 percent over February 2014 when the daily shipment rate was 169,000 tons. In comparison to the previous month, February daily shipments were down 0.7 percent from the 167,800 ton rate in January. Note that there were 20 shipping days in both February 2015 and February 2014, while January 2015 had 21. Total steel shipments were down 1.4 percent year over year.

Total steel inventories shrunk slightly from 9,961,100 tons reported at the end of January to 9,875,200 tons as of the end of February. Inventories were up 15.1 percent over the prior February. The number of months on hand stood at 3.0 months on a non-adjusted basis, this is up from 2.8 months reported at the end of January. In February 2014 the months on hand stood at 2.5 months.

Carbon Flat Rolled

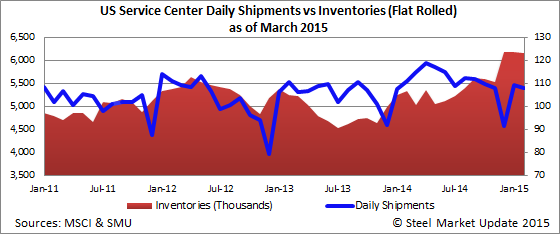

Distributors shipped 2,156,200 tons of carbon flat rolled during the month of February. This was 2.9 percent lower than one year ago. The daily shipment rate of 107,800 tons per day was 3,200 tons less than one year ago.

Flat rolled inventories stood at 6,147,500 tons at the end of February. This is 28,400 tons less than what was reported at the end of January. Inventories are now 15.4 percent higher than what was reported in February 2014. The months on hand were reported to be 2.9 months, up from 2.7 months in January and up from 2.4 months in February 2014.

A note to our Premium level members: Our forecast for shipments and inventory levels as well as the Apparent Excess were not too far off this past month. We thought the distributors would do a little better job of eliminating more of the excess inventories. We had them taking the Apparent Excess down to 720,000 net tons from 1.12 million net tons. Instead they came in with an Apparent Excess of 850,000 net tons. We will have more details and our new forecast later this week.

Carbon Plate

U.S. distributors shipped a total of 360,800 tons of plate products during the month of February. This was 5.7 percent more than what was shipped during February 2014. The daily shipment rate was 18,000 tons which was an improvement over last year’s 17,100 tons per day rate.

Plate inventories stood at 1,277,400 tons which is up 30.9 percent over one year ago (975,800 tons). The months on hand declined from 3.6 in January to 3.5 in February but remain above the 2.9 level in February 2014.

Pipe & Tube

U.S. service centers shipped 215,100 tons of pipe and tube during the month of February. This was 0.6 percent lower than last year. The daily shipment rate for the month was 10,800 tons, the exact same rate reported in February 2014.

Inventories of pipe & tube at the distributors stood at 678,200 tons, which is 3.6 percent higher than one year ago. Inventories were also 4,600 tons higher than what was reported at the end of January. The months on hand were reported to be 3.2 months, up from 3.0 months in January and up from 3.0 months one year ago.