Analysis

March 17, 2015

Housing Starts, Permits and Builder Confidence through February 2015

Written by Peter Wright

Housing starts in February declined by 184,000 annualized to 897,000 from 1,081,000 in January. This data is seasonally adjusted by the Census department.

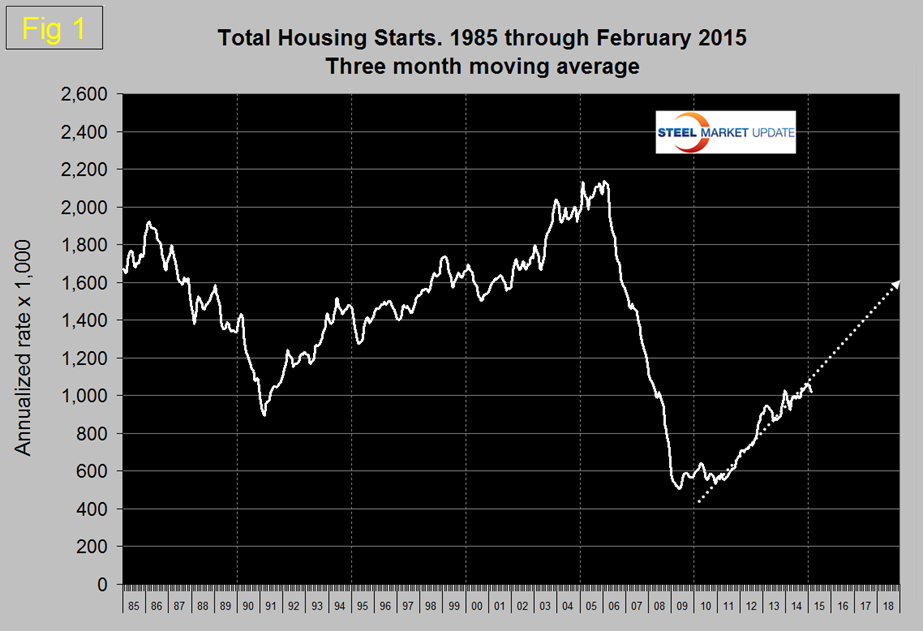

The three month moving average, (3MMA) fared much better declining to 1,020,000 from 1,059,000 which was a blip in a steadily improving trajectory, (Figure 1). This was the sixth consecutive month that the 3MMA of monthly starts, (annualized) exceeded a million units.

The year/year growth rate of the 3MMA of total starts in February was 7.0 percent. The growth rate by this measure is down from 16.7 percent in September. Note this is not seasonal because there is a seasonal adjustment and in addition we are considering year over year relationships. The four year trajectory of total starts is still on track to reach 1.6 million by the end of 2018 but the two year trajectory is suggesting a level of less than 1.3 million in 2018.

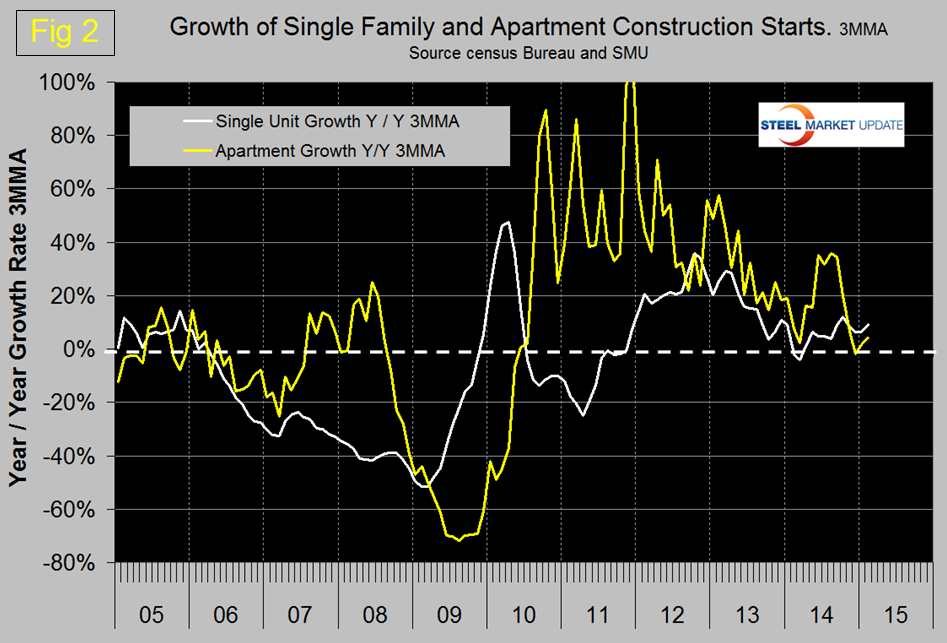

Multi-family starts are now beyond the pre-recession high of February 2006 but the growth of starts in this sector has slowed dramatically from a 3MMA year over year of 35.5 percent in August to 3.2 percent in February, (Figure 2). If we ignore the growth spurt of mid-2014, this sector has been slowing since early 2012 and may be approaching saturation.

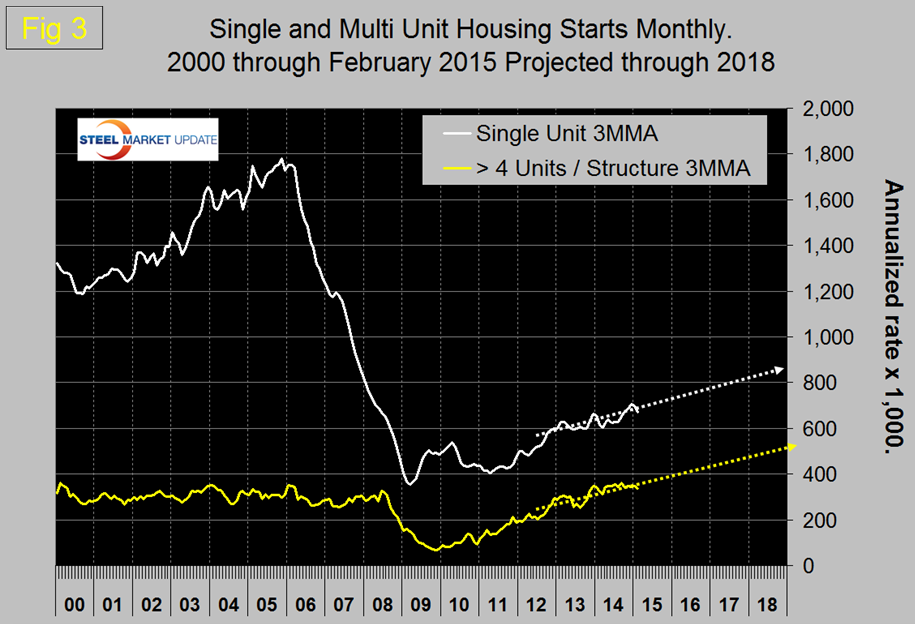

Single family is still 67.5 percent below the pre-recession level but growth in this sector has been higher than multi-family for the last four months. Figure 3 shows the trajectory of single family and apartments.

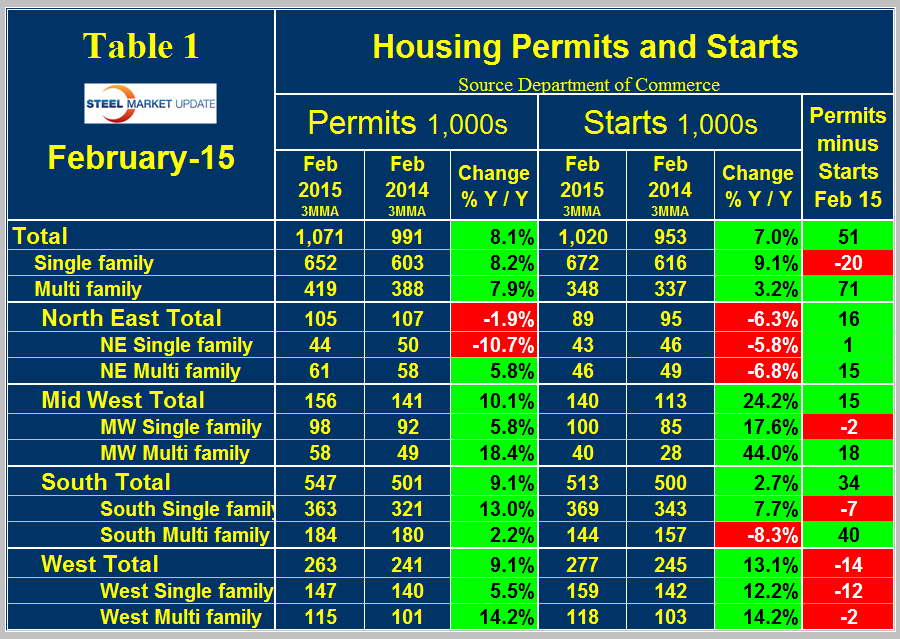

Permit data is useful is useful as a forward look at starts. If permits exceed starts then we anticipate an acceleration in construction starts and vice versa. Table 1 shows total permits and starts nationally and regionally.

At the national level the differential between permits and starts for single and multi-family units is suggesting an alternative future to that just described above. Permits exceeded starts for multi-family and lagged behind starts for single family. In total permits were 51,000 more than starts. Multi-family permits were 71,000 more than starts and single family were 20,000 less than starts.

This pattern was evident across all four regions. The permit data suggests that the recent decline in multi-family starts could be short lived and that the improvement in single family doesn’t have legs.

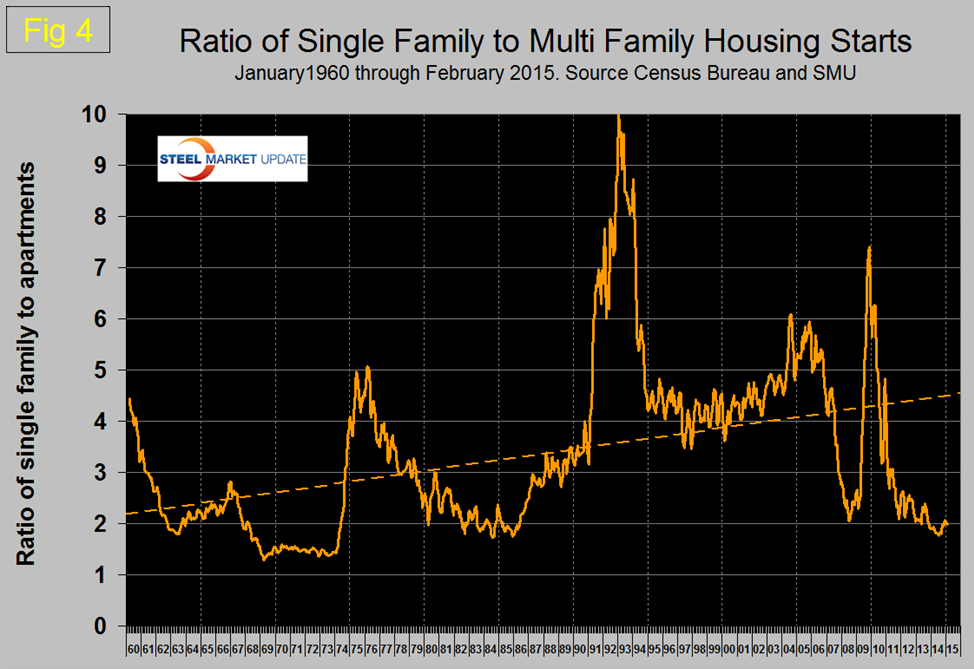

The ratio of the two sectors is shown in Figure 4 and demonstrates that single family compared to multi-family has improved slightly but single family homes continue to be less desirable than at any time in the last 30 years. Based on permit data the ratio will not change any time soon and it looks increasingly as though we are seeing the beginning of a generational shift in the mix of housing.

Student loan debt exceeded $1.3 trillion in the 3rd Q of 2014 for the first time, this must be impacting the young person’s view of other debt obligations and so presumably is the view that housing is not necessarily the great investment that it was once thought to be. In addition, uncertainty in the job market makes mobility desirable and promotes the idea of rent in preference to purchase. To attempt to counter these trends Fannie Mae and Freddie Mac have introduced a new program for first time buyers that requires only a 3 percent down payment down from what has become the traditional 20 percent level since the sub-prime debacle. First time buyers normally account for 40 percent of new home sales. In this case first time is defined as not having held a mortgage for three years.

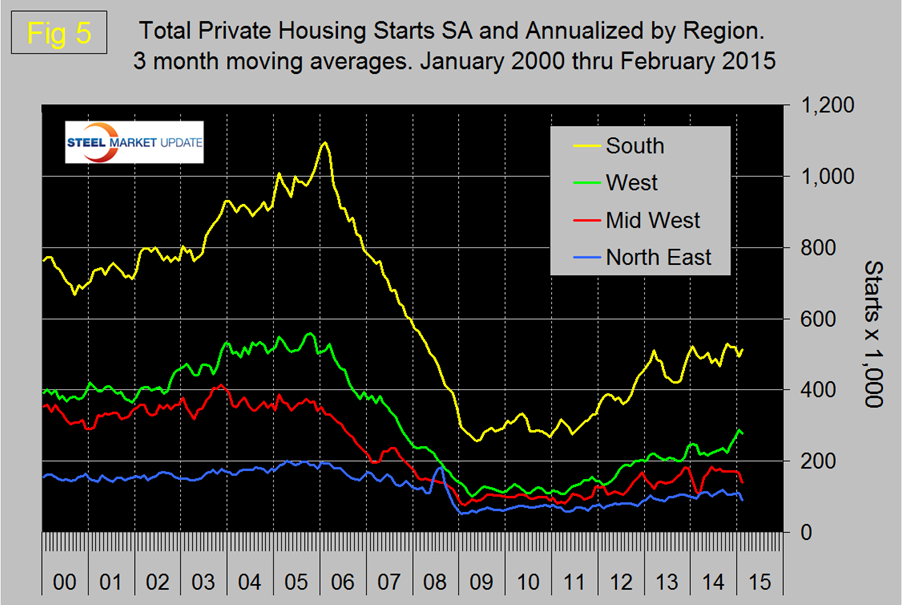

Figure 5 shows the regional situation for total residential starts since February 2000. In the latest data the South was the only region to experience and increase as the Mid-west bore the brunt of the decline.

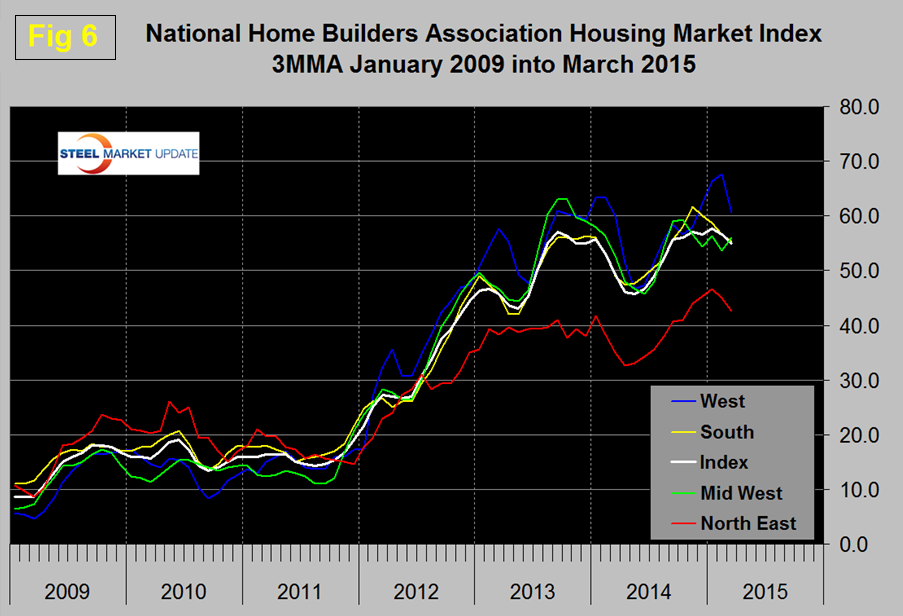

The National Association of Home Builders, (NAHB) confidence report was released on Monday, (Figure 6). Any value above 50 indicates an overall positive business confidence. The index declined by a further two points to 53 in March after a two point decline in February and one point in January. The 3MMA was down by two points from November last year. The November value of 57 was the highest since our data stream began in February 2009. On a regional basis, the West is the most optimistic and the North East the least. The composite index, signals that homebuilders are generally positive in their views of the market. All regions except the North East have a positive outlook.

The official release from the NAHB read as follows.

March 16, 2015 – Builder confidence in the market for newly built, single-family homes in March fell two points to a level of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“Even with this slight slip, the HMI remains in positive territory and we expect the market to improve as we enter the spring buying season,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“The drop in builder confidence is largely attributable to supply chain issues, such as lot and labor shortages as well as tight underwriting standards,” said NAHB Chief Economist David Crowe. “These obstacles notwithstanding, we are expecting solid gains in the housing market this year, buoyed by sustained job growth, low mortgage interest rates and pent-up demand.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two of the three HMI components posted losses in March. The component gauging current sales conditions fell three points to 58 while the component measuring buyer traffic dropped two points to 37. The gauge charting sales expectations in the next six months held steady at 59.

Looking at the three-month moving averages for regional HMI scores, the Northeast and South each posted a two-point drop to 43 and 55, respectively. The Midwest rose two points to 56, while the West fell seven points to 61.

Editor’s Note: The NAHB/Wells Fargo Housing Market Index is strictly the product of NAHB Economics, and is not seen or influenced by any outside party prior to being released to the public. HMI tables can be found at nahb.org/hmi.